Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sylar Company insured the life of its president for P1,000,000, with it being the beneficiary. The annual premium is P40,000 and the policy is

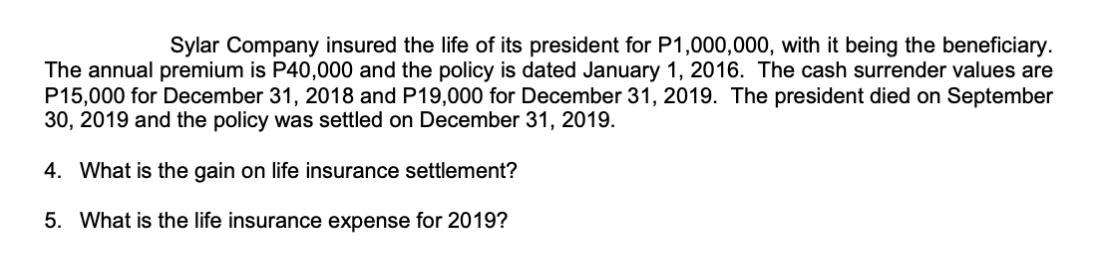

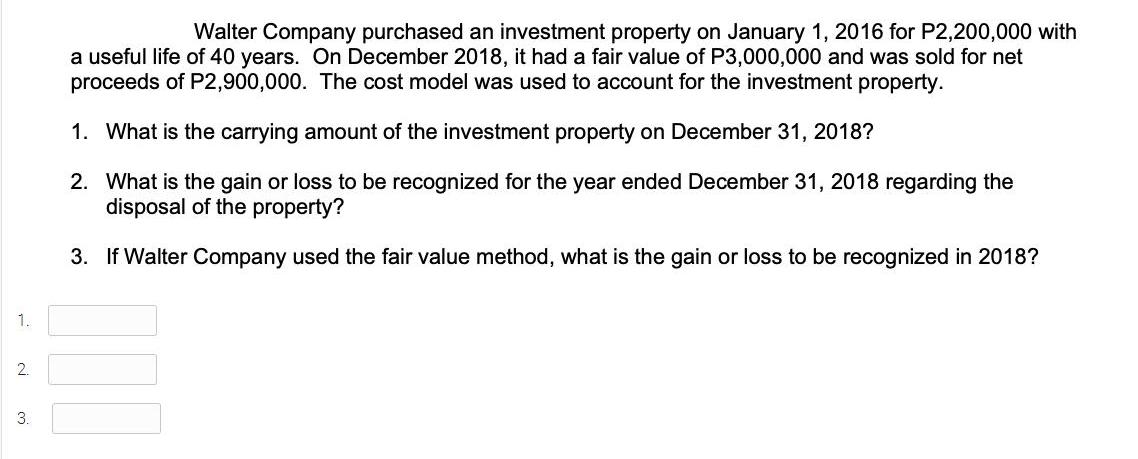

Sylar Company insured the life of its president for P1,000,000, with it being the beneficiary. The annual premium is P40,000 and the policy is dated January 1, 2016. The cash surrender values are P15,000 for December 31, 2018 and P19,000 for December 31, 2019. The president died on September 30, 2019 and the policy was settled on December 31, 2019. 4. What is the gain on life insurance settlement? 5. What is the life insurance expense for 2019? 1. 2. 3. Walter Company purchased an investment property on January 1, 2016 for P2,200,000 with a useful life of 40 years. On December 2018, it had a fair value of P3,000,000 and was sold for net proceeds of P2,900,000. The cost model was used to account for the investment property. 1. What is the carrying amount of the investment property on December 31, 2018? 2. What is the gain or loss to be recognized for the year ended December 31, 2018 regarding the disposal of the property? 3. If Walter Company used the fair value method, what is the gain or loss to be recognized in 2018?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each question one by one Question 4 What is the gain on life insurance settlement To calculate the gain on the life insurance settlement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started