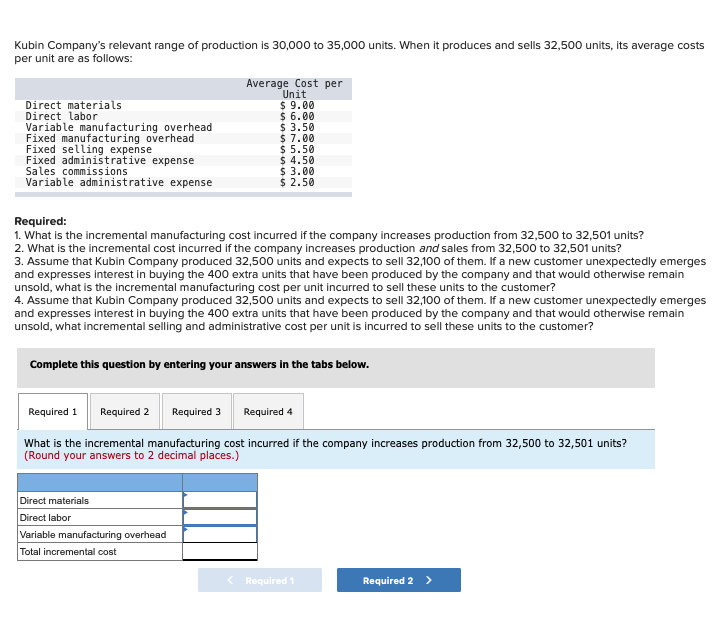

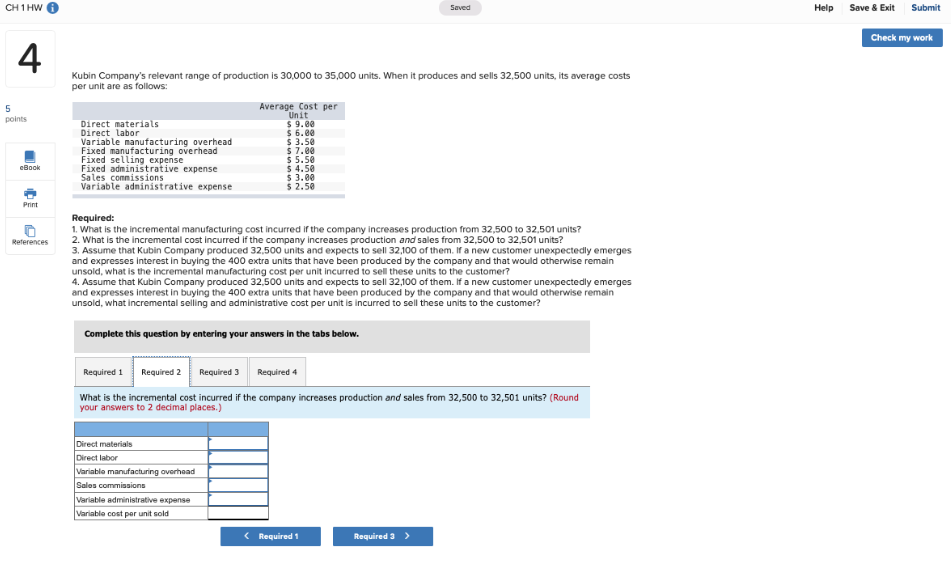

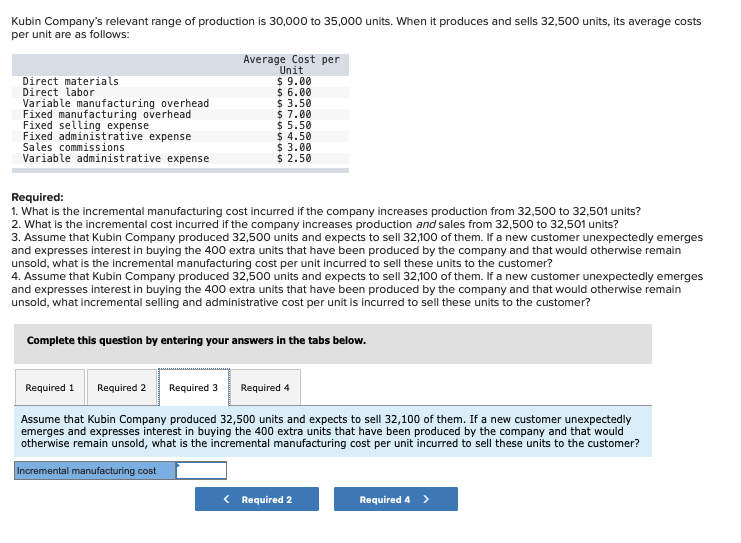

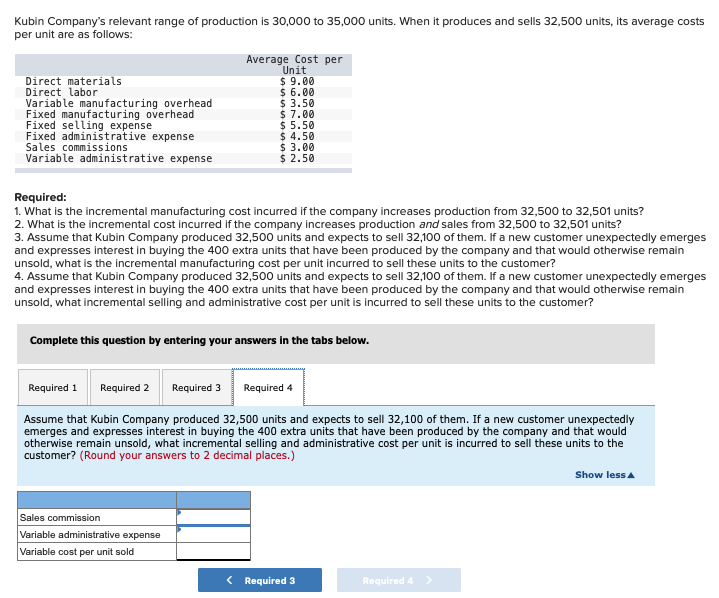

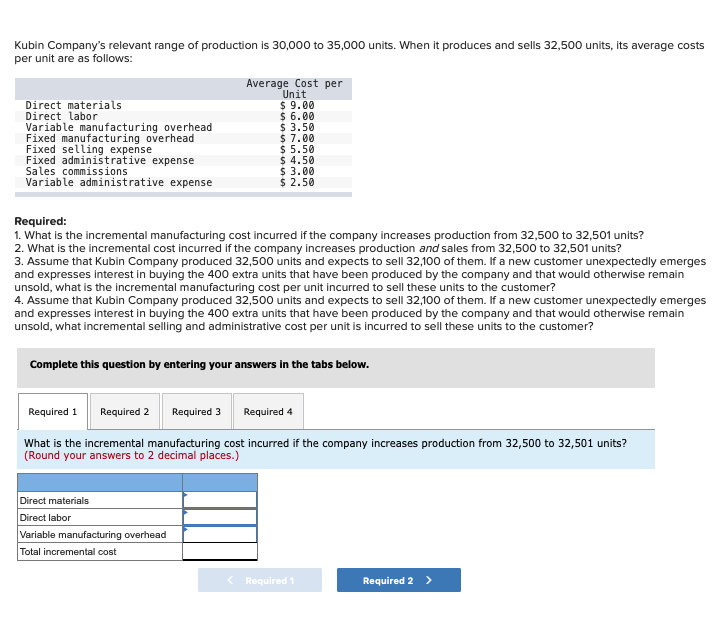

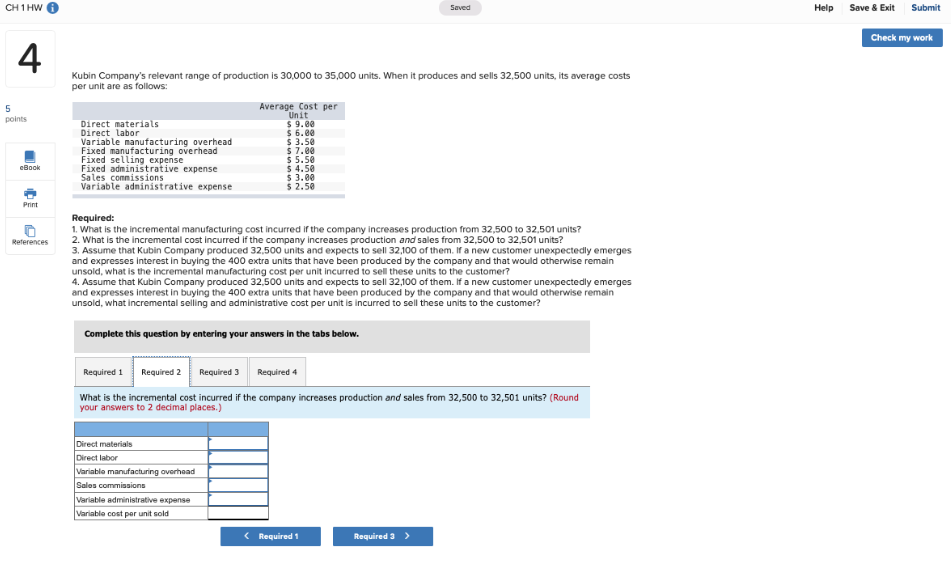

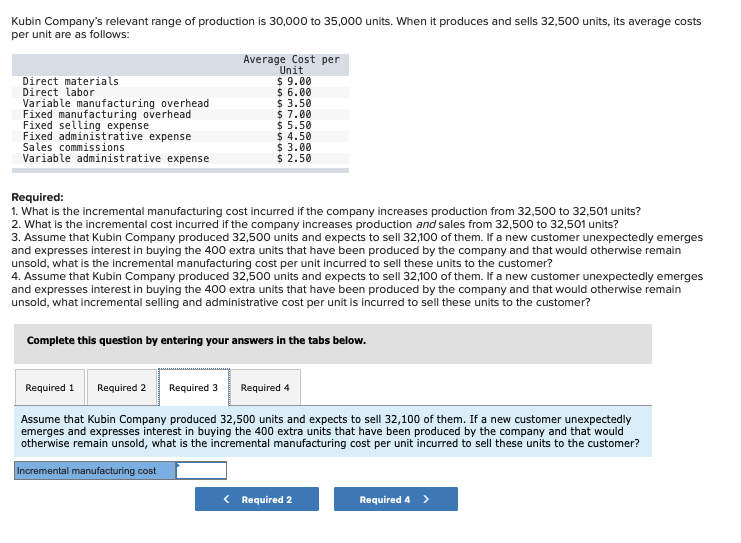

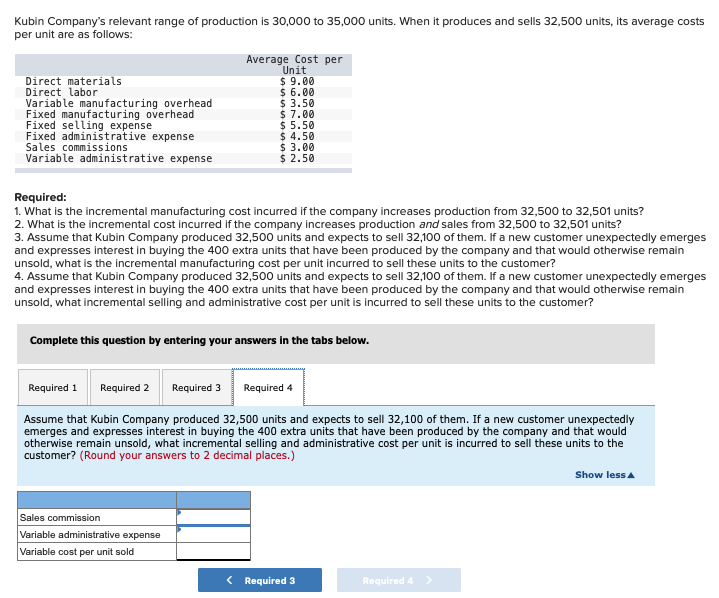

Kubin Company's relevant range of production is 30,000 to 35,000 units. When it produces and sells 32,500 units, its average costs per unit are as follows: Average cost per Unit Direct materials $ 9.00 Direct labor $ 6.00 Variable manufacturing overhead $ 3.50 Fixed manufacturing overhead $ 7.00 Fixed selling expense $ 5.50 Fixed administrative expense $ 4.50 Sales commissions $ 3.00 Variable administrative expense $ 2.50 Required: 1. What is the incremental manufacturing cost incurred if the company increases production from 32,500 to 32,501 units? 2. What is the incremental cost incurred if the company increases production and sales from 32,500 to 32,501 units? 3. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? 4. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What is the incremental manufacturing cost incurred if the company increases production from 32,500 to 32,501 units? (Round your answers to 2 decimal places.) Direct materials Direct labor Variable manufacturing overhead Total incremental cost Required Required 2 > CH 1 HW Saved Help Save & Exit Submit Check my work 4 Kubin Company's relevant range of production is 30,000 to 35,000 units. When it produces and sells 32,500 units, its average costs per unit are as follows: 5 points Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $ 9.80 $ 6.88 $ 3.50 $ 7.00 $5.50 $ 4.50 $ 3.80 $ 2.50 eBook Print References Required: 1. What is the incremental manufacturing cost incurred if the company increases production from 32,500 to 32,501 units? 2. What is the incremental cost incurred if the company increases production and sales from 32,500 to 32,501 units? 3. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? 4. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 What is the incremental cost incurred if the company increases production and sales from 32,500 to 32,501 units? (Round your answers to 2 decimal places.) Direct materials Direct labor Variable manufacturing overhead Sales commissions Variable administrative expense Variable cost per unit sold (Required 1 Required 3 > Kubin Company's relevant range of production is 30,000 to 35,000 units. When it produces and sells 32,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 9.00 Direct labor $ 6.00 Variable manufacturing overhead $ 3.50 Fixed manufacturing overhead $ 7.00 Fixed selling expense $ 5.50 Fixed administrative expense $ 4.50 Sales commissions $ 3.00 Variable administrative expense $ 2.50 Required: 1. What is the incremental manufacturing cost incurred if the company increases production from 32,500 to 32,501 units? 2. What is the incremental cost incurred if the company increases production and sales from 32,500 to 32,501 units? 3. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? 4. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? Incremental manufacturing cost Kubin Company's relevant range of production is 30,000 to 35,000 units. When it produces and sells 32,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 9.00 Direct labor $ 6.00 Variable manufacturing overhead $ 3.50 Fixed manufacturing overhead $ 7.00 Fixed selling expense $ 5.50 Fixed administrative expense $ 4.50 Sales commissions $ 3.00 Variable administrative expense $ 2.50 Required: 1. What is the incremental manufacturing cost incurred if the company increases production from 32,500 to 32,501 units? 2. What is the incremental cost incurred if the company increases production and sales from 32,500 to 32,501 units? 3. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what is the incremental manufacturing cost per unit incurred to sell these units to the customer? 4. Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assume that Kubin Company produced 32,500 units and expects to sell 32,100 of them. If a new customer unexpectedly emerges and expresses interest in buying the 400 extra units that have been produced by the company and that would otherwise remain unsold, what incremental selling and administrative cost per unit is incurred to sell these units to the customer? (Round your answers to 2 decimal places.) Show less Sales commission Variable administrative expense Variable cost per unit sold