Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lambert and Mirza were in partnership without any agreement. They admitted Newton to partnership on 1st October 2012. Profit of the partnership for the year

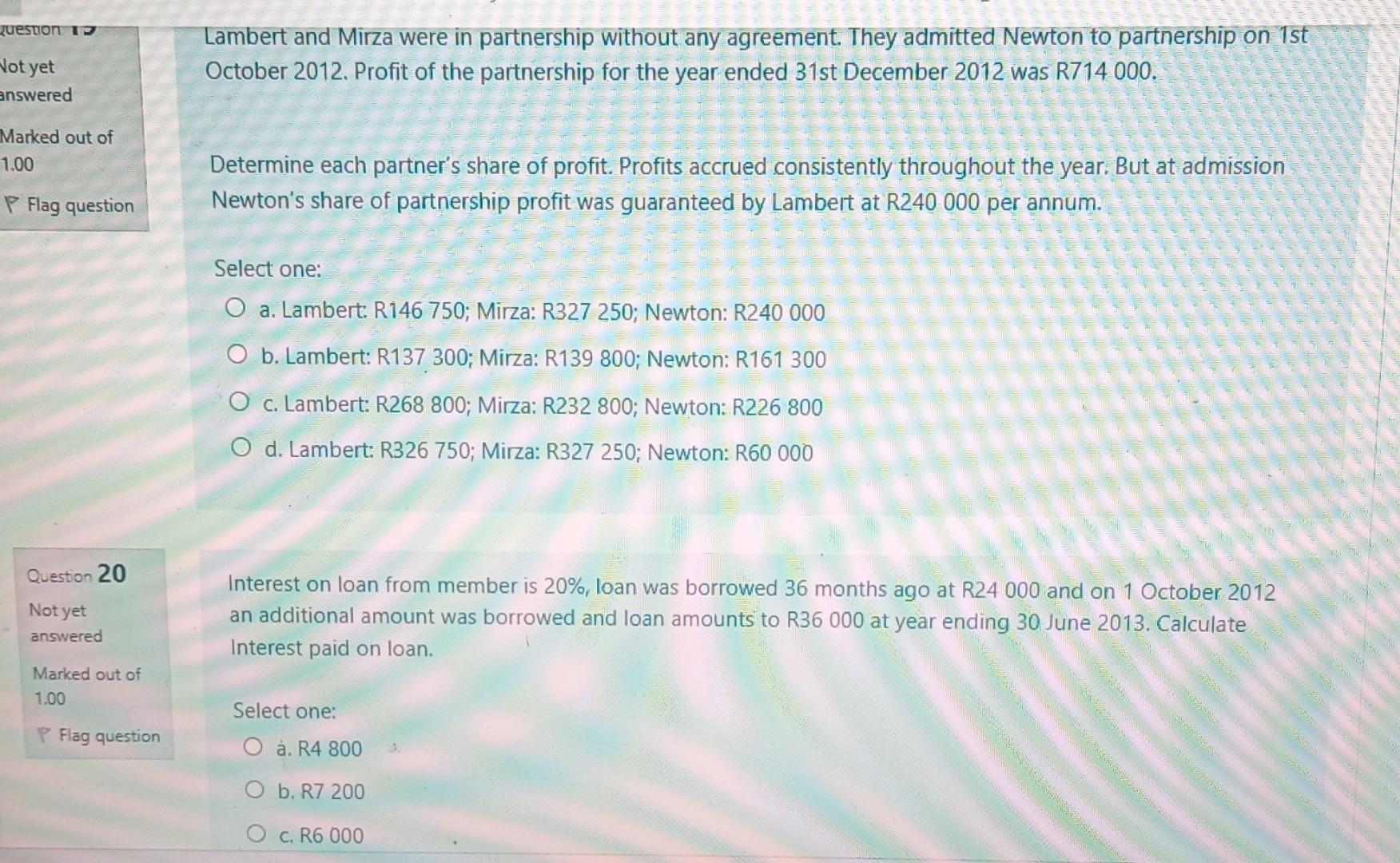

Lambert and Mirza were in partnership without any agreement. They admitted Newton to partnership on 1st October 2012. Profit of the partnership for the year ended 31st December 2012 was R714 000. Determine each partner's share of profit. Profits accrued consistently throughout the year. But at admission Newton's share of partnership profit was guaranteed by Lambert at R240 000 per annum. Select one: a. Lambert: R146 750; Mirza: R327 250; Newton: R240 000 b. Lambert: R137 300; Mirza: R139 800; Newton: R161 300 c. Lambert: R268 800; Mirza: R232 800; Newton: R226 800 d. Lambert: R326 750; Mirza: R327 250; Newton: R60 000 Interest on loan from member is 20\%, loan was borrowed 36 months ago at R24 000 and on 1 October 2012 an additional amount was borrowed and loan amounts to R36 000 at year ending 30 June 2013. Calculate Interest paid on loan. Select one: a. R4 800 b. R7 200 c. R6 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started