Answered step by step

Verified Expert Solution

Question

1 Approved Answer

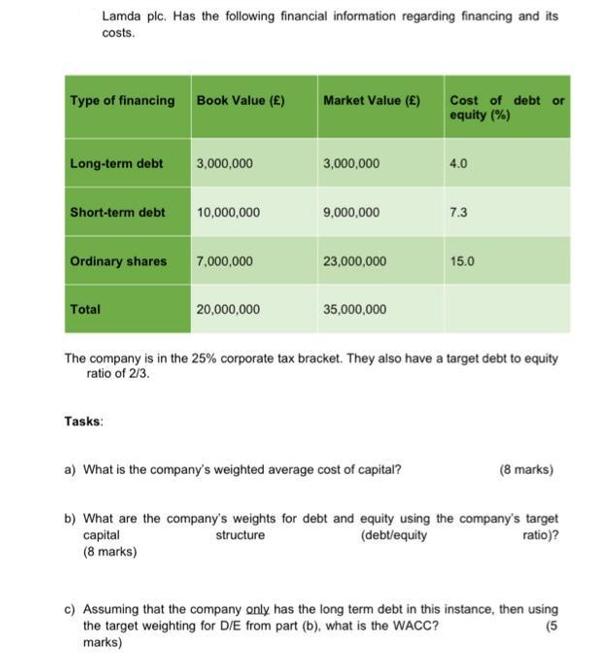

Lamda plc. Has the following financial information regarding financing and its costs. Type of financing Book Value (E) Long-term debt Short-term debt Ordinary shares

Lamda plc. Has the following financial information regarding financing and its costs. Type of financing Book Value (E) Long-term debt Short-term debt Ordinary shares Total 3,000,000 Tasks: 10,000,000 7,000,000 20,000,000 Market Value () 3,000,000 9,000,000 23,000,000 35,000,000 Cost of debt or equity (%) a) What is the company's weighted average cost of capital? 4.0 7.3 The company is in the 25% corporate tax bracket. They also have a target debt to equity ratio of 2/3. 15.0 (8 marks) b) What are the company's weights for debt and equity using the company's target capital structure (debt/equity ratio)? (8 marks) c) Assuming that the company only has the long term debt in this instance, then using the target weighting for D/E from part (b), what is the WACC? marks) (5 (Show working)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The weighted average cost of capital WACC is calculated by weighting the cost of each component of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started