Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L. The payoff is lower than the profit D. The payoff and profit has no relation E. None above The following information is used for

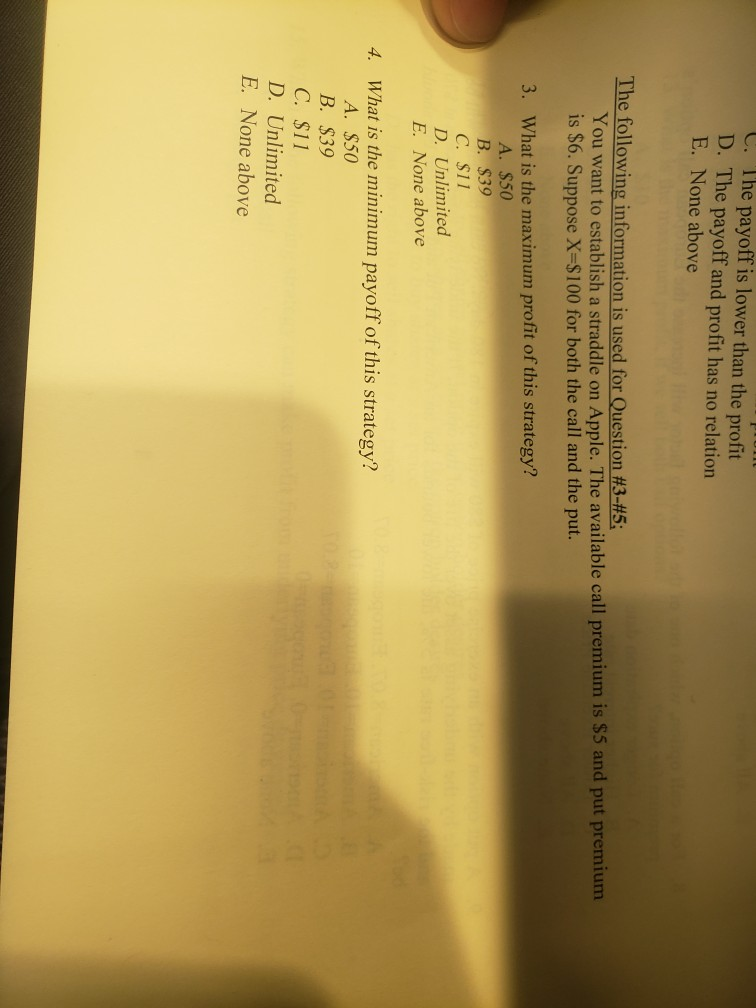

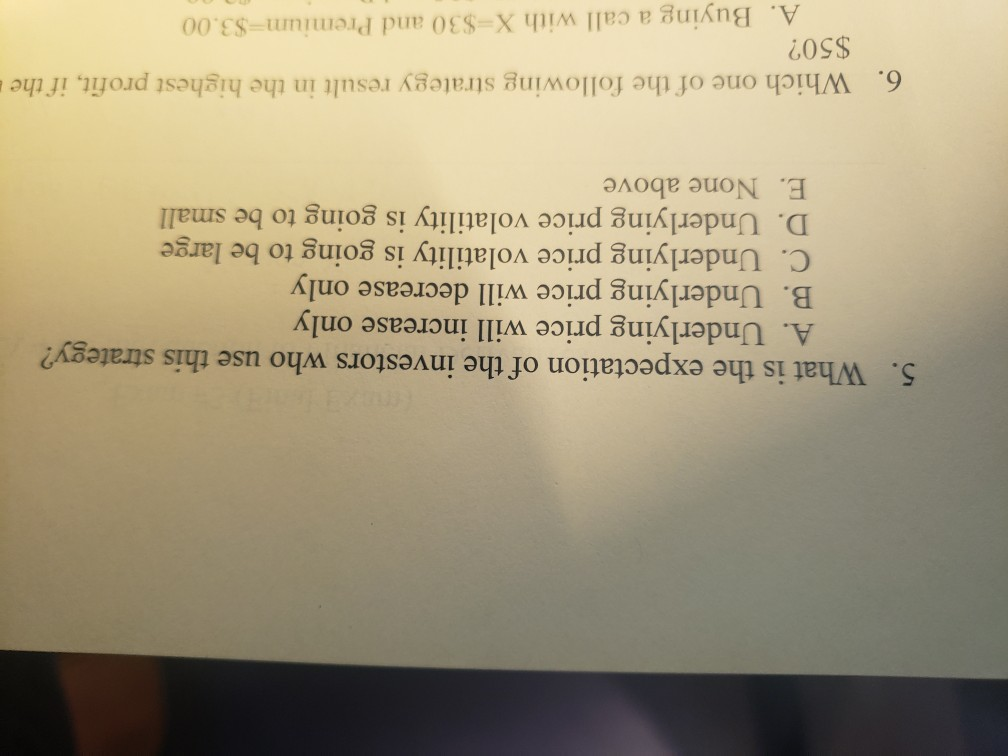

L. The payoff is lower than the profit D. The payoff and profit has no relation E. None above The following information is used for Question #3-#5; You want to establish a straddle on Apple. The available call premium is $5 and put premium is $6. Suppose X=$100 for both the call and the put. 3. What is the maximum profit of this strategy? A. $50 B. $39 C. $11 D. Unlimited E. None above 4. What is the minimum payoff of this strategy? A. $50 B. $39 C. $11 D. Unlimited E. None above 5. What is the expectation of the investors who use this strategy? A. Underlying price will increase only B. Underlying price will decrease only C. Underlying price volatility is going to be large D. Underlying price volatility is going to be small E. None above 6. Which one of the following strategy result in the highest profit, if the $50? A. Buying a call with X=$30 and Premium=$3.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started