Answered step by step

Verified Expert Solution

Question

1 Approved Answer

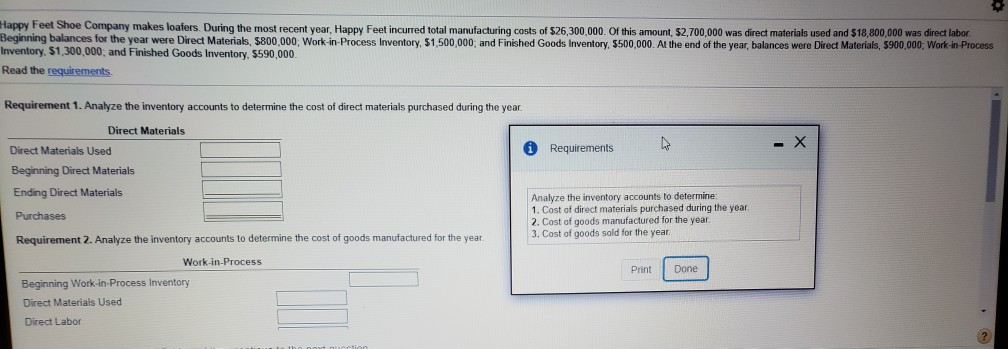

lappy Feet Shoe Company makes loafers. During the most recent year, Happy Feet incurred total manufacturing costs of s26,300,000. Of this amount, $2,700,000 was direct

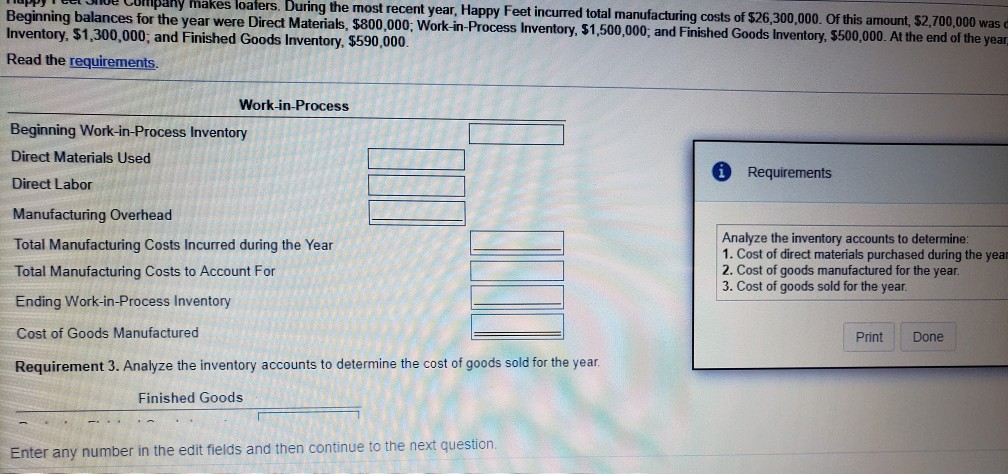

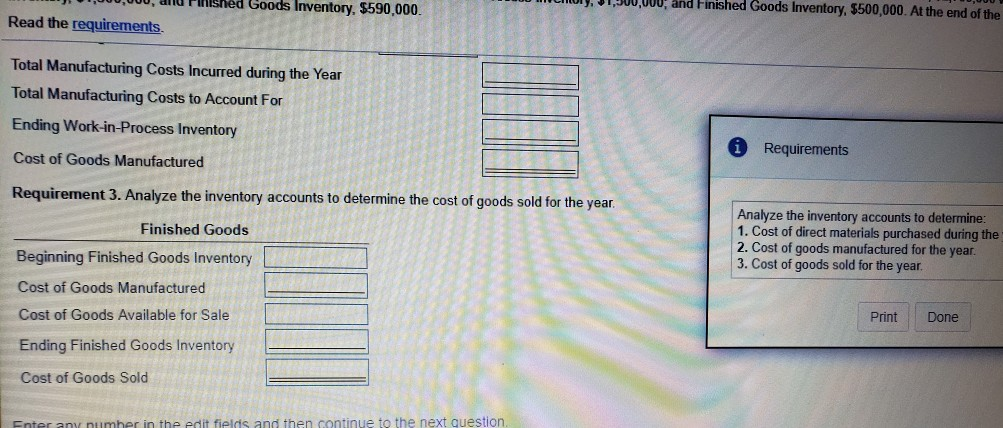

lappy Feet Shoe Company makes loafers. During the most recent year, Happy Feet incurred total manufacturing costs of s26,300,000. Of this amount, $2,700,000 was direct materials used and $18,800,000 was directlabor Beginning balances for the year were Direct Materials, $800,000, Work-in-Process Inventory, $1,500,000;, and Finished Goods Inventory, $500,000. At the end of the year, balances were Direct Materials, $900,000; Work in-Process Inventory. $1,300,000, and Finished Goods Inventory, $590,000 Read the requirements. Requirement 1. Analyze the inventory accounts to determine the cost of direct materials purchased during the year Direct Materials Requirements Direct Materials Used Beginning Direct Materials Ending Direct Materials Purchases Requirement 2. Analyze the inventory accounts to determine the cost of goods manufactured for the year Analyze the inventory accounts to determine: 1. Cost of direct materials purchased during the year 2. Cost of goods manufactured for the year 3. Cost of goods sold for the year Work-in-Process Print Done Beginning Work-in-Process Inventory Direct Materials Used Direct Labor ide Company makes loaters. During eel a the most recent year, Happy Feet incurred total manufacturing costs of $26,300,000. Of this amount, $2,700,000 was o balances for the year were Direct Materials, S800,000; Work in-Process Inventory, $1,500,000; and Finished Goods Inventory, $500,000. At the end of the year Inventory, $1,300,000; and Finished Goods Inventory, $590,000. Read the requirements. Work in.Process Beginning Work-in-Process Inventory Direct Materials Used Direct Labor Manufacturing Overhead Total Manufacturing Costs Incurred during the Year Total Manufacturing Costs to Account For Ending Work-in-Process Inventory Cost of Goods Manufactured Requirements Analyze the inventory accounts to determine: 1. Cost of direct materials purchased during the yean 2. Cost of goods manufactured for the year. 3. Cost of goods sold for the year Print Done Requirement 3. Analyze the inventory accounts to determine the cost of goods sold for the year. Finished Goods Enter any number in the edit fields and then continue to the next question 00,00, lu PIHiShed Goods Inventory, $590,000 , 01,900,00U; and Finished Goods Inventory, $500,000. At the end of the Read the requirements Total Manufacturing Costs Incurred during the Year Total Manufacturing Costs to Account For Ending Work-in-Process Inventory Cost of Goods Manufactured Requirement 3. Analyze the inventory accounts to determine the cost of goods sold for the year Requirements Analyze the inventory accounts to determine 1. Cost of direct materials purchased during the 2. Cost of goods manufactured for the year 3. Cost of goods sold for the year Finished Goods Beginning Finished Goods Inventory Cost of Goods Manufactured Cost of Goods Available for Sale Print Done Ending Finished Goods Inventory Cost of Goods Sold Enter any numher in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started