Answered step by step

Verified Expert Solution

Question

1 Approved Answer

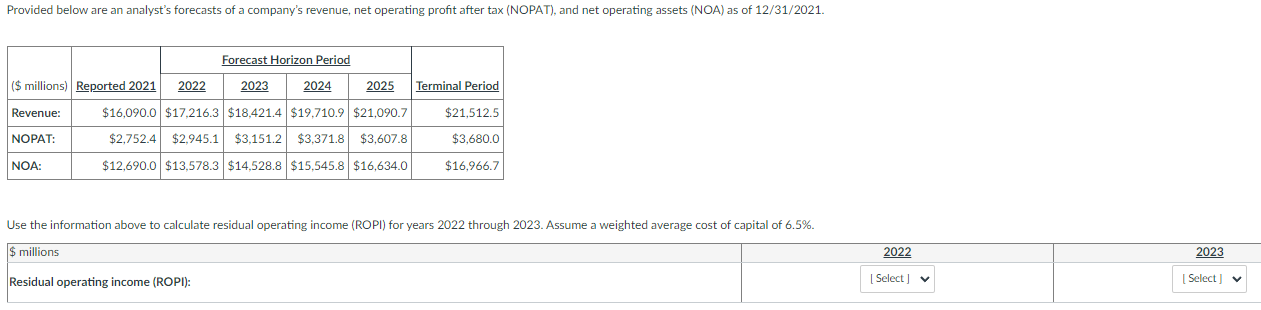

Provided below are an analyst's forecasts of a company's revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2021.

Provided below are an analyst's forecasts of a company's revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2021. Forecast Horizon Period ($ millions) Reported 2021 2022 2023 2024 2025 Terminal Period $16,090.0 $17,216.3 $18,421.4 $19,710.9 $21,090.7 $2,752.4 $2,945.1 $3,151.2 $3,371.8 $3,607.8 Revenue: NOPAT: $12,690.0 $13,578.3 $14,528.8 $15,545.8 $16,634.0 NOA: $21,512.5 $3,680.0 $16.966.7 Use the information above to calculate residual operating income (ROPI) for years 2022 through 2023. Assume a weighted average cost of capital of 6.5%. $ millions Residual operating income (ROPI): 2022 [Select] 2023 [Select]

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the residual operating income ROP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started