Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L. Lancer Corporation purchased a parcel of land as s factory site for $150,000. Construction began immediately on a new building. Costs Incurred are as

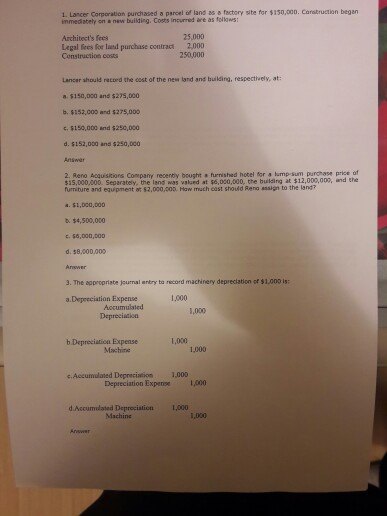

L. Lancer Corporation purchased a parcel of land as s factory site for $150,000. Construction began immediately on a new building. Costs Incurred are as follows: 25,000 Architect's fees Legal fees for laed purchase contract 2,000 Construction costs 250,000 Lancer should recoed the eest of the new land and building, respectively, at: $150,000 and $275,000 . $152,000 and $275,000 $150,000 and $250,000 d. $152,000 and $250,000 2. Reno Aoquisitions Company recently bought a furnished hotel for a lump-sum purchase price of $15,000,000. Separately, the lend was valued at $6,000,000, the bulding at $12,000,000, and the furniture ,nd equipment$2,000,000. How much east should Rena sasign to the lard? b. 4,500,000 .$6,000,00 d. $8,000,000 3. The appropriate journal enbry to record machinery deprediation of $1,000 is a.Depeeciation Expense 1,000 1,000 Depreciation b Deprociation Expense 1,000 Machine 1,000 e. Aecumlaned Depreciasion 1.000 Depreciation Expense 1,000 Machine 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started