Answered step by step

Verified Expert Solution

Question

1 Approved Answer

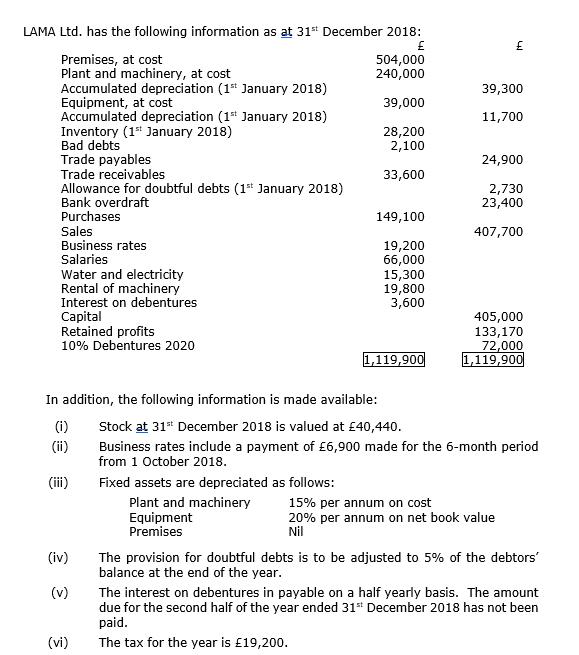

LAMA Ltd. has the following information as at 31st December 2018: Premises, at cost Plant and machinery, at cost Accumulated depreciation (1st January 2018)

LAMA Ltd. has the following information as at 31st December 2018: Premises, at cost Plant and machinery, at cost Accumulated depreciation (1st January 2018) Equipment, at cost Accumulated depreciation (1st January 2018) Inventory (1st January 2018) Bad debts Trade payables Trade receivables Allowance for doubtful debts (1st January 2018) Bank overdraft Purchases Sales Business rates Salaries Water and electricity Rental of machinery Interest on debentures Capital Retained profits 10% Debentures 2020 (i) (ii) (iii) (iv) (v) (vi) 504,000 240,000 39,000 28,200 2,100 33,600 Fixed assets are depreciated as follows: Plant and machinery Equipment Premises 149,100 19,200 66,000 15,300 19,800 3,600 1,119,900 In addition, the following information is made available: Stock at 31st December 2018 is valued at 40,440. Business rates include a payment of 6,900 made for the 6-month period from 1 October 2018. 39,300 11,700 24,900 2,730 23,400 407,700 405,000 133,170 72,000 1,119,900 15% per annum on cost 20% per annum on net book value Nil The provision for doubtful debts is to be adjusted to 5% of the debtors' balance at the end of the year. The interest on debentures in payable on a half yearly basis. The amount due for the second half of the year ended 31st December 2018 has not been paid. The tax for the year is 19,200. Required: (a) Prepare an income statement for LAMA Ltd. for the year ended 31* December 2018. (15 marks) (b) Prepare a statement of financial position for LAMA Ltd. as at the 31st December 2018. (14 marks)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

LAMA Ltd Income statement for the year ended 31 December 2018 Sales 40770000 Less Cost of sales Open...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started