Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lakson investment Company holds an option on HBL's stock. The contract multiplier is 500 shares with a exercise price of PKR70 per share. The

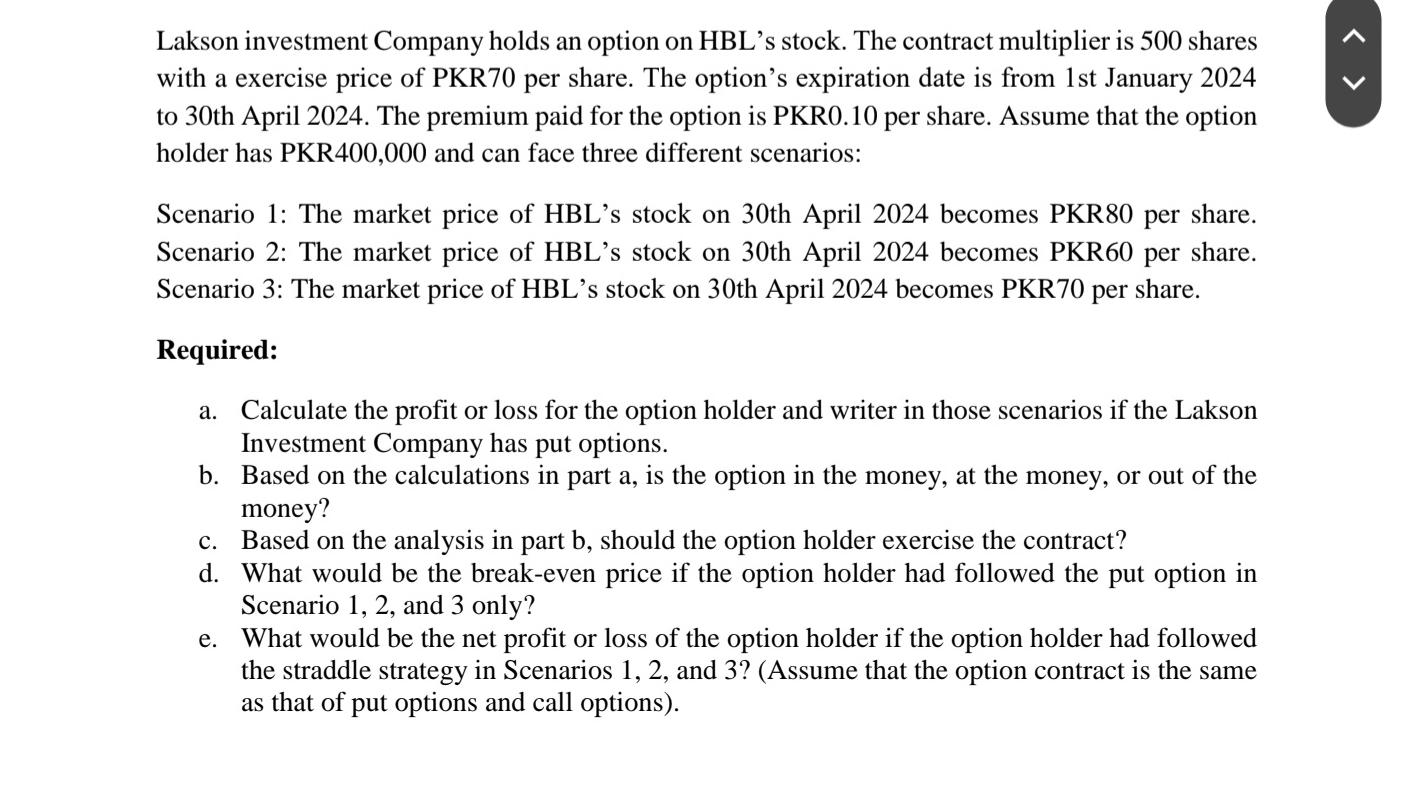

Lakson investment Company holds an option on HBL's stock. The contract multiplier is 500 shares with a exercise price of PKR70 per share. The option's expiration date is from 1st January 2024 to 30th April 2024. The premium paid for the option is PKRO.10 per share. Assume that the option holder has PKR400,000 and can face three different scenarios: Scenario 1: The market price of HBL's stock on 30th April 2024 becomes PKR80 per share. Scenario 2: The market price of HBL's stock on 30th April 2024 becomes PKR60 per share. Scenario 3: The market price of HBL's stock on 30th April 2024 becomes PKR70 per share. Required: a. Calculate the profit or loss for the option holder and writer in those scenarios if the Lakson Investment Company has put options. b. Based on the calculations in part a, is the option in the money, at the money, or out of the money? c. Based on the analysis in part b, should the option holder exercise the contract? d. What would be the break-even price if the option holder had followed the put option in Scenario 1, 2, and 3 only? e. What would be the net profit or loss of the option holder if the option holder had followed the straddle strategy in Scenarios 1, 2, and 3? (Assume that the option contract is the same as that of put options and call options).

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Lakson Investment Companys Option Analysis Put Option Contract Details Underlying Stock HBL Contract Multiplier 500 shares Exercise Price PKR 70 per share Option Premium PKR 010 per share Expiration D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started