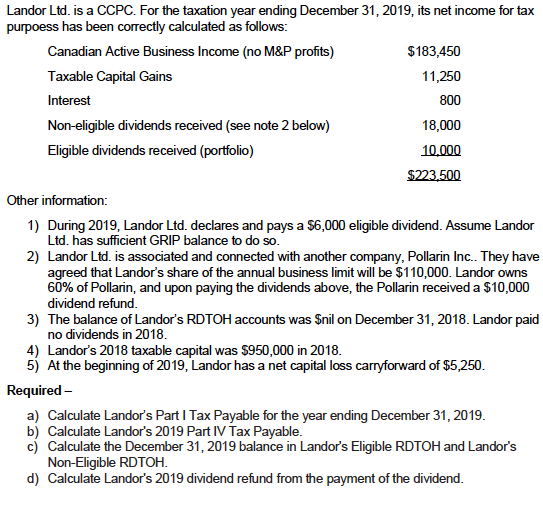

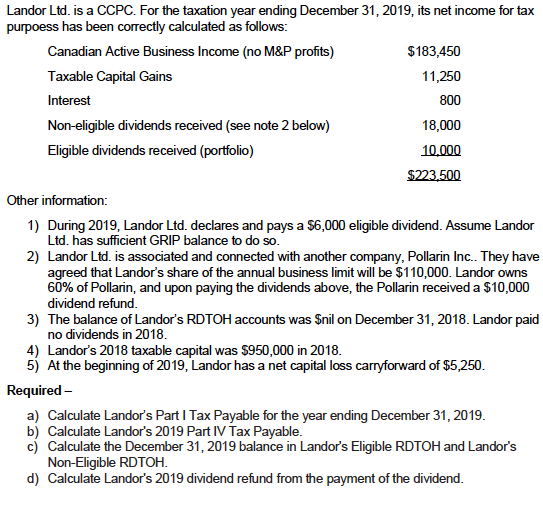

Landor Ltd. is a CCPC. For the taxation year ending December 31, 2019, its net income for tax purpoess has been correctly calculated as follows: Canadian Active Business Income (no M&P profits) $183,450 Taxable Capital Gains 11,250 Interest 800 Non-eligible dividends received (see note 2 below) 18,000 Eligible dividends received (portfolio) 10.000 $223.500 Other information: 1) During 2019, Landor Ltd. declares and pays a $6,000 eligible dividend. Assume Landor Ltd. has sufficient GRIP balance to do so. 2) Landor Ltd. is associated and connected with another company, Pollarin Inc.. They have agreed that Landor's share of the annual business limit will be $110,000. Landor owns 60% of Pollarin, and upon paying the dividends above, the Pollarin received a $10,000 dividend refund. 3) The balance of Landor's RDTOH accounts was Snil on December 31, 2018. Landor paid no dividends in 2018. 4) Landor's 2018 taxable capital was $950,000 in 2018. 5) At the beginning of 2019, Landor has a net capital loss carryforward of $5,250. Required - a) Calculate Landor's Part I Tax Payable for the year ending December 31, 2019. b) Calculate Landor's 2019 Part IV Tax Payable. c) Calculate the December 31, 2019 balance in Landor's Eligible RDTOH and Landor's Non-Eligible RDTOH. d) Calculate Landor's 2019 dividend refund from the payment of the dividend. Landor Ltd. is a CCPC. For the taxation year ending December 31, 2019, its net income for tax purpoess has been correctly calculated as follows: Canadian Active Business Income (no M&P profits) $183,450 Taxable Capital Gains 11,250 Interest 800 Non-eligible dividends received (see note 2 below) 18,000 Eligible dividends received (portfolio) 10.000 $223.500 Other information: 1) During 2019, Landor Ltd. declares and pays a $6,000 eligible dividend. Assume Landor Ltd. has sufficient GRIP balance to do so. 2) Landor Ltd. is associated and connected with another company, Pollarin Inc.. They have agreed that Landor's share of the annual business limit will be $110,000. Landor owns 60% of Pollarin, and upon paying the dividends above, the Pollarin received a $10,000 dividend refund. 3) The balance of Landor's RDTOH accounts was Snil on December 31, 2018. Landor paid no dividends in 2018. 4) Landor's 2018 taxable capital was $950,000 in 2018. 5) At the beginning of 2019, Landor has a net capital loss carryforward of $5,250. Required - a) Calculate Landor's Part I Tax Payable for the year ending December 31, 2019. b) Calculate Landor's 2019 Part IV Tax Payable. c) Calculate the December 31, 2019 balance in Landor's Eligible RDTOH and Landor's Non-Eligible RDTOH. d) Calculate Landor's 2019 dividend refund from the payment of the dividend