Answered step by step

Verified Expert Solution

Question

1 Approved Answer

L6-E1-PP100-Friends Home Health 1. What additional items would you like to see included in the Friends Home cash flow statement? 2. Do you believe that

L6-E1-PP100-Friends Home Health

1. What additional items would you like to see included in the Friends Home cash flow statement?

2. Do you believe that the numbers above are realistic? Explain.

3. For which items would you like to have additional information? How might this be best presented?

4. Solely based on the cash flow statement, would you believe that this venture was worth investing in if you were an investor? Why or Why not?

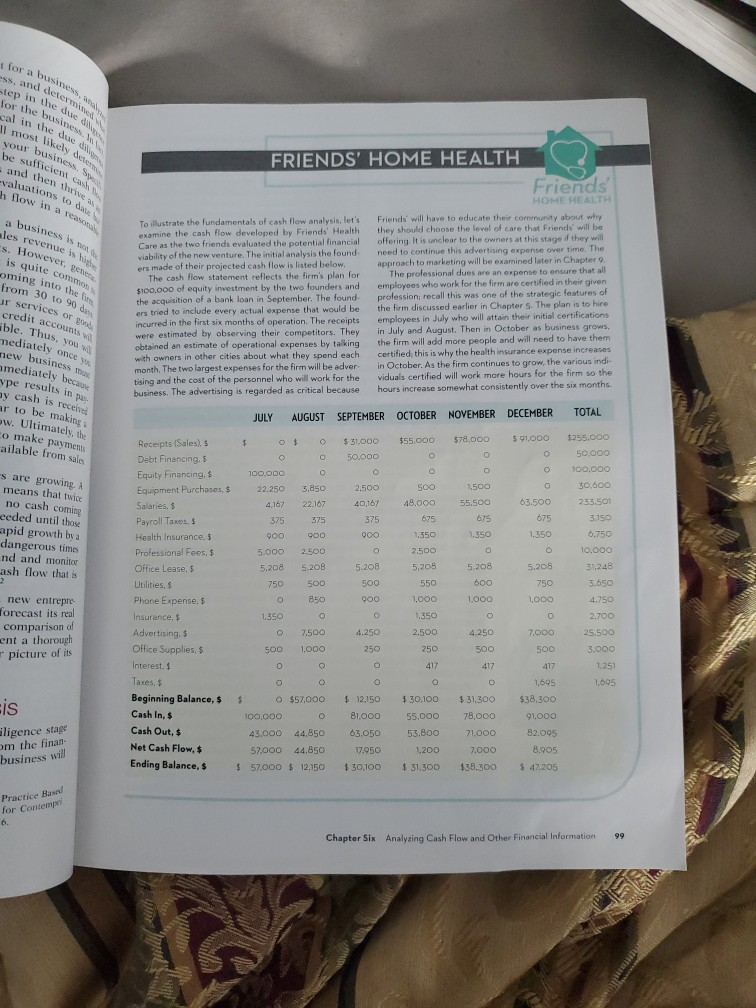

tep in the due cal in FRIENDS' HOME HEALTH Friends credit accounts ble. Thus, you mediately because I a ass, for the business 11 most likely Oce your business be sufficient ca to and then thrive a h flow in a react da a les revenue is on CS. However, geen is quite com oming into the in from 30 to 90 ir services or good mediately once you new business Me vpe results in a ove HOME HEALTH To illustrate the fundamentals of cash flow analysis, let's Friends will have to educate their community about why examine the cash flow developed by Friends' Health they should choose the level of care that Friends will be Care as the two friends evaluated the potential financial offering. It is unclear to the owners at this stage if they will viability of the new venture. The initial analysis the found need to continue this advertising expense over time. The ers made of their projected cash flow is listed below. approach to marketing will be examined later in Chapter 9 The cash flow statement reflects the firm's plan for The professional dues are an expense to ensure that all $100,000 of equity investment by the two founders and employees who work for the firm are certified in their given the acquisition of a bank loan in September. The found profession: recall this was one of the strategic features of ers tried to include every actual expense that would be the firm discussed earlier in Chapter 5. The plan is to hire incurred in the first six months of operation. The receipts employees in July who will attain their initial certifications were estimated by observing their competitors. They in July and August. Then in October as business grows, obtained an estimate of operational expenses by talking the firm will add more people and will need to have them with owners in other cities about what they spend each certified, this is why the health insurance expense increases month. The two largest expenses for the firm will be adver in October. As the firm continues to grow, the various indi- tising and the cost of the personnel who will work for the viduals certified will work more hours for the firm so the business. The advertising is regarded as critical because hours increase somewhat consistently over the six months JULY AUGUST SEPTEMBER OCTOBER NOVEMBER DECEMBER TOTAL Receipts (Sales) $ $ o$ $31.000 $55,000 $78,000 $ 91,000 $255.000 Debt Financing. $ 50.000 o O 50.000 Equity Financing, 100,000 0 100.000 Equipment Purchases, $ 22.250 3,850 2.500 SOO 1,500 30,600 azzo Salaries. $ 4,167 22.167 40,167 48.000 55.500 63.500 233.501 Payroll Taxes. $ 375 375 375 675 675 675 3.150 Health Insurance. $ 900 900 000 1.350 1.350 1.350 0.750 nood Professional Fees, 5.000 2.500 o 2.500 10,000 lood cone Enne ash flow that is Office Lease $ 5.208 5,208 5.208 5,205 5.208 5.206 31,248 2 Utilities, $ 750 500 500 od 550 000 750 3.650 new entrepre Phone Expenses O 850 000 1,000 1.000 1.000 4.750 forecast its real Insurance, $ 1.350 o 1.350 O O 2.700 comparison of Advertising. $ 7.500 4.250 2.500 4250 7.000 ent a thorough 25.500 Office Supplies SO 1.000 picture of its 250 250 500 soo 3.000 Interest, $ O o 417 417 417 1.251 Taxes. $ o 0 1,695 1,005 Beginning Balance, $ $ o $57.000 $ 12,150 sis $30.100 $ 31,300 $38,300 Cash In, $ 100,000 81.000 55.000 78,000 91,000 Gligence stage Cash Out, $ 43.000 44,850 63.050 53.800 71.000 82.095 Net Cash Flow, $ 57.000 44.850 17.950 1,200 7.000 8.905 Ending Balance, $ $57.000 $ 12.150 $ 30,100 $31.300 $33,300 $ 47.205 ay cash is receive ar to be making ew. Ultimately, the Co make paymes ailable from sales s are growing. A means that twice no cash coming eeded until those apid growth by a dangerous times nd and monitor $ om the finan business will Practice Based for Contempi 6. 99 Chapter Six Analyzing Cash Flow and Other Financial Information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started