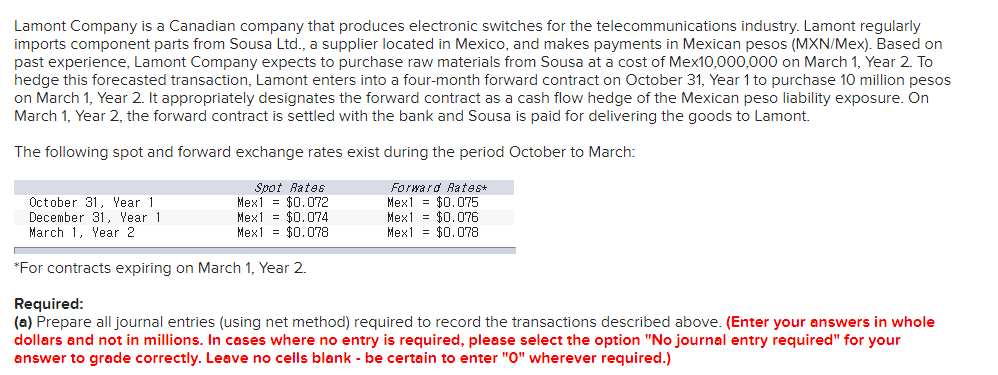

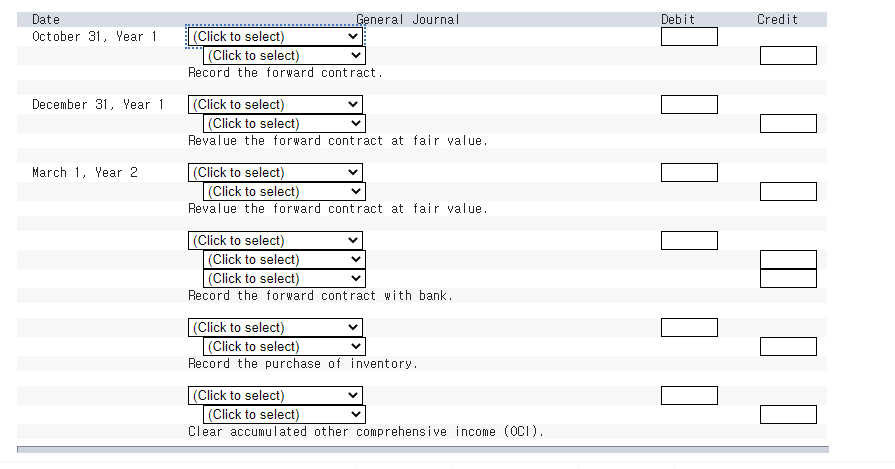

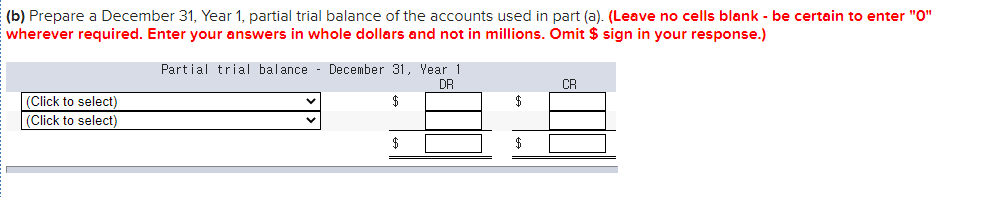

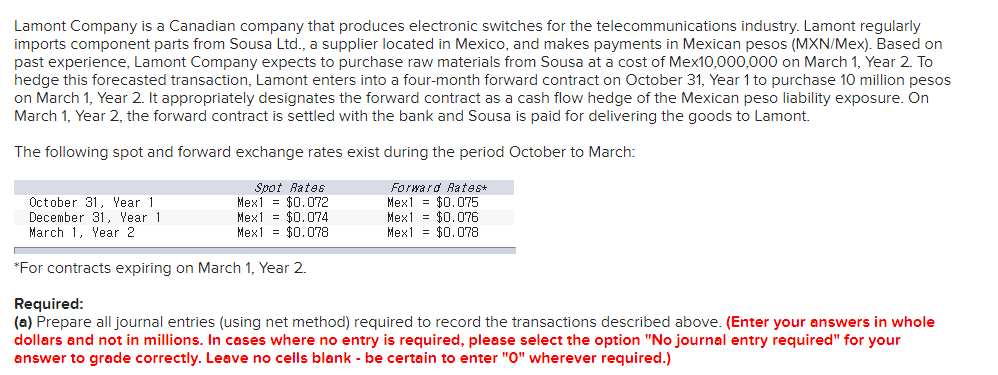

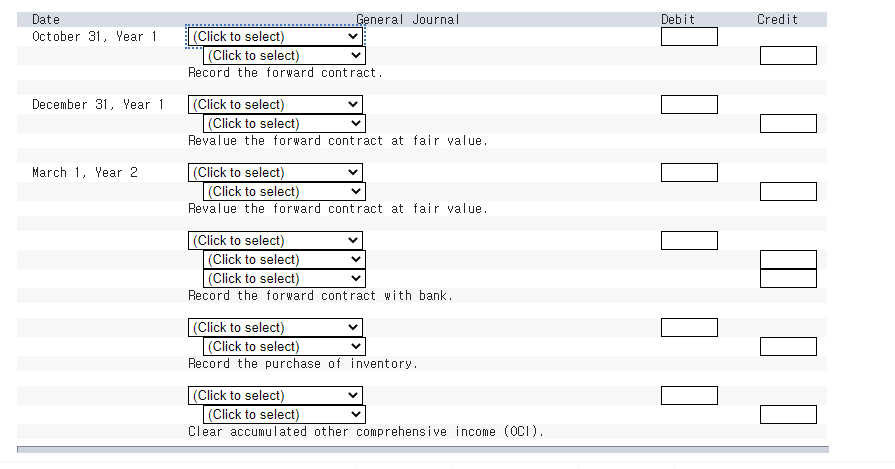

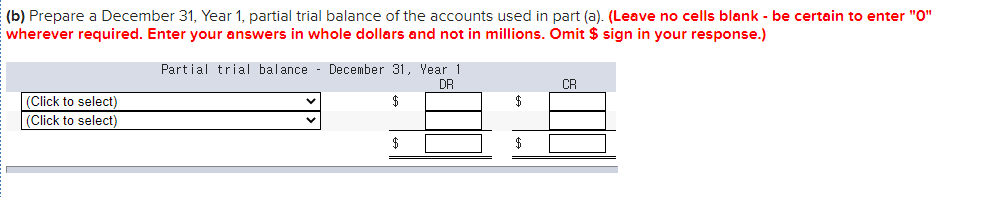

Lamont Company is a Canadian company that produces electronic switches for the telecommunications industry. Lamont regularly imports component parts from Sousa Ltd., a supplier located in Mexico, and makes payments in Mexican pesos (MXN/Mex). Based on past experience, Lamont Company expects to purchase raw materials from Sousa at a cost of Mex10,000,000 on March 1, Year 2. To hedge this forecasted transaction, Lamont enters into a four-month forward contract on October 31, Year 1 to purchase 10 million pesos on March 1, Year 2. It appropriately designates the forward contract as a cash flow hedge of the Mexican peso liability exposure. On March 1, Year 2, the forward contract is settled with the bank and Sousa is paid for delivering the goods to Lamont. The following spot and forward exchange rates exist during the period October to March: October 31, Year 1 December 31, Year 1 March 1, Year 2 Spot Aates Mex1 = $0.072 Mex1 = $0.074 Mex1 = $0.078 Forward Aatest Mex1 = $0.075 Mex1 = $0.076 Mex1 = $0.078 *For contracts expiring on March 1, Year 2. Required: (a) Prepare all journal entries (using net method) required to record the transactions described above. (Enter your answers in whole dollars and not in millions. In cases where no entry is required, please select the option "No journal entry required" for your answer to grade correctly. Leave no cells blank - be certain to enter "0" wherever required.) Debit Credit Date October 31, Year 1 General Journal (Click to select) (Click to select) Record the forward contract. December 31, Year 1 (Click to select) (Click to select) Revalue the forward contract at fair value. March 1, Year 2 (Click to select) (Click to select) Revalue the forward contract at fair value. (Click to select) (Click to select) (Click to select) Record the forward contract with bank. (Click to select) (Click to select) Record the purchase of inventory. (Click to select) (Click to select) Clear accumulated other comprehensive income (OCI). (b) Prepare a December 31, Year 1, partial trial balance of the accounts used in part (a). (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers in whole dollars and not in millions. Omit $ sign in your response.) Partial trial balance - December 31, Year 1 DR $ CR $ (Click to select) (Click to select) $