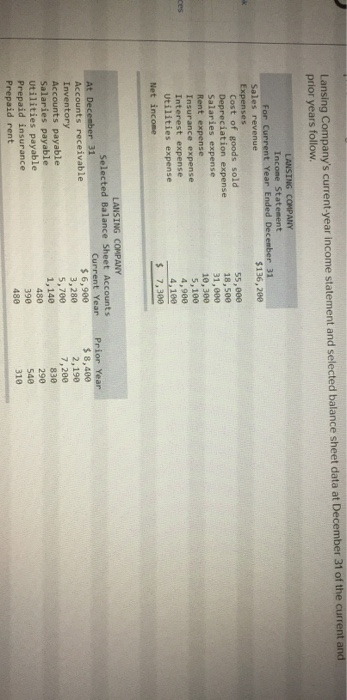

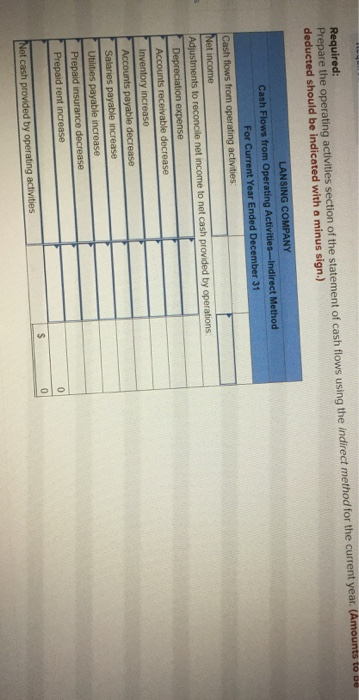

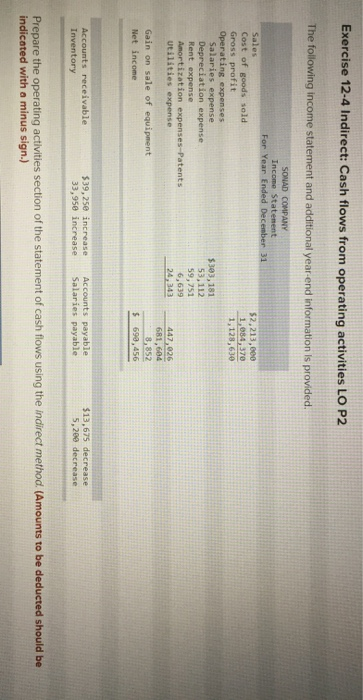

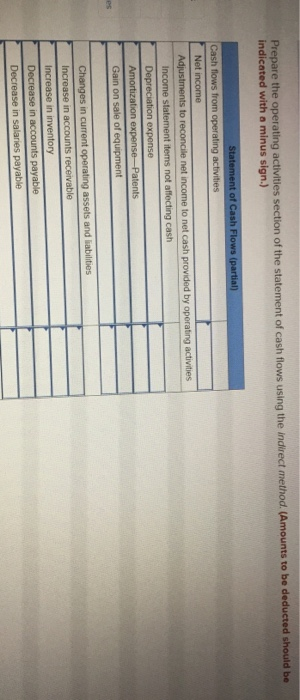

Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and prior years follow LANSING COMPANY Income Statement For Current Year Ended December 31 Sales revenue $136,200 Expenses Cost of goods sold 55,000 Depreciation expense 18,500 Salaries expense 31,000 Rent expense 10,300 Insurance expense Interest expense 4,900 Utilities expense 4.100 Net income $ 7,300 5,100 ces LANSING COMPANY Selected Balance Sheet Accounts At December 31 Current Year Accounts receivable $ 6,900 Inventory 3,280 Accounts payable 5,700 Salaries payable 1,140 Utilities payable 480 Prepaid insurance 390 Prepaid rent 480 Prior Year $ 8,400 2,190 7,200 830 290 540 310 Required: Prepare the operating activities section of the statement of cash flows using the indirect method for the current year. (Amounts to be deducted should be indicated with a minus sign.) LANSING COMPANY Cash Flows from Operating Activities --Indirect Method For Current Year Ended December 31 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operations Depreciation expense Accounts receivable decrease Inventory increase Accounts payable decrease Salaries payable increase Utilities payable increase Prepaid insurance decrease Prepaid rent increase 0 $ 0 Net cash provided by operating activities Exercise 12-4 Indirect: Cash flows from operating activities LO P2 The following income statement and additional year-end information is provided. SONAD COMPANY Income Statement For Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Salaries expense $393,181 Depreciation expense 53,112 Rent expense 59,751 Amortization expenses-Patents 6,639 utilities expense 24, 343 $2,213,000 1,084,370 1,128,630 Gain on sale of equipment Net income 447,026 681,604 8,852 $ 690,456 Accounts receivable Inventory $39, 250 increase 33,950 increase Accounts payable Salaries payable $13,675 decrease 5,200 decrease Prepare the operating activities section of the statement of cash flows using the indirect method (Amounts to be deducted should be indicated with a minus sign.) Prepare the operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Depreciation expense Amortization expense-Patents Gain on sale of equipment ps Changes in current operating assets and liabilities Increase in accounts receivable Increase in inventory Decrease in accounts payable Decrease in salaries payable