Answered step by step

Verified Expert Solution

Question

1 Approved Answer

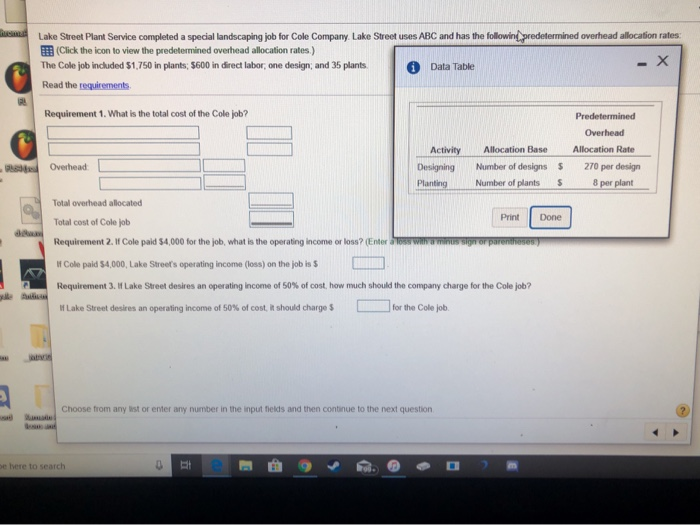

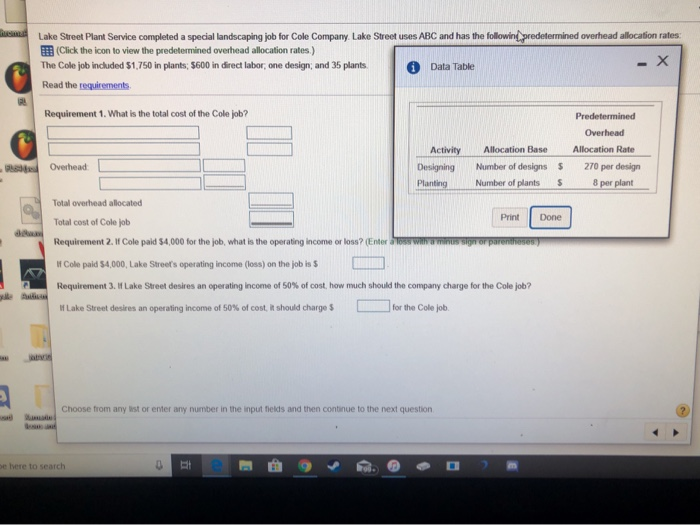

Lake Street Plant Service completed a special landscaping job for Cole Company Lake Street uses ABC and has the followingredetermined overhead allocation rates: (Click the

Lake Street Plant Service completed a special landscaping job for Cole Company Lake Street uses ABC and has the followingredetermined overhead allocation rates: (Click the icon to view the predetermined overhead allocation rates) The Cole job included $1,750 in plants: $600 in direct labor, one design, and 35 plants 1 Data Table Read the requirements - X Requirement 1. What is the total cost of the Cole job? Activity Designing Planting Overhead Predetermined Overhead Allocation Rate 270 per design 8 per plant Allocation Base Number of designs Number of plants 5 S Total overhead allocated Total cost of Cole job Print Done Requirement 2. If Cole paid $4,000 for the job, what is the operating income or loss? (Enter a loss with If Cole paid $4,000, Lake Streets operating income (loss) on the job is $ Requirement 3. I Lake Street desires an operating income of 50% of cost, how much should the company charge for the Cole job? If Lake Street desires an operating income of 50% of cost, it should charges for the Cole job. Choose from any list or enter any number in the input fields and then continue to the next question e here to search 9

Lake Street Plant Service completed a special landscaping job for Cole Company Lake Street uses ABC and has the followingredetermined overhead allocation rates: (Click the icon to view the predetermined overhead allocation rates) The Cole job included $1,750 in plants: $600 in direct labor, one design, and 35 plants 1 Data Table Read the requirements - X Requirement 1. What is the total cost of the Cole job? Activity Designing Planting Overhead Predetermined Overhead Allocation Rate 270 per design 8 per plant Allocation Base Number of designs Number of plants 5 S Total overhead allocated Total cost of Cole job Print Done Requirement 2. If Cole paid $4,000 for the job, what is the operating income or loss? (Enter a loss with If Cole paid $4,000, Lake Streets operating income (loss) on the job is $ Requirement 3. I Lake Street desires an operating income of 50% of cost, how much should the company charge for the Cole job? If Lake Street desires an operating income of 50% of cost, it should charges for the Cole job. Choose from any list or enter any number in the input fields and then continue to the next question e here to search 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started