Lab # 2 - You are a manager at Northern Fibre...

Lab # 2 - You are a manager at Northern Fibre...

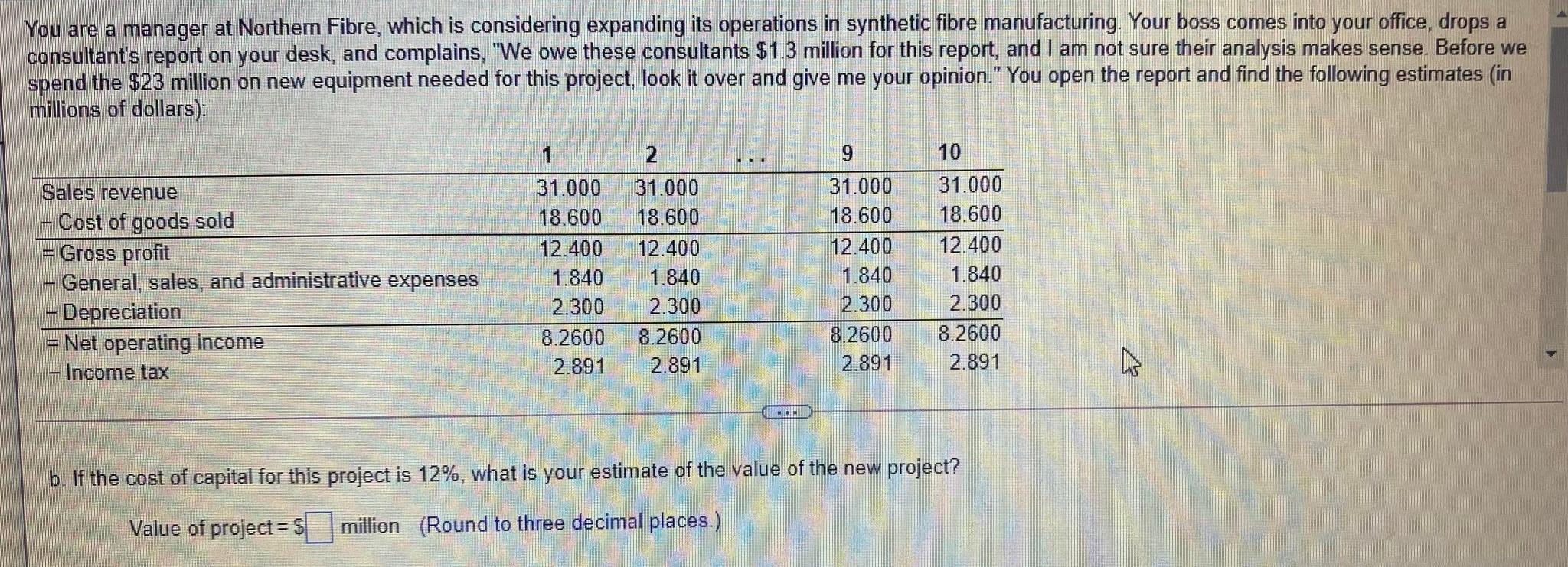

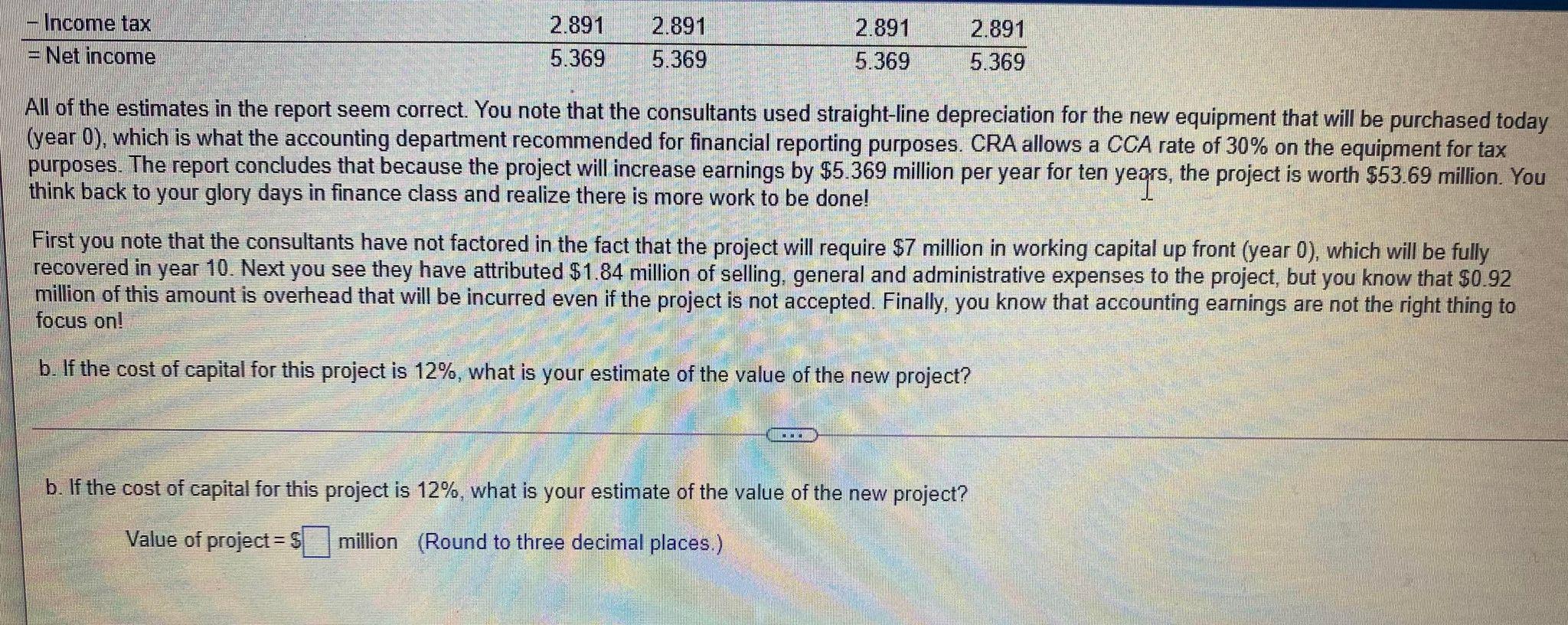

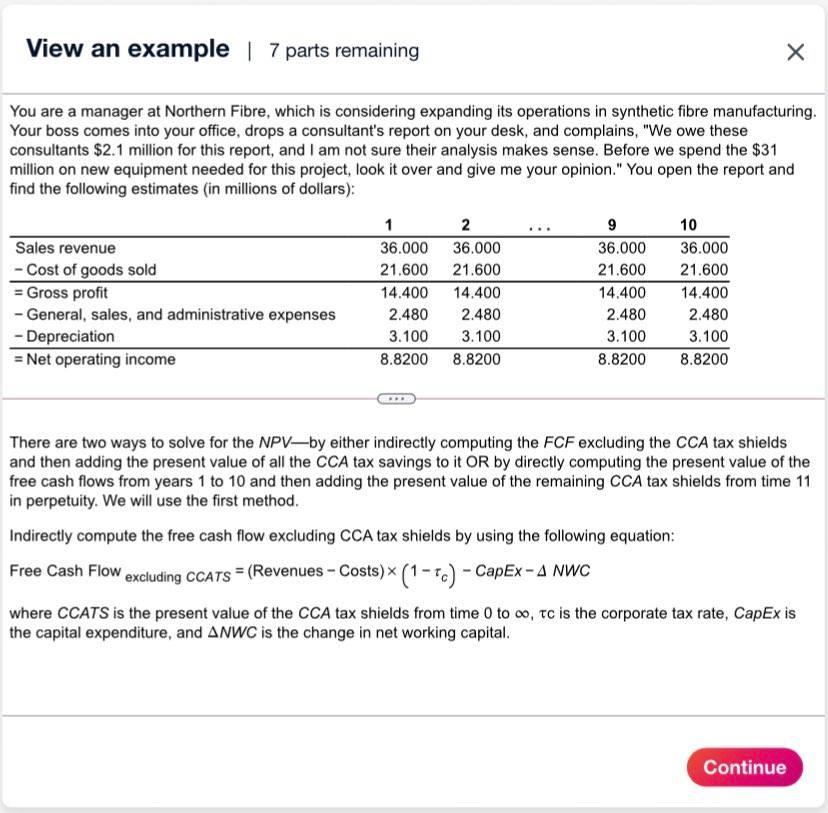

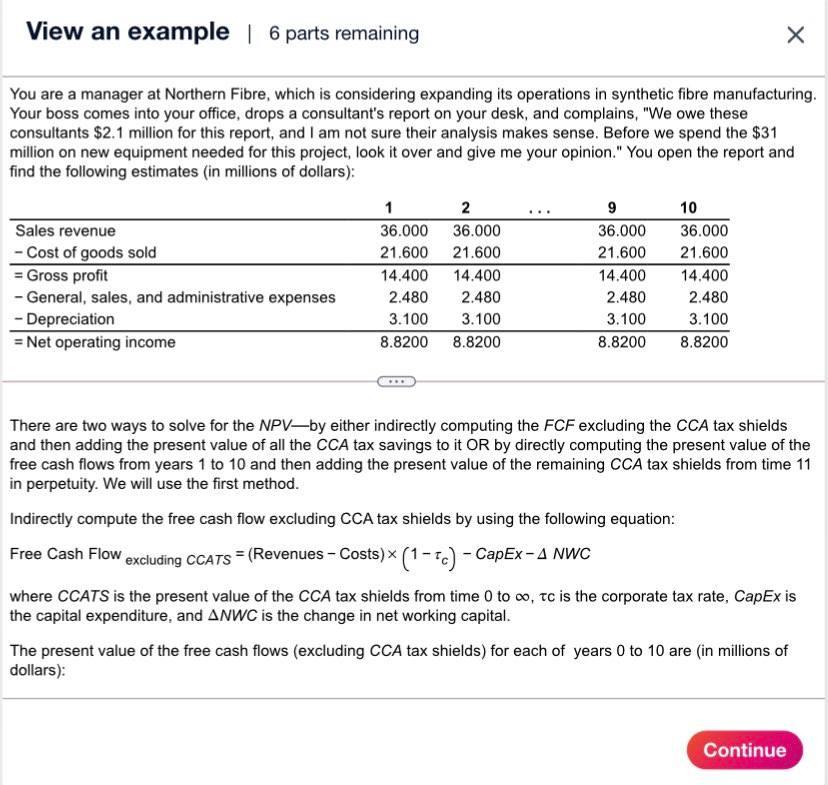

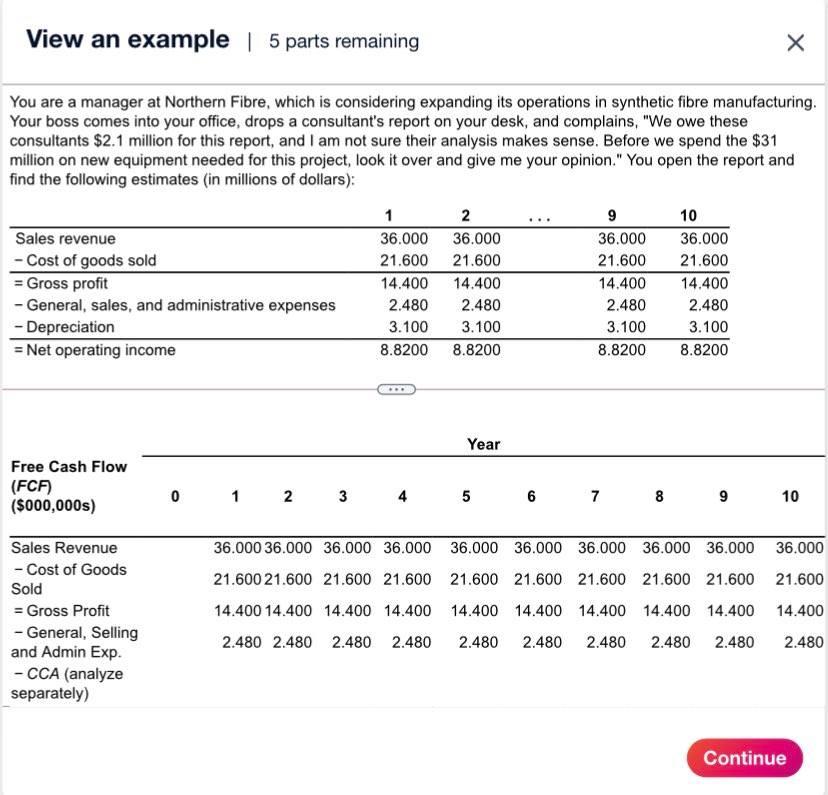

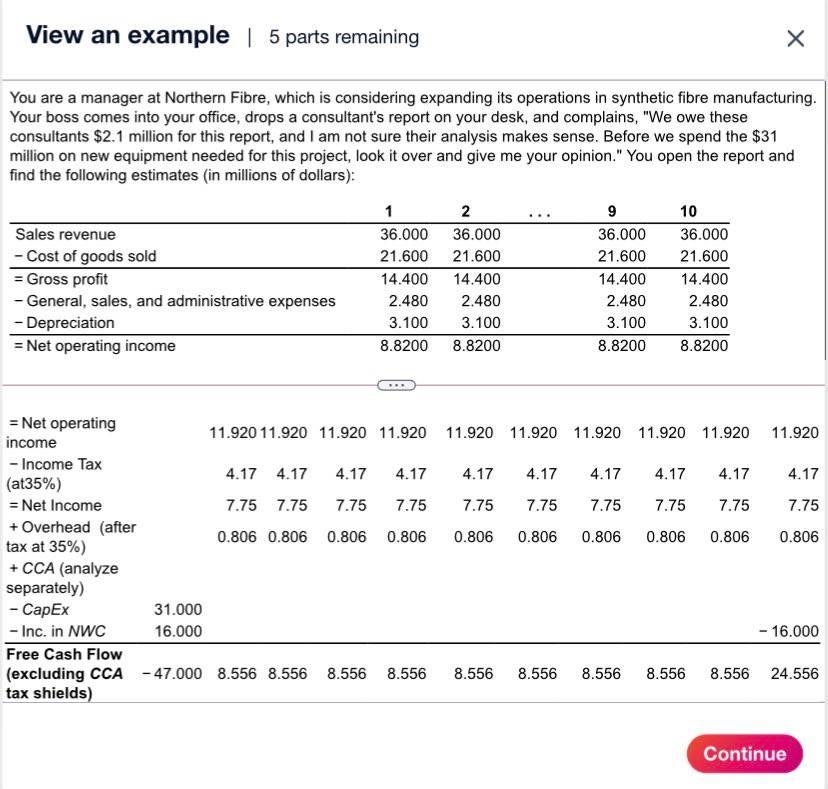

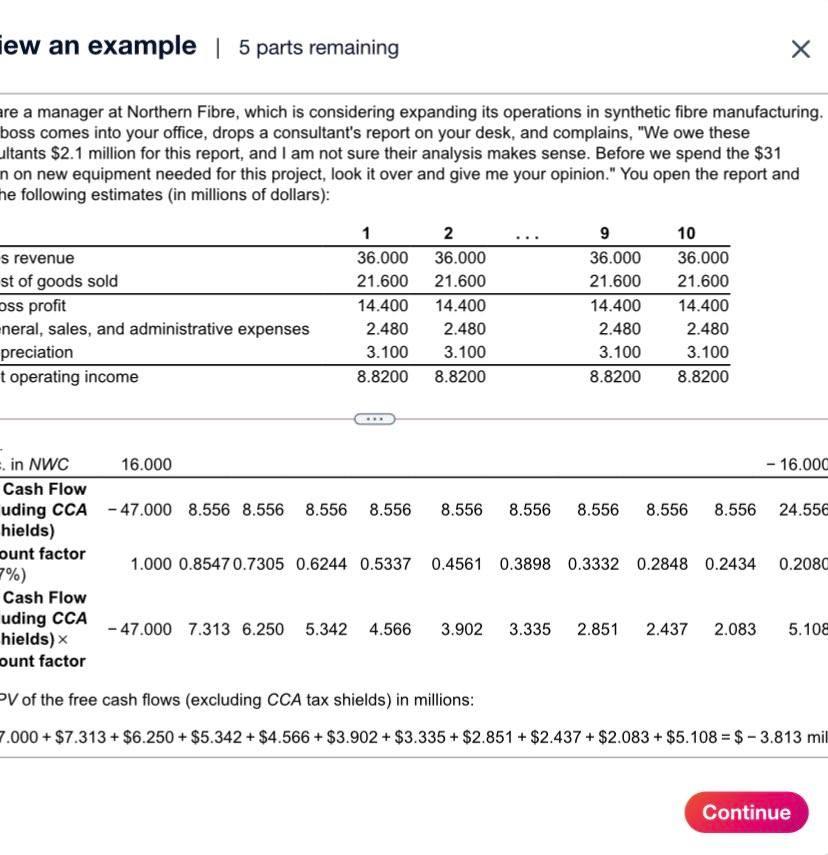

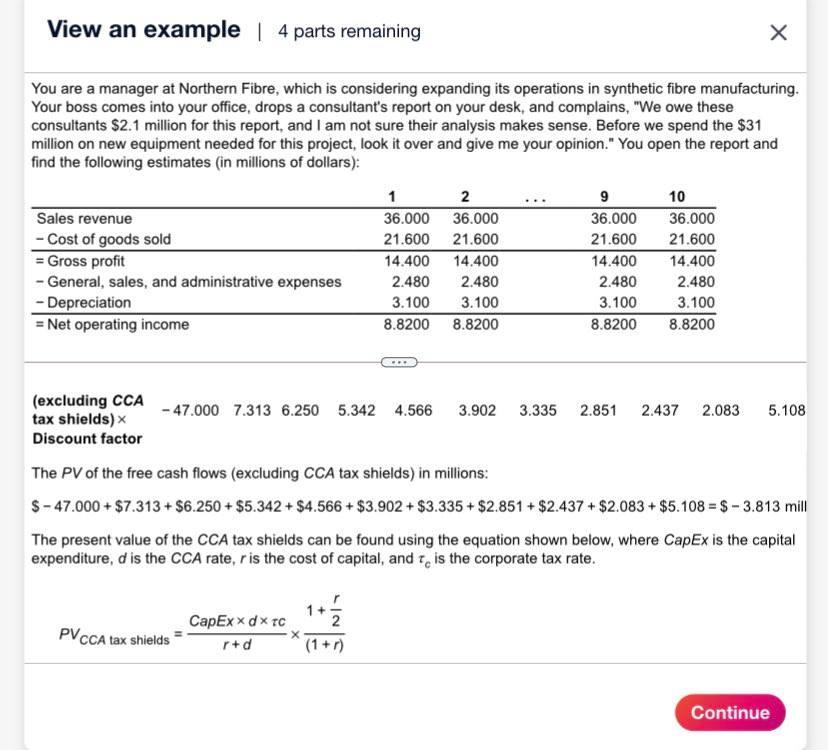

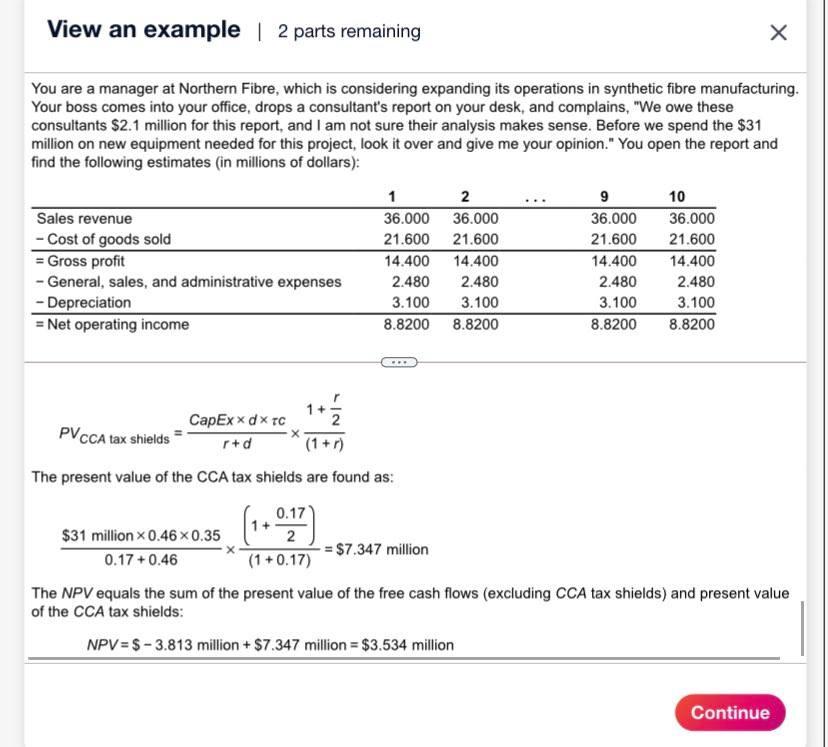

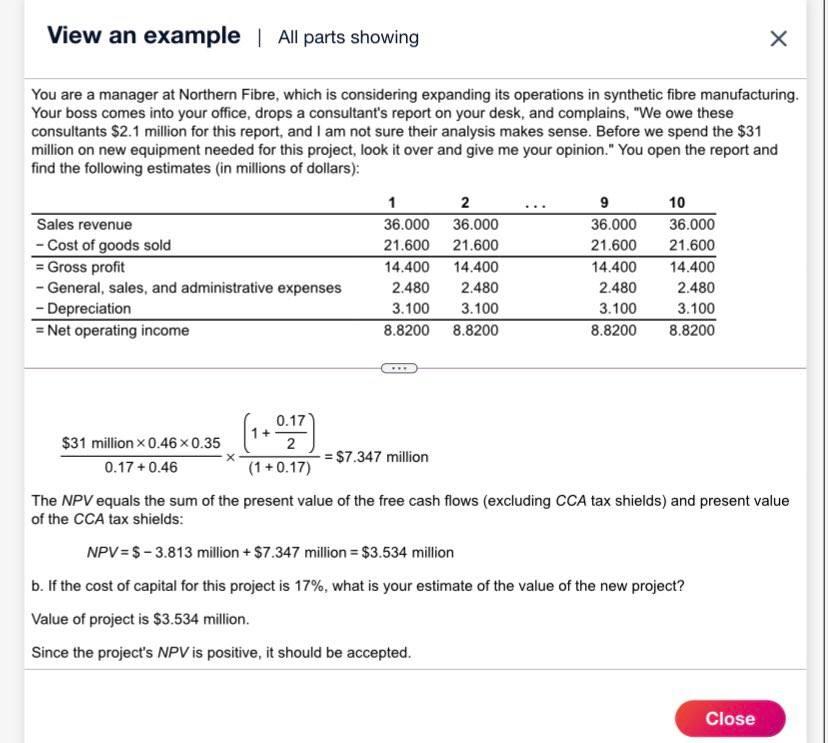

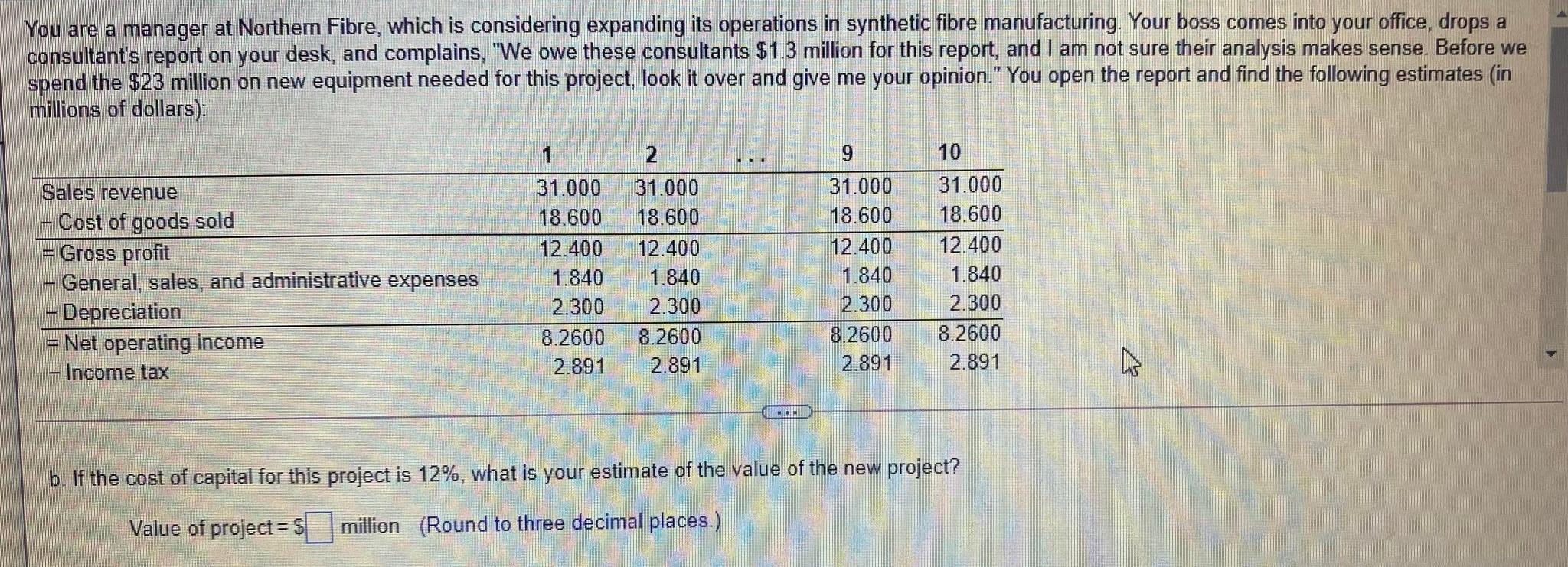

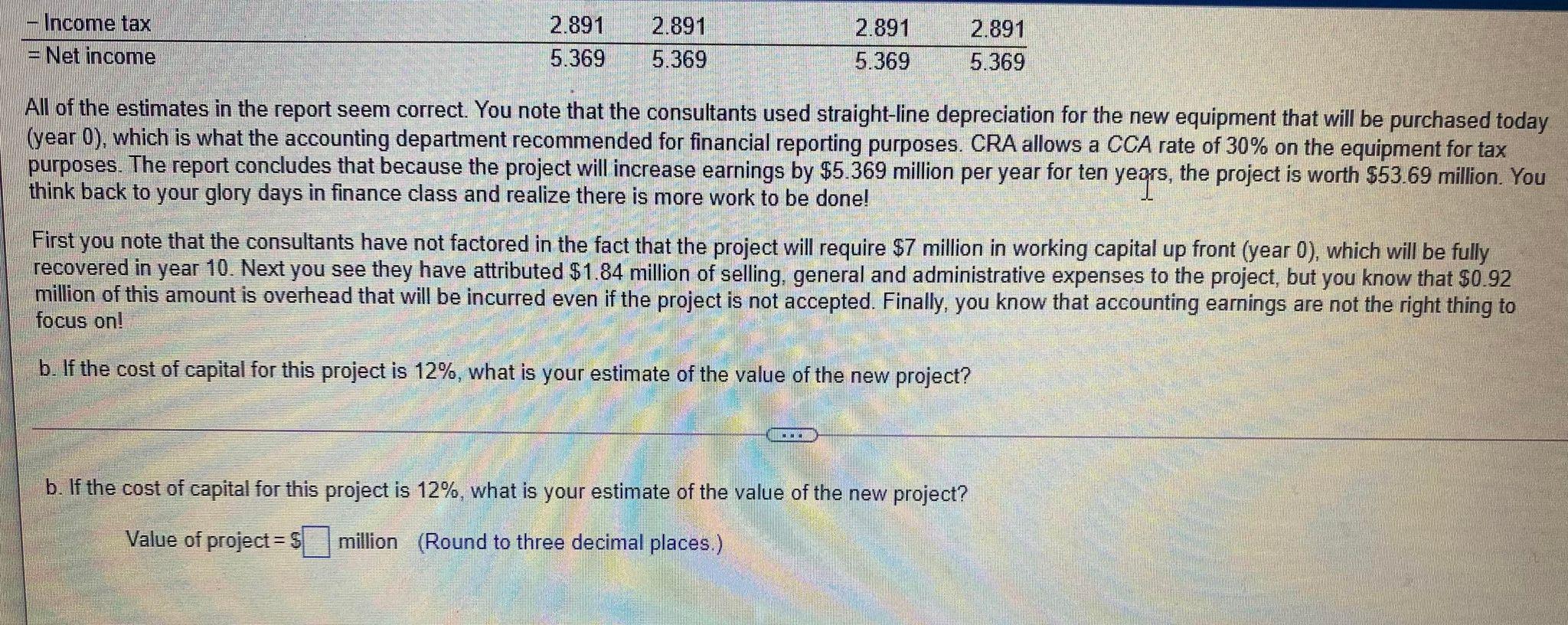

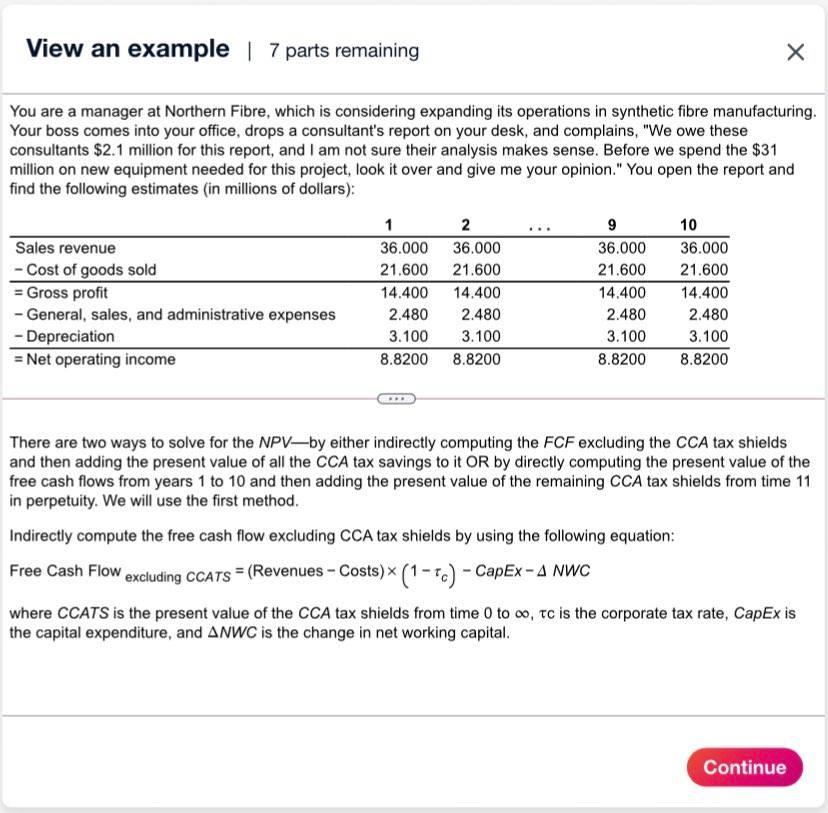

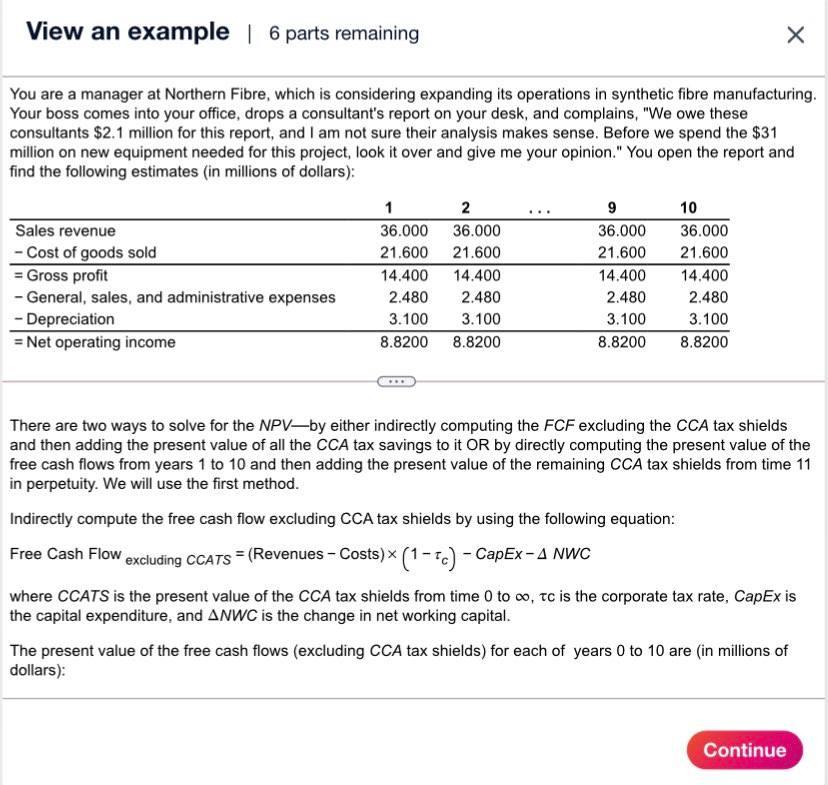

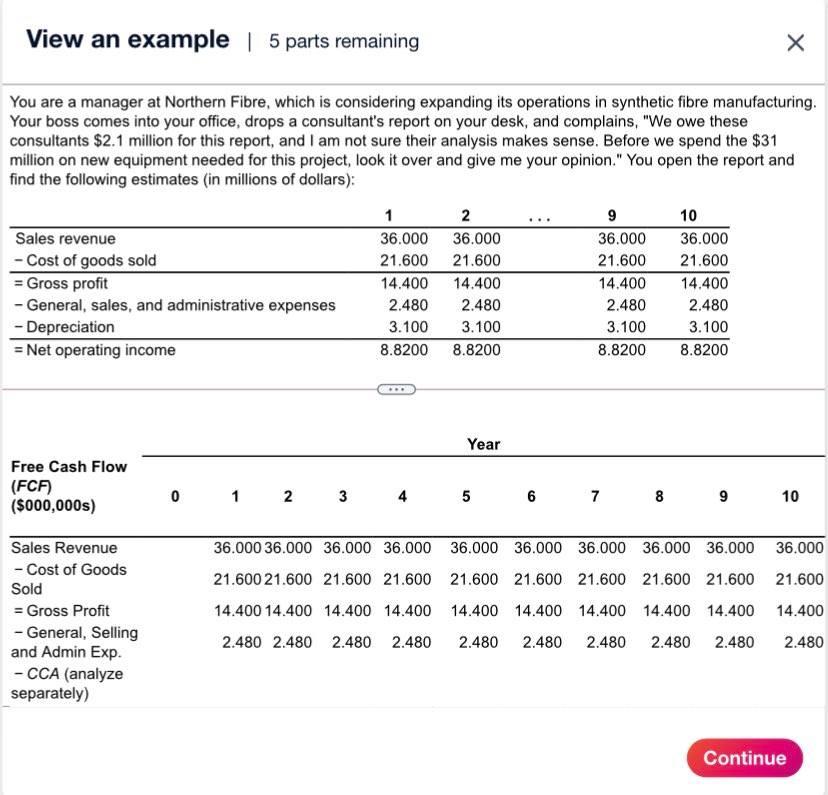

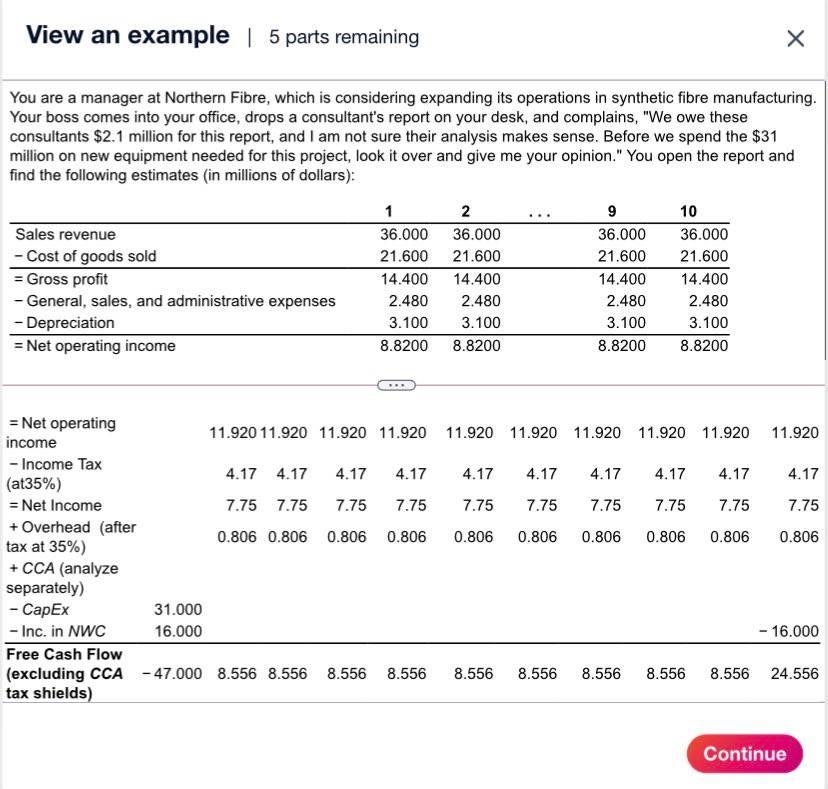

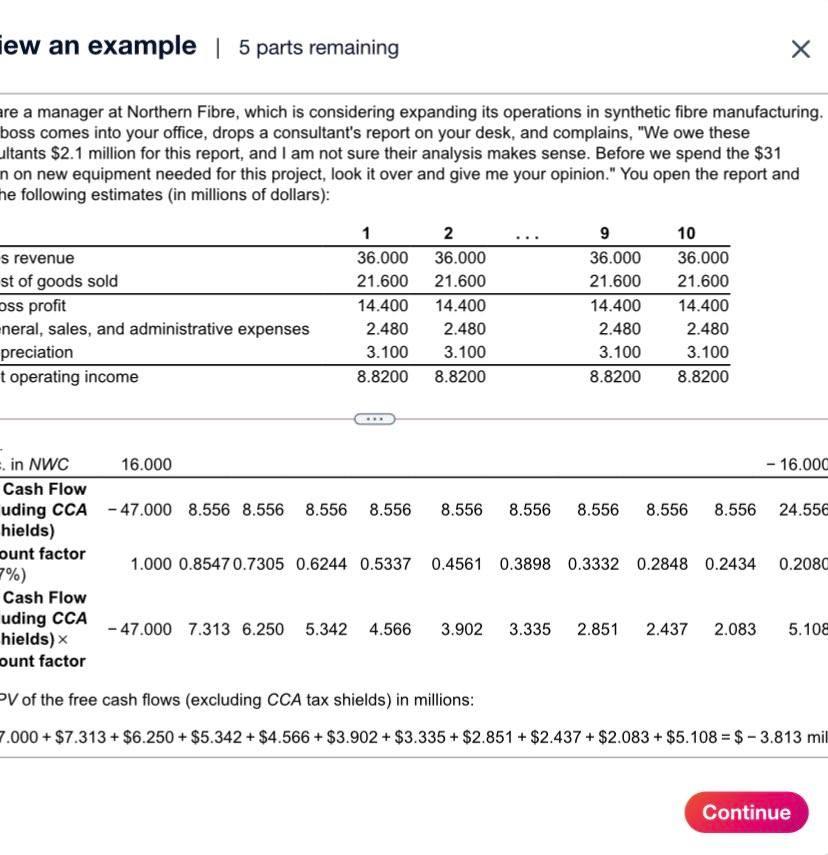

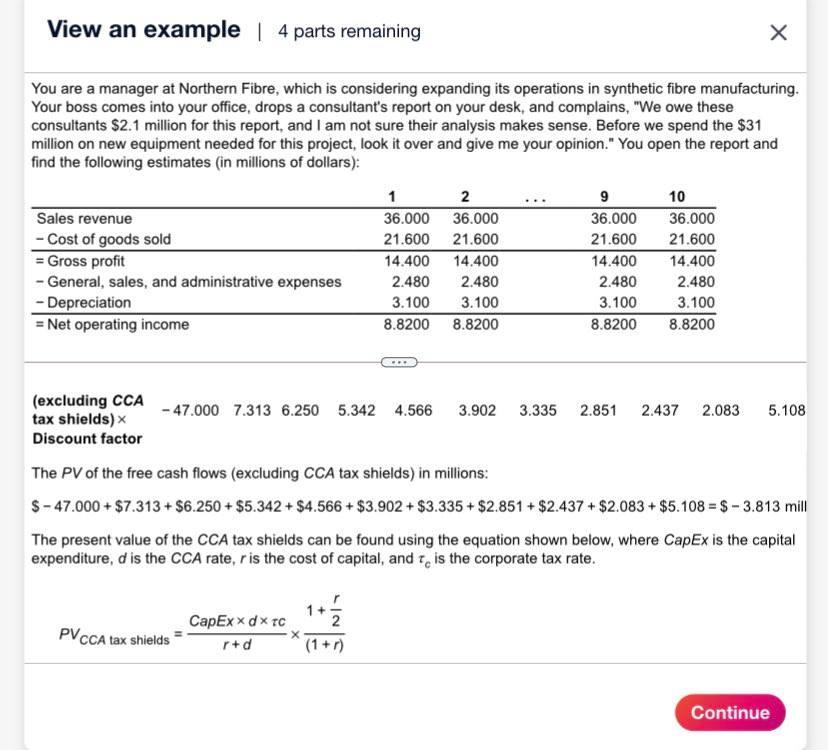

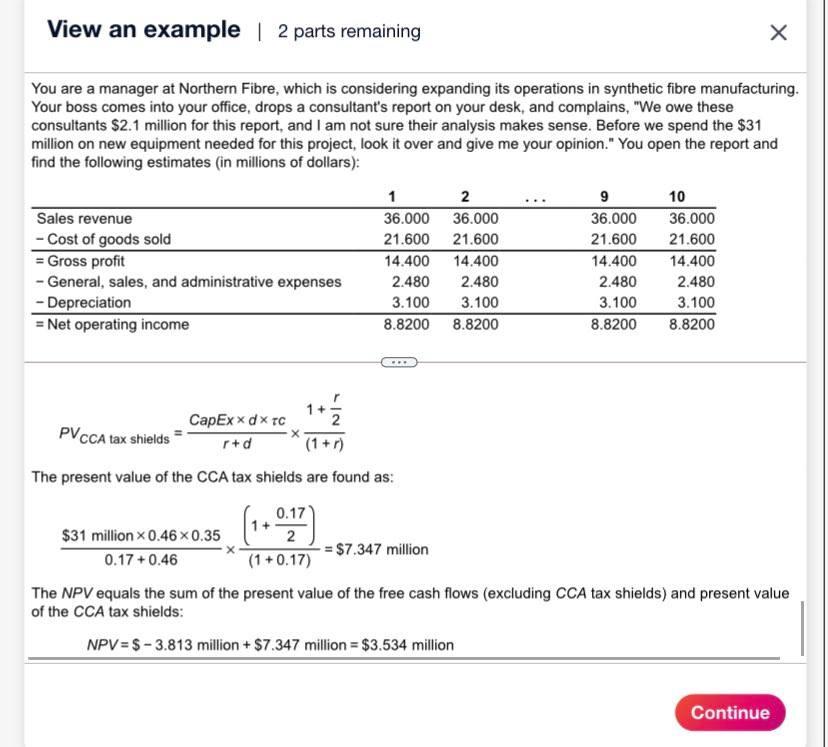

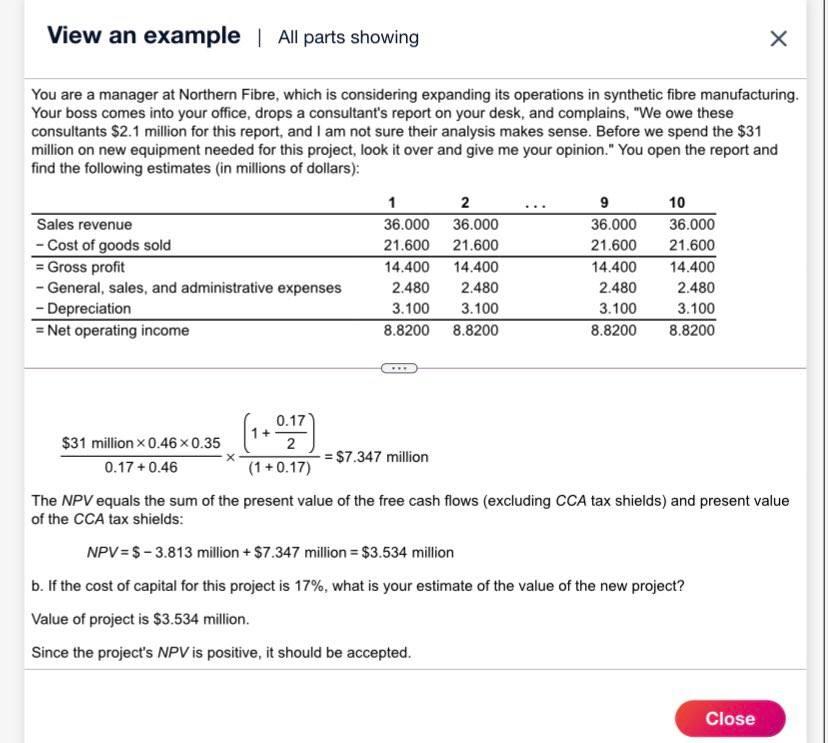

You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.3 million for this report, and I am not sure their analysis makes sense. Before we spend the $23 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 2 Sales revenue - Cost of goods sold = Gross profit General, sales, and administrative expenses - Depreciation = Net operating income Income tax 1 31.000 18.600 12.400 1.840 2.300 8.2600 2.891 31.000 18.600 12.400 1.840 2.300 8.2600 2.891 9 31.000 18.600 12.400 1.840 2.300 8.2600 2.891 10 31.000 18.600 12.400 1.840 2.300 8.2600 2.891 . 23 b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? Value of project=5 million (Round to three decimal places.) - Income tax = Net income 2.891 5.369 2.891 5.369 2.891 5.369 2.891 5.369 All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended for financial reporting purposes. CRA allows a CCA rate of 30% on the equipment for tax purposes. The report concludes that because the project will increase earnings by $5.369 million per year for ten years, the project is worth $53.69 million. You think back to your glory days in finance class and realize there is more work to be done! First you note that the consultants have not factored in the fact that the project will require $7 million in working capital up front (year 0), which will be fully recovered in year 10. Next you see they have attributed $1.84 million of selling, general and administrative expenses to the project, but you know that $0.92 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on! b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? b. If the cost of capital for this project is 12%, what is your estimate of the value of the new project? Value of project = S million (Round to three decimal places.) View an example 7 parts remaining | 10 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 1 2 9 Sales revenue 36.000 36.000 36.000 36.000 - Cost of goods sold 21.600 21.600 21.600 21.600 = Gross profit 14.400 14.400 14.400 14.400 - General, sales, and administrative expenses 2.480 2.480 2.480 2.480 - Depreciation 3.100 3.100 3.100 3.100 = Net operating income 8.8200 8.8200 8.8200 8.8200 There are two ways to solve for the NPVby either indirectly computing the FCF excluding the CCA tax shields and then adding the present value of all the CCA tax savings to it OR by directly computing the present value of the free cash flows from years 1 to 10 and then adding the present value of the remaining CCA tax shields from time 11 in perpetuity. We will use the first method. Indirectly compute the free cash flow excluding CCA tax shields by using the following equation: Free Cash Flow excluding Ccats = (Revenues - Costs) x (1-7) CapEx-1 NWC where CCATS is the present value of the CCA tax shields from time 0 to 00, tc is the corporate tax rate, CapEx is the capital expenditure, and ANWC is the change in net working capital. Continue View an example 6 parts remaining | x You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 10 Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 36.000 21.600 14.400 2.480 3.100 8.8200 2 36.000 21.600 14.400 2.480 3.100 8.8200 9 36.000 21.600 14.400 2.480 3.100 8.8200 36.000 21.600 14.400 2.480 3.100 8.8200 There are two ways to solve for the NPVby either indirectly computing the FCF excluding the CCA tax shields and then adding the present value of all the CCA tax savings to it OR by directly computing the present value of the free cash flows from years 1 to 10 and then adding the present value of the remaining CCA tax shields from time 11 in perpetuity. We will use the first method. Indirectly compute the free cash flow excluding CCA tax shields by using the following equation: Free Cash Flow excluding CCATs = (Revenues - Costs)x (1-7c) - CapEx-A NWC where CCATS is the present value of the CCA tax shields from time 0 to , tc is the corporate tax rate, CapEx is the capital expenditure, and ANWC is the change in net working capital. The present value of the free cash flows (excluding CCA tax shields) for each of years 0 to 10 are in millions of dollars): Continue View an example 5 parts remaining | You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing, Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 10 Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 36.000 21.600 14.400 2.480 3.100 8.8200 2 36.000 21.600 14.400 2.480 3.100 8.8200 9 36.000 21.600 14.400 2.480 3.100 8.8200 36.000 21.600 14.400 2.480 3.100 8.8200 Year Free Cash Flow (FCF) ($000,000s) 0 1 2 3 4 5 6 7 8 9 10 36.000 36.000 36.000 36.000 36.000 36.000 36.000 36.000 36.000 36.000 21.600 21.600 21.600 21.600 21.600 21.600 21.600 21.600 21.600 21.600 14.400 14.400 14.400 14.400 14.400 14.400 14.400 14.400 14.400 14.400 Sales Revenue - Cost of Goods Sold = Gross Profit - General, Selling and Admin Exp. - CCA (analyze separately) 2.480 2.480 2.480 2.480 2.480 2.480 2.480 2.480 2.480 2.480 Continue View an example 5 parts remaining | You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 36.000 21.600 14.400 2.480 3.100 8.8200 2 36.000 21.600 14.400 2.480 3.100 8.8200 9 36.000 21.600 14.400 2.480 3.100 8.8200 10 36.000 21.600 14.400 2.480 3.100 8.8200 11.920 11.920 11.920 11.920 11.920 11.920 4.17 4.17 4.17 4.17 4.17 4.17 7.75 7.75 7.75 7.75 7.75 7.75 0.806 0.806 0.806 0.806 0.806 0.806 = Net operating 11.920 11.920 11.920 11.920 income - Income Tax 4.17 4.17 4.17 4.17 (at35%) = Net Income 7.75 7.75 7.75 7.75 + Overhead (after 0.806 0.806 0.806 0.806 tax at 35%) + CCA (analyze separately) - Capex 31.000 - Inc. in NWC 16.000 Free Cash Flow (excluding CCA - 47.000 8.556 8.556 8.556 8.556 tax shields) - 16.000 8.556 8.556 8.556 8.556 8.556 24.556 Continue iew an example 5 parts remaining are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these ultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 non new equipment needed for this project, look it over and give me your opinion." You open the report and he following estimates (in millions of dollars): s revenue st of goods sold oss profit neral, sales, and administrative expenses preciation toperating income 1 36.000 21.600 14.400 2.480 3.100 8.8200 2 36.000 21.600 14.400 2.480 3.100 8.8200 9 36.000 21.600 14.400 2.480 3.100 8.8200 10 36.000 21.600 14.400 2.480 3.100 8.8200 in NWC 16.000 - 16.000 Cash Flow uding CCA - 47.000 8.556 8.556 8.556 8.556 8.556 8.556 8.556 8.556 8.556 24.556 hields) punt factor 1.000 0.85470.7305 0.6244 0.5337 0.4561 0.3898 0.3332 0.2848 0.2434 0.2080 7%) Cash Flow uding CCA - 47.000 7.313 6.250 5.342 4.566 3.902 3.335 2.851 2.437 2.083 5.10 hields) ount factor PV of the free cash flows (excluding CCA tax shields) in millions: 7.000 + $7.313 + $6.250 + $5.342 + $4.566 + $3.902 + $3.335 + $2.851 + $2.437 + $2.083 + $5.108 = $ - 3.813 mil Continue View an example 4 parts remaining 10 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 1 2 9 Sales revenue 36.000 36.000 36.000 36.000 - Cost of goods sold 21.600 21.600 21.600 21.600 = Gross profit 14.400 14.400 14.400 14.400 - General, sales, and administrative expenses 2.480 2.480 2.480 2.480 - Depreciation 3.100 3.100 3.100 3.100 = Net operating income 8.8200 8.8200 8.8200 8.8200 (excluding CCA 47.000 7.313 6.250 5.342 4.566 3.902 tax shields) 3.335 2.851 2.437 2.083 5.108 Discount factor The PV of the free cash flows (excluding CCA tax shields) in millions: $- 47.000 + $7.313 + $6.250 + $5.342 + $4.566 + $3.902 + $3.335 + $2.851 + $2.437 + $2.083 + $5.108 = $ - 3.813 mill The present value of the CCA tax shields can be found using the equation shown below, where CapEx is the capital expenditure, d is the CCA rate, r is the cost of capital, and 7, is the corporate tax rate. PV CCA tax shields CapExx dxC r+d 2 (1+r) Continue View an example 2 parts remaining 10 You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 1 2 9 Sales revenue 36.000 36.000 36.000 36.000 - Cost of goods sold 21.600 21.600 21.600 21.600 = Gross profit 14.400 14.400 14.400 14.400 - General, sales, and administrative expenses 2.480 2.480 2.480 2.480 - Depreciation 3.100 3.100 3.100 3.100 = Net operating income 8.8200 8.8200 8.8200 8.8200 Capexx d * TC 1+ PVCCA tax shields r+d (1 + r) The present value of the CCA tax shields are found as: 0.17 1 + $31 million x 0.46 0.35 2 = $7.347 million 0.17 +0.46 (1 + 0.17) The NPV equals the sum of the present value of the free cash flows (excluding CCA tax shields) and present value of the CCA tax shields: NPV = $ -3.813 million + $7.347 million = $3.534 million Continue View an example | All parts showing You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $2.1 million for this report, and I am not sure their analysis makes sense. Before we spend the $31 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 36.000 21.600 14.400 2.480 3.100 8.8200 2 36.000 21.600 14.400 2.480 3.100 8.8200 9 36.000 21.600 14.400 2.480 3.100 8.8200 10 36.000 21.600 14.400 2.480 3.100 8.8200 (1+ X 0.17 $31 million x 0.46 x 0.35 2 = $7.347 million 0.17 +0.46 (1 +0.17) The NPV equals the sum of the present value of the free cash flows (excluding CCA tax shields) and present value of the CCA tax shields: NPV = 5 -3.813 million + $7.347 million = $3.534 million b. If the cost of capital for this project is 17%, what is your estimate of the value of the new project? Value of project is $3.534 million. Since the project's NPV is positive, it should be accepted. Close

Lab # 2 - You are a manager at Northern Fibre...

Lab # 2 - You are a manager at Northern Fibre...