Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LaFarge Swaps Euros for Pounds. I only have 15 minutes left! Please solve this question!! LaFarge Swaps Euros for Pounds. LaFarge, a major French multinational,

LaFarge Swaps Euros for Pounds.

I only have 15 minutes left! Please solve this question!!

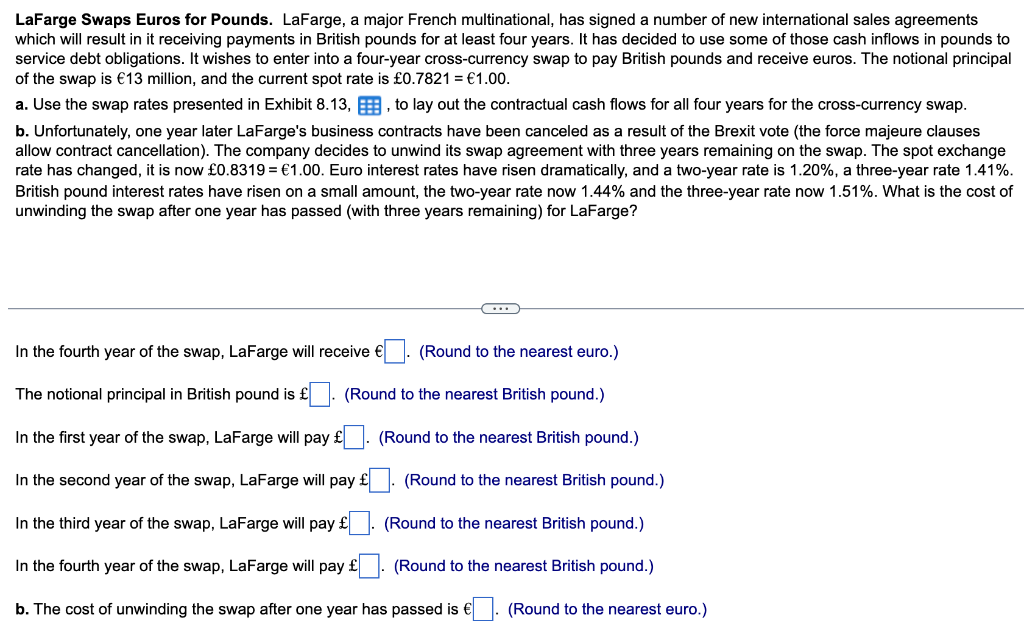

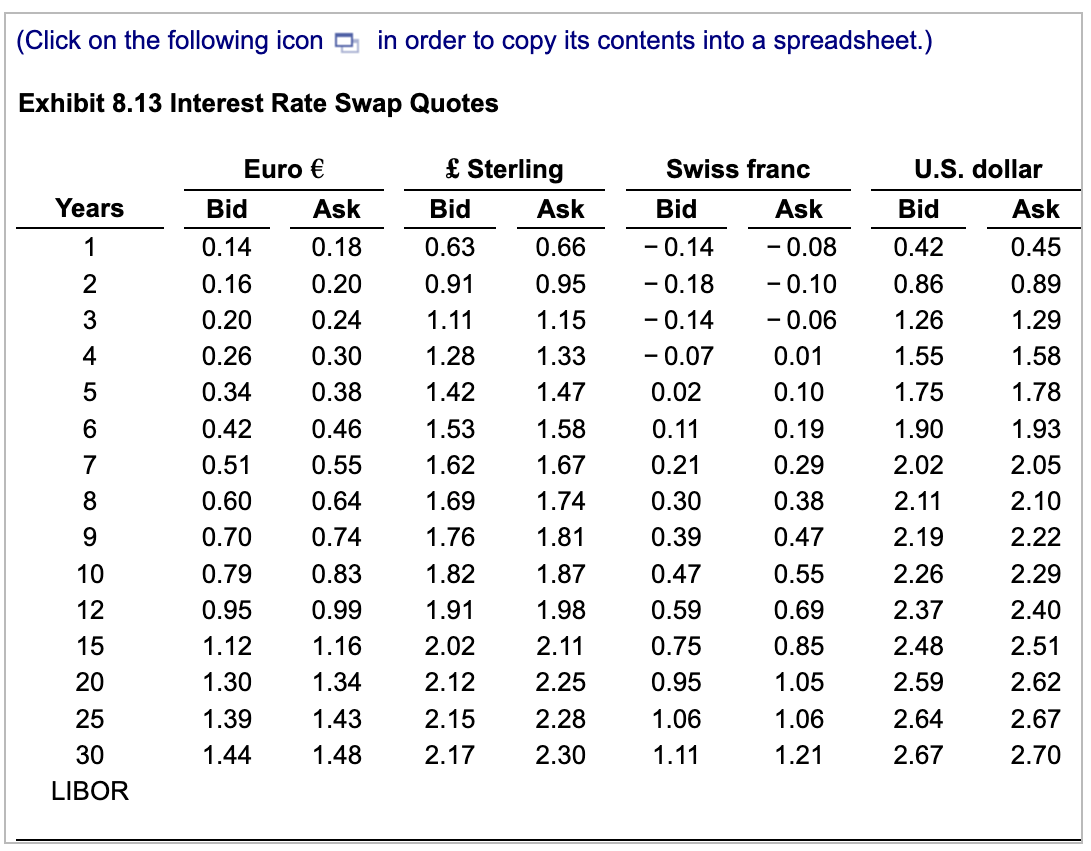

LaFarge Swaps Euros for Pounds. LaFarge, a major French multinational, has signed a number of new international sales agreements which will result in it receiving payments in British pounds for at least four years. It has decided to use some of those cash inflows in pounds to service debt obligations. It wishes to enter into a four-year cross-currency swap to pay British pounds and receive euros. The notional principal of the swap is 13 million, and the current spot rate is 0.7821=1.00. a. Use the swap rates presented in Exhibit 8.13, , to lay out the contractual cash flows for all four years for the cross-currency swap. b. Unfortunately, one year later LaFarge's business contracts have been canceled as a result of the Brexit vote (the force majeure clauses allow contract cancellation). The company decides to unwind its swap agreement with three years remaining on the swap. The spot exchange rate has changed, it is now 0.8319=1.00. Euro interest rates have risen dramatically, and a two-year rate is 1.20%, a three-year rate 1.41%. British pound interest rates have risen on a small amount, the two-year rate now 1.44% and the three-year rate now 1.51%. What is the cost of unwinding the swap after one year has passed (with three years remaining) for LaFarge? In the fourth year of the swap, LaFarge will receive . (Round to the nearest euro.) The notional principal in British pound is . (Round to the nearest British pound.) In the first year of the swap, LaFarge will pay . (Round to the nearest British pound.) In the second year of the swap, LaFarge will pay . (Round to the nearest British pound.) In the third year of the swap, LaFarge will pay . (Round to the nearest British pound.) In the fourth year of the swap, LaFarge will pay . (Round to the nearest British pound.) b. The cost of unwinding the swap after one year has passed is . (Round to the nearest euro.) a. Use the swap rates presented in Exhibit 8.12, , to lay out the contractual cash flows for all four years for the cross-currency swap. In the first year of the swap, LaFarge will receive . (Round to the nearest euro.) In the second year of the swap, LaFarge will receive . (Round to the nearest euro.) In the third year of the swap, LaFarge will receive . (Round to the nearest euro.) (Click on the following icon in order to copy its contents into a spreadsheet.) Exhibit 8.13 Interest Rate Swap QuotesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started