Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lakeside Incorporated produces a product that currently sells for $64 per unit. Current production costs per unit include direct materials, $17.00; direct labor, $19.00;

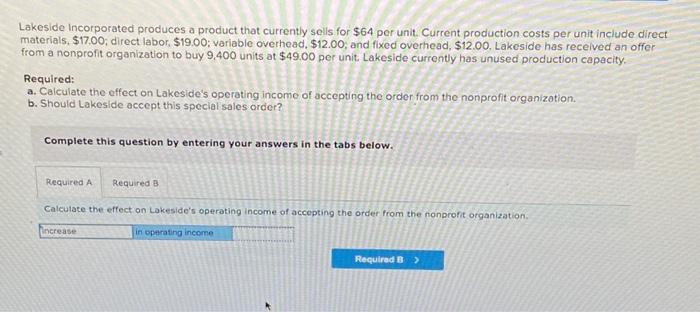

Lakeside Incorporated produces a product that currently sells for $64 per unit. Current production costs per unit include direct materials, $17.00; direct labor, $19.00; variable overhead, $12.00; and fixed overhead, $12.00. Lakeside has received an offer from a nonprofit organization to buy 9,400 units at $49.00 per unit. Lakeside currently has unused production capacity. Required: a. Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. b. Should Lakeside accept this special sales order? Complete this question by entering your answers in the tabs below. Required A Required B Calculate the effect on Lakeside's operating income of accepting the order from the nonprofit organization. in operating income Increase Required B >

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the effect on Lakesides operating income of accepting the order from the nonprofit organization we need to compare the contribution mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started