Answered step by step

Verified Expert Solution

Question

1 Approved Answer

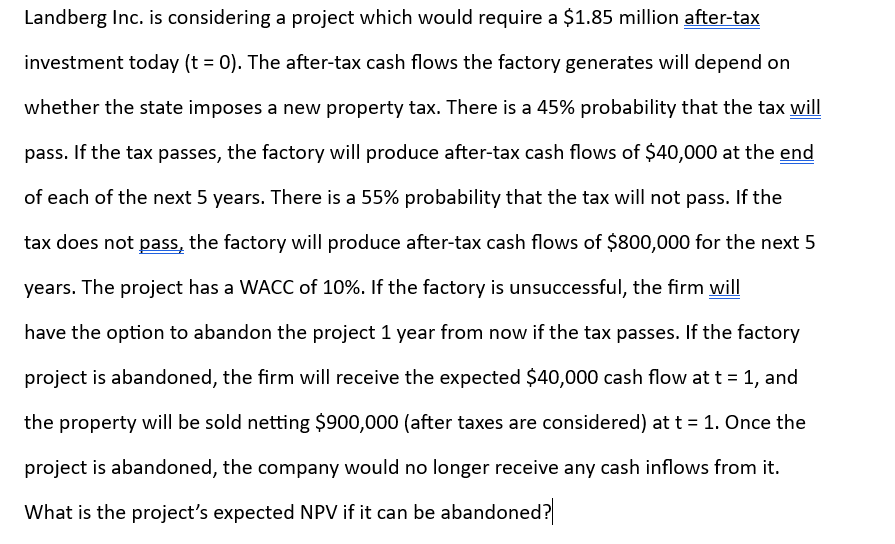

Landberg Inc. is considering a project which would require a $ 1 . 8 5 million after - tax investment today ( t = 0

Landberg Inc. is considering a project which would require a $ million aftertax

investment today The aftertax cash flows the factory generates will depend on

whether the state imposes a new property tax. There is a probability that the tax will

pass. If the tax passes, the factory will produce aftertax cash flows of $ at the end

of each of the next years. There is a probability that the tax will not pass. If the

tax does not pass, the factory will produce aftertax cash flows of $ for the next

years. The project has a WACC of If the factory is unsuccessful, the firm will

have the option to abandon the project year from now if the tax passes. If the factory

project is abandoned, the firm will receive the expected $ cash flow at and

the property will be sold netting $after taxes are considered at Once the

project is abandoned, the company would no longer receive any cash inflows from it

What is the project's expected NPV if it can be abandoned?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started