l

l

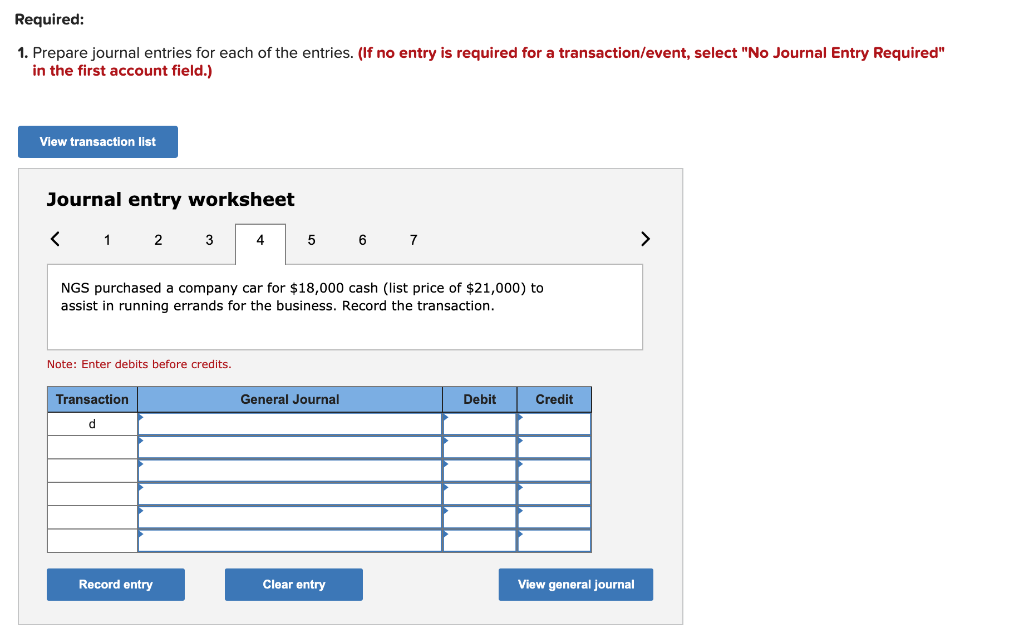

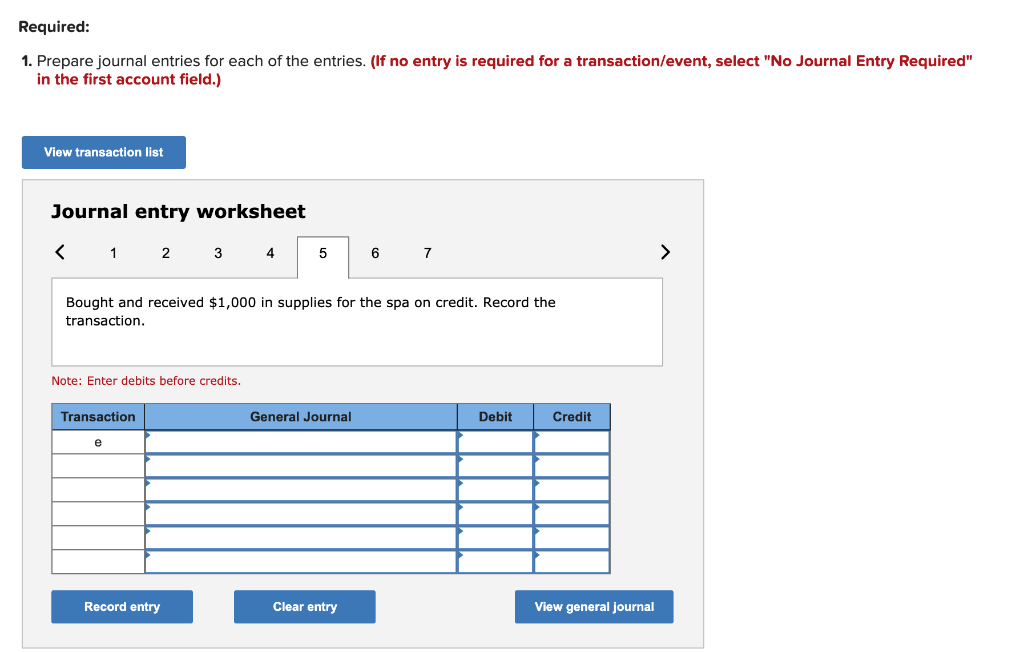

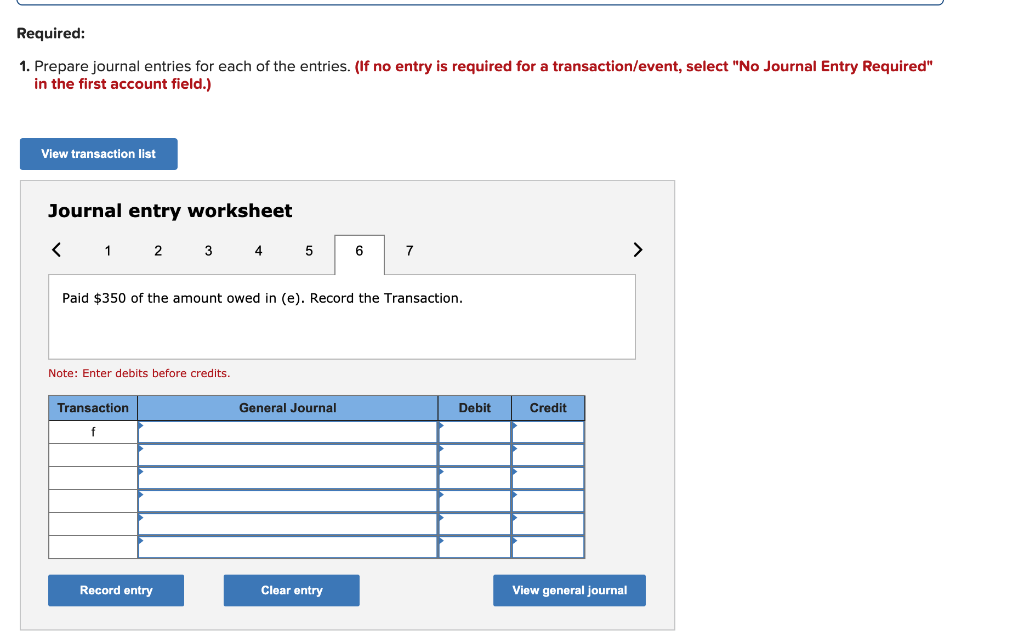

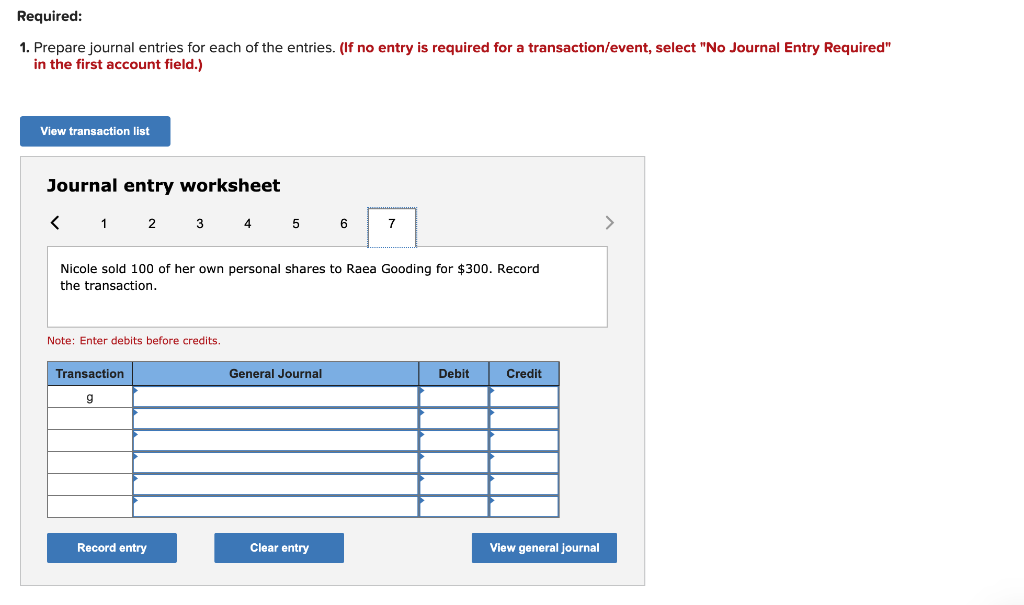

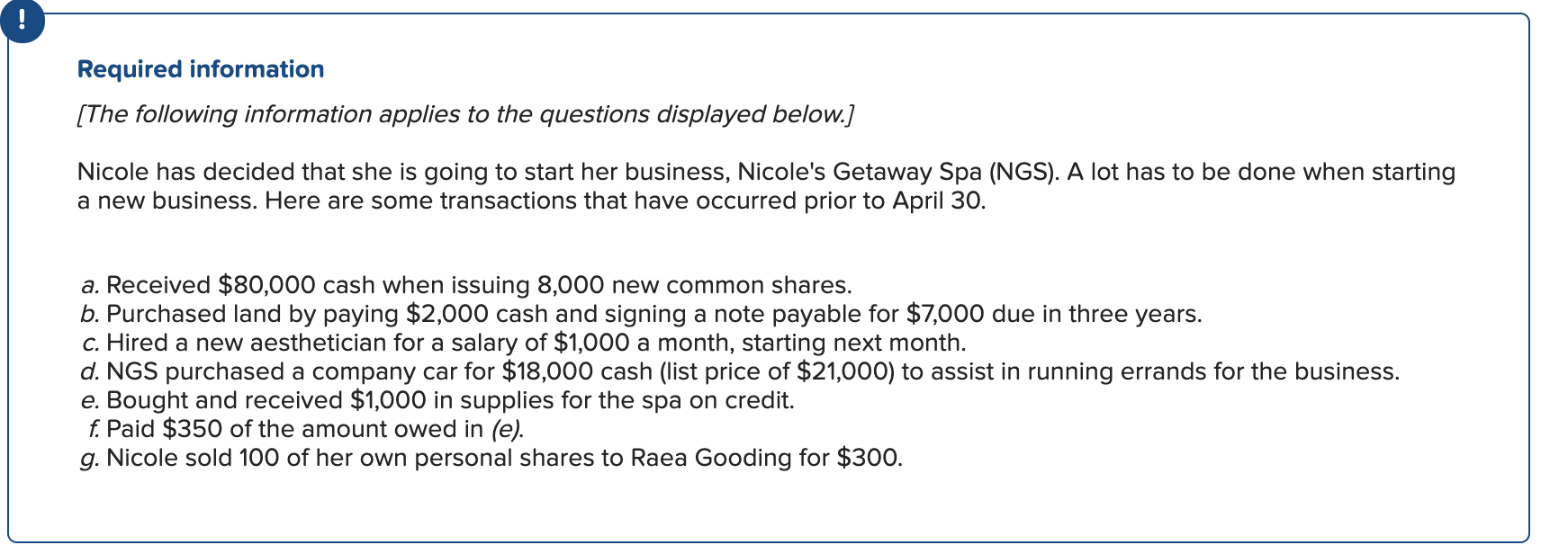

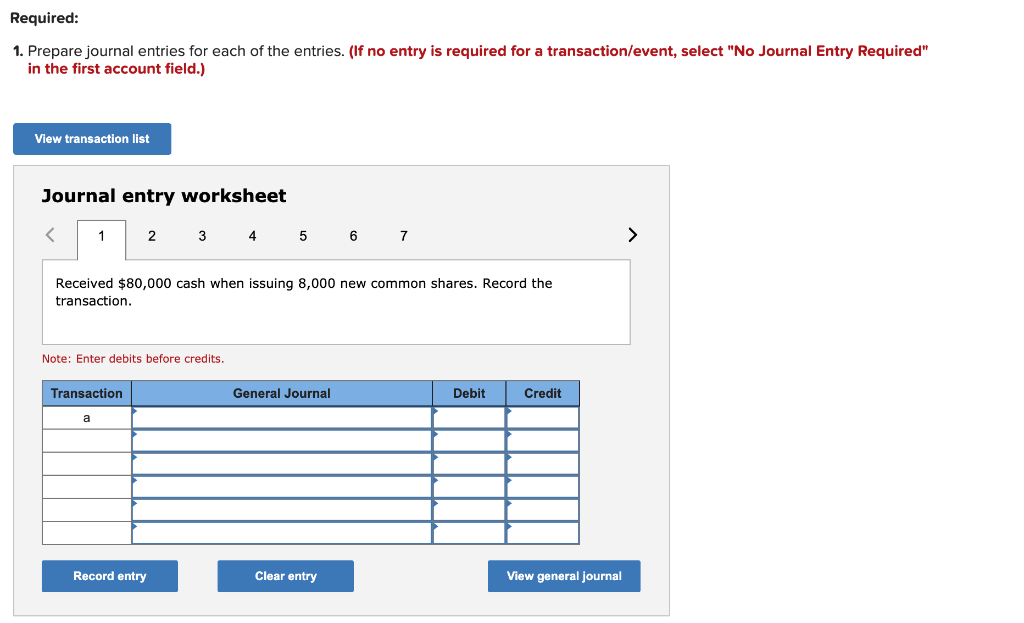

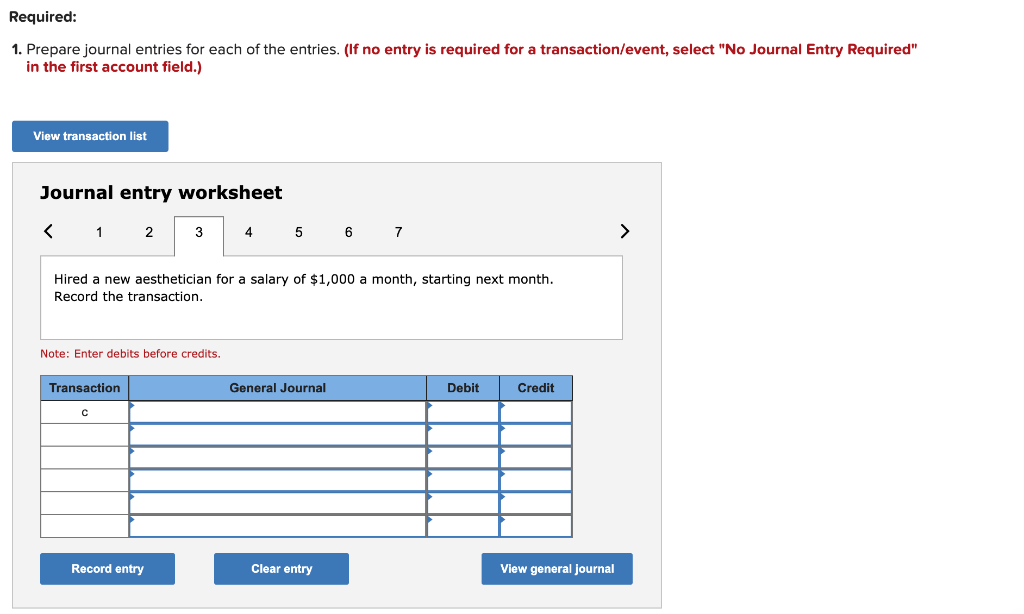

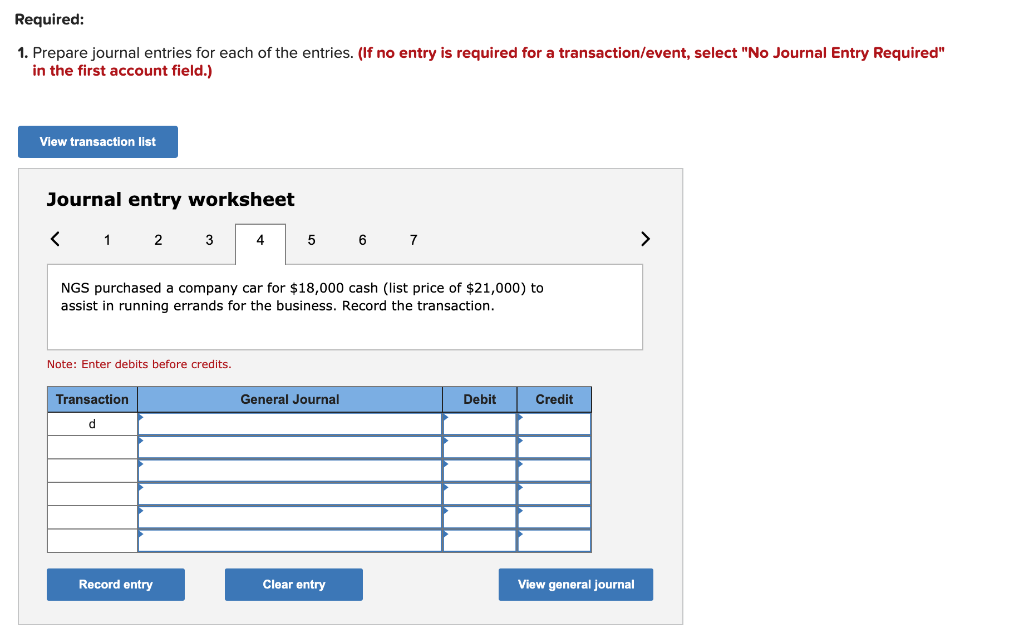

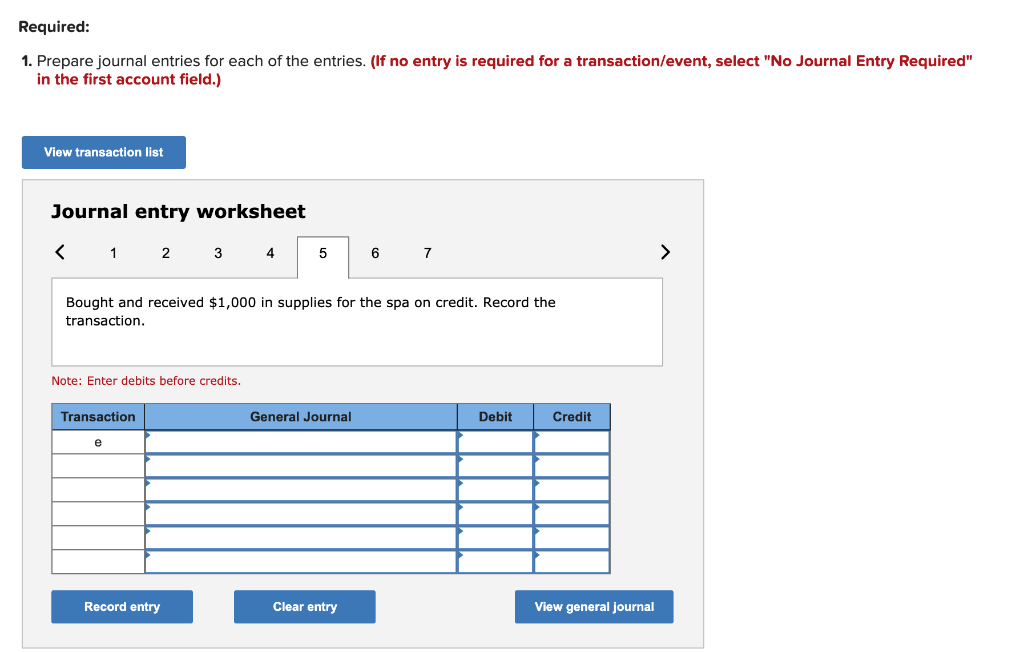

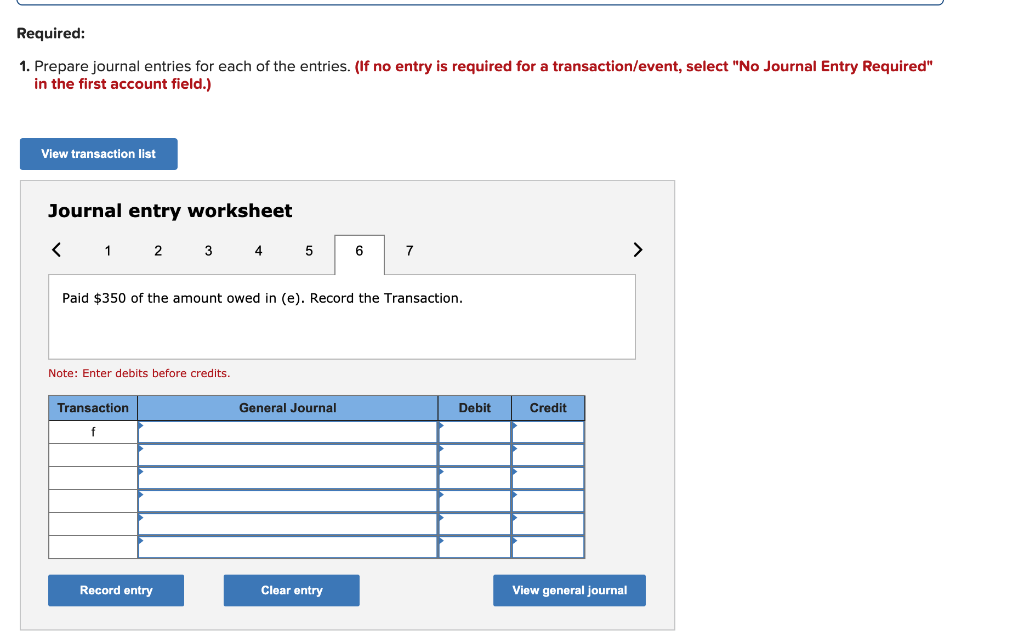

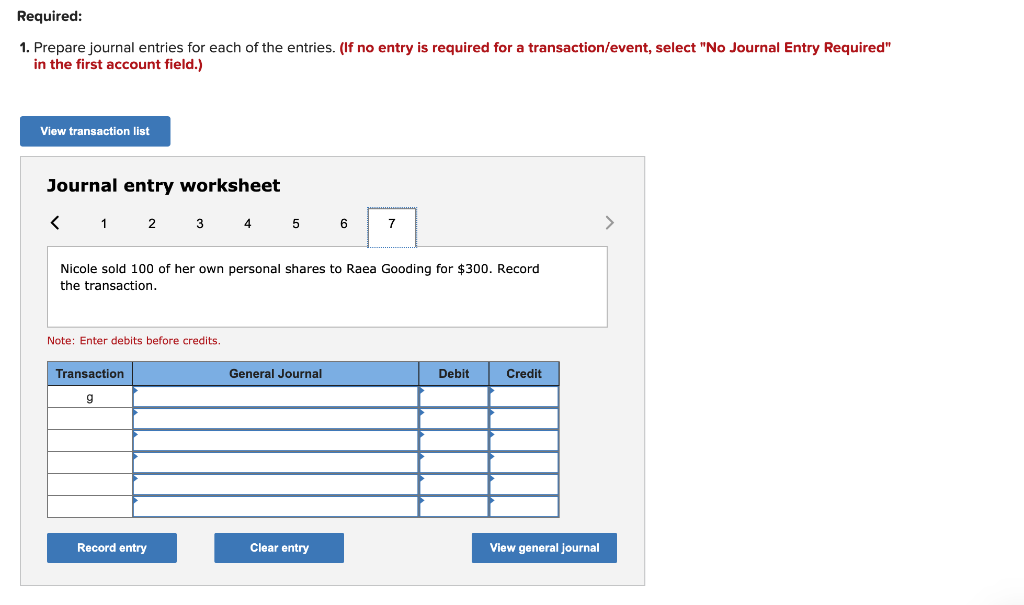

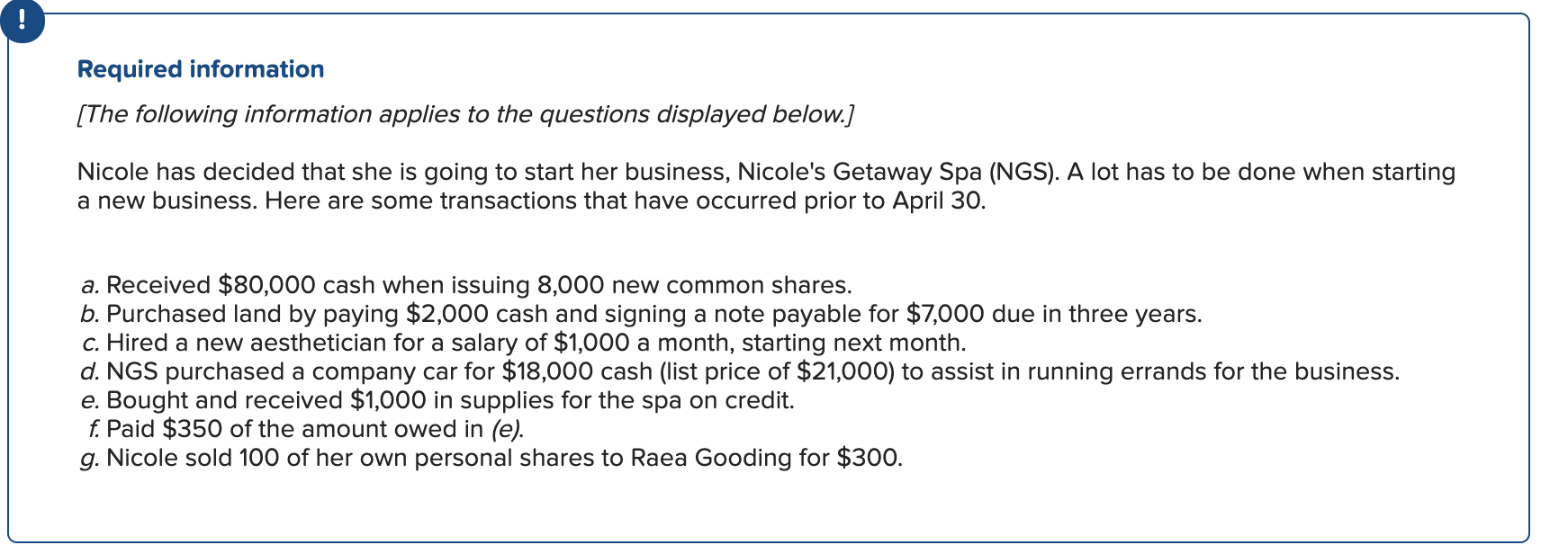

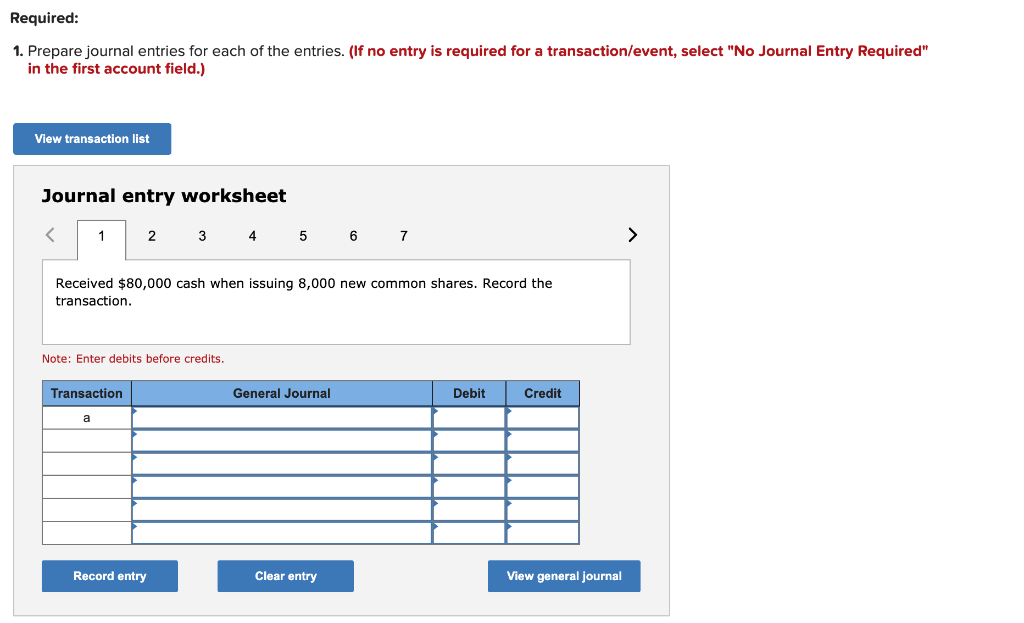

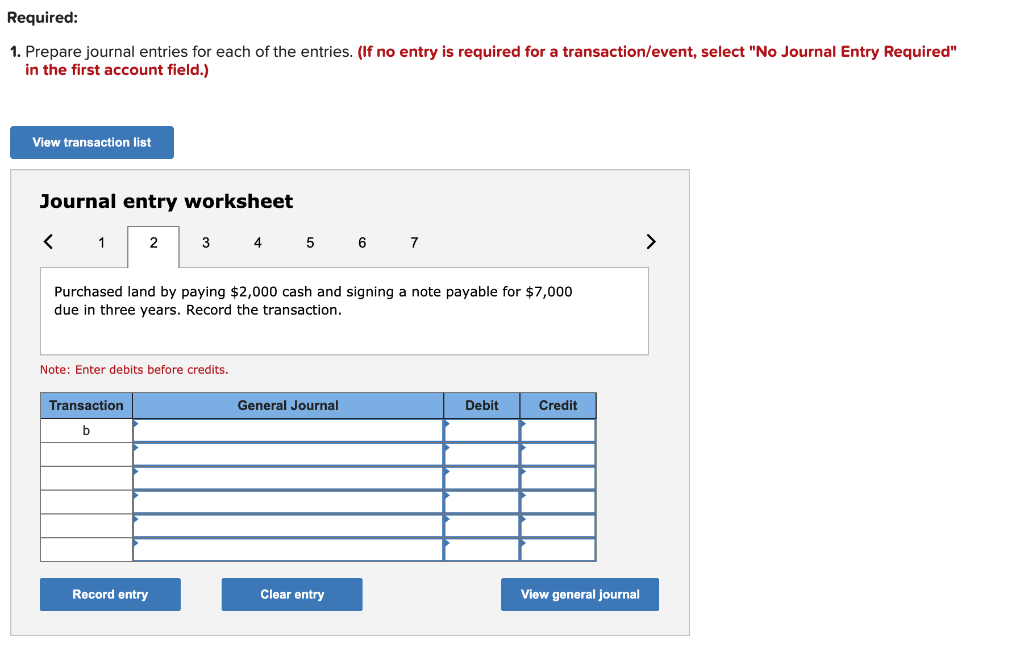

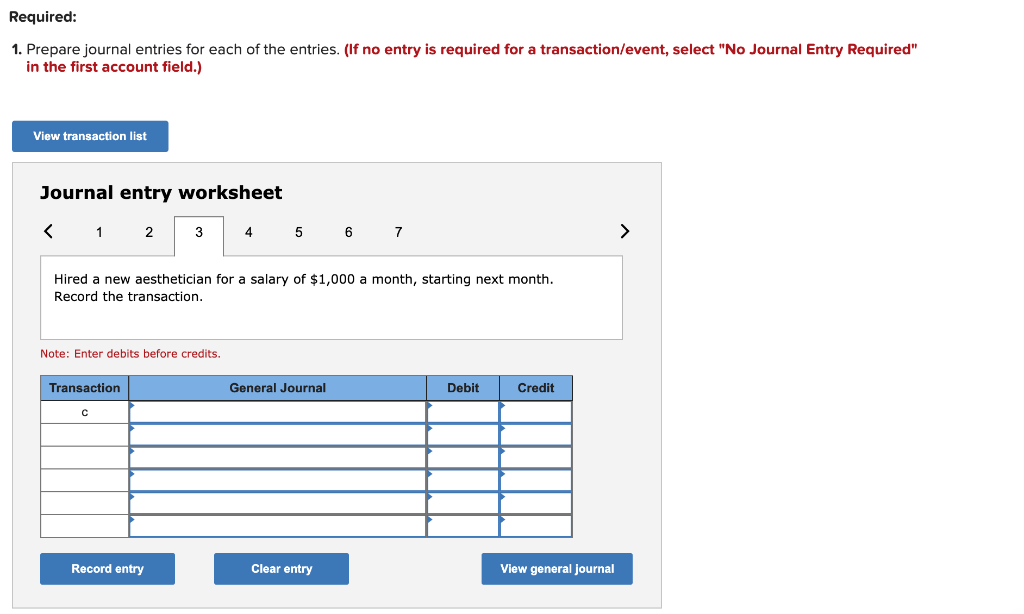

Required information [The following information applies to the questions displayed below.) Nicole has decided that she is going to start her business, Nicole's Getaway Spa (NGS). A lot has to be done when starting a new business. Here are some transactions that have occurred prior to April 30. a. Received $80,000 cash when issuing 8,000 new common shares. b. Purchased land by paying $2,000 cash and signing a note payable for $7,000 due in three years. c. Hired a new aesthetician for a salary of $1,000 a month, starting next month. d. NGS purchased a company car for $18,000 cash (list price of $21,000) to assist in running errands for the business. e. Bought and received $1,000 in supplies for the spa on credit. f. Paid $350 of the amount owed in (e). g. Nicole sold 100 of her own personal shares to Raea Gooding for $300. Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Received $80,000 cash when issuing 8,000 new common shares. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Purchased land by paying $2,000 cash and signing a note payable for $7,000 due in three years. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit b Record entry Clear entry View general journal Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet NGS purchased a company car for $18,000 cash (list price of $21,000) to assist in running errands for the business. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit d Record entry Clear entry View general journal Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Bought and received $1,000 in supplies for the spa on credit. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit e Record entry Clear entry View general journal Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Paid $350 of the amount owed in (e). Record the Transaction. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal Required: 1. Prepare journal entries for each of the entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Nicole sold 100 of her own personal shares to Raea Gooding for $300. Record the transaction. Note: Enter debits before credits Transaction General Journal Debit Credit g Record entry Clear entry View general journal

l

l