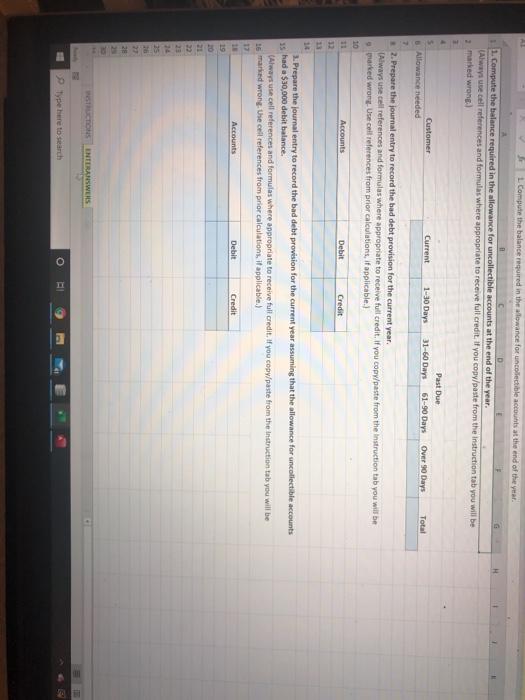

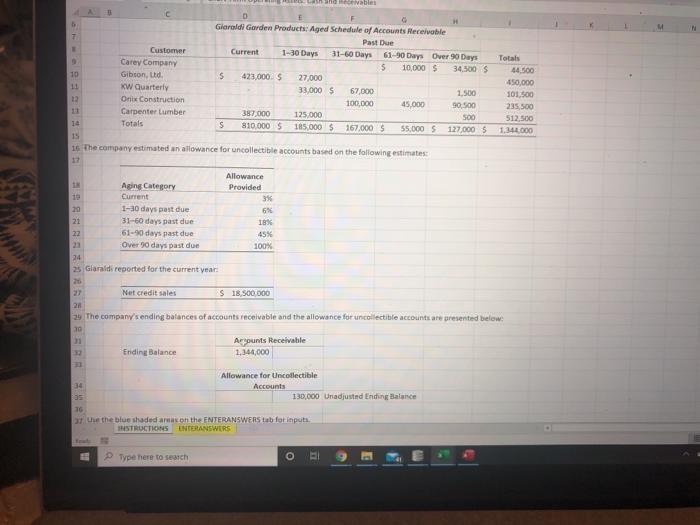

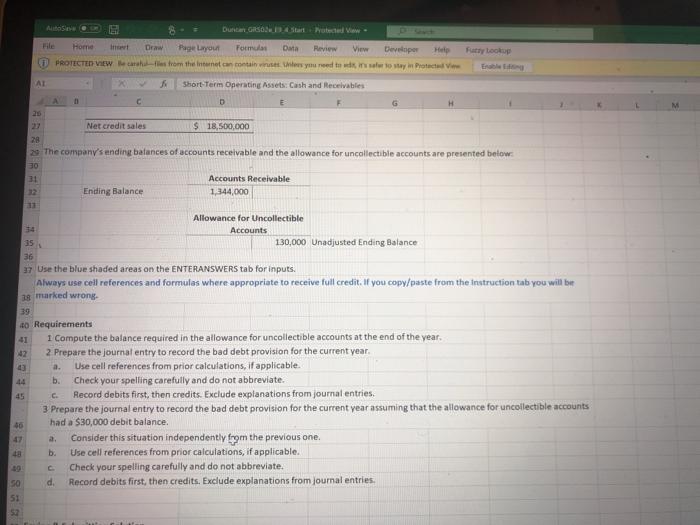

L Compute the balance required in the allowance for uncollectible accounts at the end of the year. D 11. Compute the balance required in the allowance for uncollectible accounts at the end of the year. Always use cell references and formulas where appropriate to receive full credit. if you copy/paste from the instruction tab you will be 2 marked wrong Customer Allowance needed Current Past Due 31-60 Days 61-90 Days 1-30 Days Over 90 Days Total 2. Prepare the journal entry to record the bad debt provision for the current year. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be parked wrong. Use coil references from prior calculations, if applicable.) 10 Accounts Debit Credit 3. Prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts s had a $30,000 debit balance Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be is marked wrong. Use cell references from prior calculations if applicable) Accounts Debit Credit 9-9 STRUCTIONS INTERANSWERS Type here to search O ables c F H Giarald Garden Products: Aged Schedule of Accounts Receivable 7 Past Due Customer Current 1-30 Days 31-60 Days 61-90 Days Over 90 Days Carey Company 5 10,000 $ 34.500 5 19 Gibson, Ltd $ 423,000 $ 27,000 11 KW Quarterly 33,000 $ 67,000 1,500 Orix Construction 100.000 45.000 30,500 Carpenter Lumber 387 000 125.000 500 19 Totals S 810.0005 185 000 $ 167,000 $ 55,000 127.000 $ 15 1. The company estimated an allowance for uncollectible accounts based on the following estimates: 17 Totals 44.500 450,000 101.500 235,500 512,500 1.344.000 Allowance Aging Category Provided Current 3% 20 1-30 days past due 6% 21 31-60 days past due 18% 22 61-9 days past due 45% 23 Over 90 days past due 100% 24 25 Glaraldi reported for the current year 26 27 Net credit sales S 18.500.000 2 39 The company sending balances of accounts receivable and the allowance for uncollectible accounts are presented below. 20 Argounts Receivable 2 Ending Balance 1,346,000 Allowance for Uncollectible 34 Accounts 130.000 Uradjusted Ending Balance 20 37 th the blue shaded areason the ENTERANSWERS tab for inputa INSTRUCTIONS INTERANSWERS Type here to search AUSE Duncan Studio Date Fatty Lookup Draw Page Layout Formular View Developer D PROTECTED VIEW Le cartes from the Internet con containers you to win in Protect AT Short-Term Operating Assets: Cash and Receivables C D G 20 27 Net credit sales $ 18,500,000 28 29 The company's ending balances of accounts receivable and the allowance for uncollectible accounts are presented below 30 31 Accounts Receivable Ending Balance 1,344,000 42 Allowance for Uncollectible Accounts 15 130,000 Unadjusted Ending Balance 36 * Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the instruction tab you will be 18 marked wrong 39 40 Requirements 41 1 Compute the balance required in the allowance for uncollectible accounts at the end of the year. 2 Prepare the journal entry to record the bad debt provision for the current year. a. Use cell references from prior calculations, if applicable. b. Check your spelling carefully and do not abbreviate. Record debits first, then credits. Exclude explanations from journal entries. 3 Prepare the journal entry to record the bad debt provision for the current year assuming that the allowance for uncollectible accounts had a $30,000 debit balance. Consider this situation independently from the previous one. b. Use cell references from prior calculations, if applicable. Check your spelling carefully and do not abbreviate. 50 Record debits first, then credits. Exclude explanations from journal entries. 51 52 45 C d