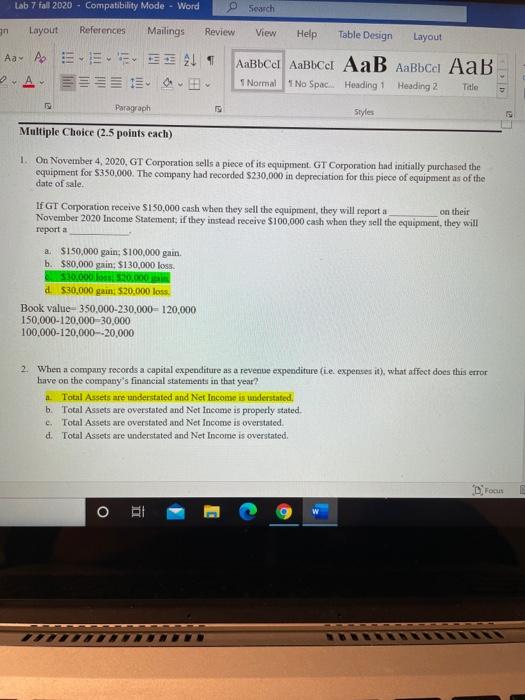

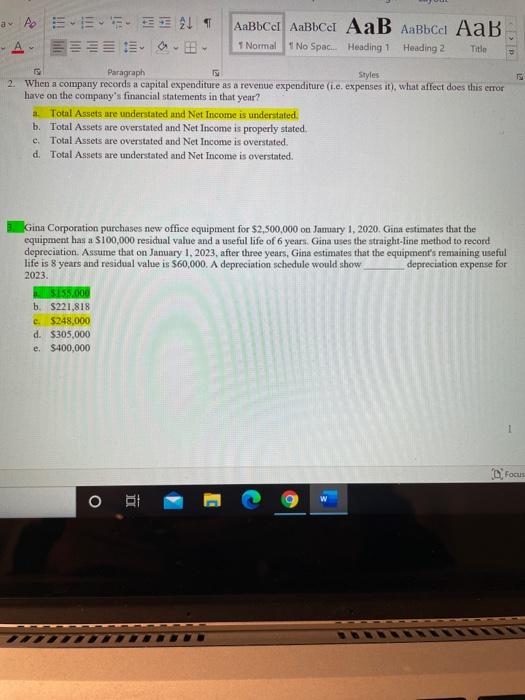

Lab 7 fall 2020 - Compatibility Mode - Word Search an Layout References Mailings Review View Help Table Design Layout Aa A ESE 211 el el AESE C Normal 1 No Space Heading 1 Heading 2 Title Paragraph Styles Multiple Choice (2.5 points each) 1. On November 4, 2020, GT Corporation sells a piece of its equipment. GT Corporation had initially purchased the equipment for $350,000. The company had recorded $230,000 in depreciation for this piece of equipment as of the date of sale. If GT Corporation receive $150,000 cash when they sell the equipment, they will report a on their November 2020 Income Statement, if they instead receive $100,000 cash when they sell the equipment, they will report a a $150,000 gain: $100,000 gain. b. $80,000 gain: $130,000 loss. $30.000 20.00 d $30,000 gain: $20.000 loss, Book value- 350,000-230,000-120,000 150,000-120,000-30,000 100,000-120,000--20,000 2. When a company records a capital expenditure as a revente expenditure i.e. expenses it), what affect does this error have on the company's financial statements in that year? Total Assets are understated and Net Income is understated b. Total Assets are overstated and Net Income is properly stated. c. Total Assets are overstated and Net Income is overstated. d. Total Assets are understated and Net Income is overstated Droo ORI el AaB AaBbcci Normal 1 No Spac. Heading 1 Heading 2 Title Paragraph Styles 2. When a company records a capital expenditure as a revente expenditure (i.c. expenses it), what affect does this error have on the company's financial statements in that year? Total Assets are understated and Net Income is understated. b. Total Assets are overstated and Net Income is properly stated. c Total Assets are overstated and Net Income is overstated. d. Total Assets are understated and Net Income is overstated. Gina Corporation purchases new office equipment for $2,500,000 on January 1, 2020. Gina estimates that the equipment has a $100.000 residual value and a useful life of 6 years. Gina uses the straight-line method to record depreciation. Assume that on January 1, 2023, after three years, Gina estimates that the equipment's remaining useful life is 8 years and residual value is 560,000. A depreciation schedule would show depreciation expense for 2023. SI55.000 b. $221,818 c. $248,000 d. $305,000 e $400,000 1 D Focus OBI