Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification,

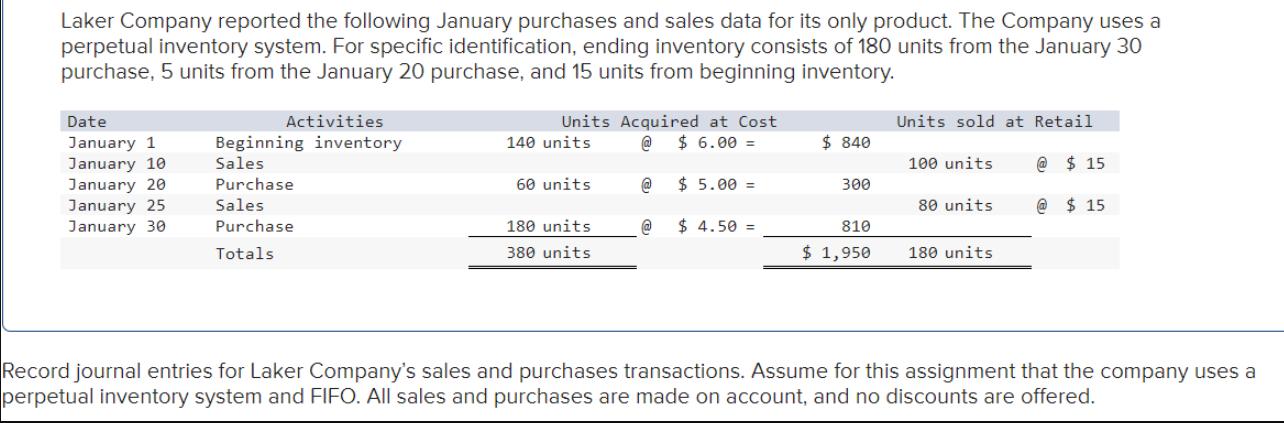

Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 180 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $6.00 = 140 units 60 units 180 units 380 units @ $5.00 = $ 4.50 = $ 840 300 810 $ 1,950 Units sold at Retail 100 units 80 units 180 units @ $15 @$15 Record journal entries for Laker Company's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO. All sales and purchases are made on account, and no discounts are offered.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To record the sales and purchases transactions for Laker Company using the perpetual inventory syste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started