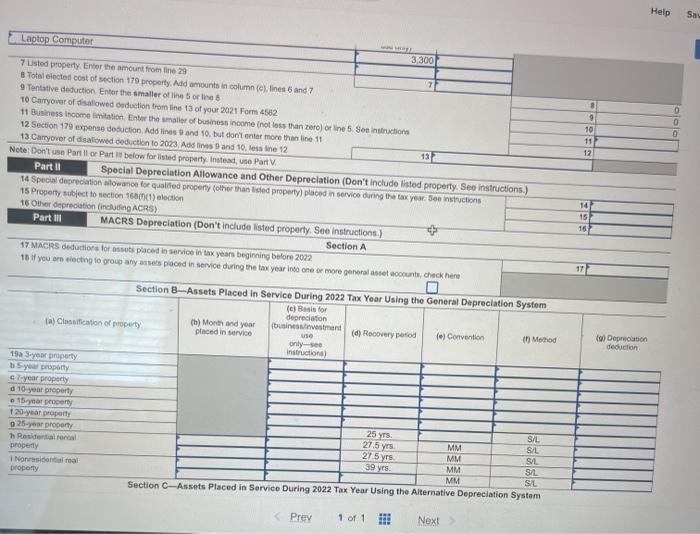

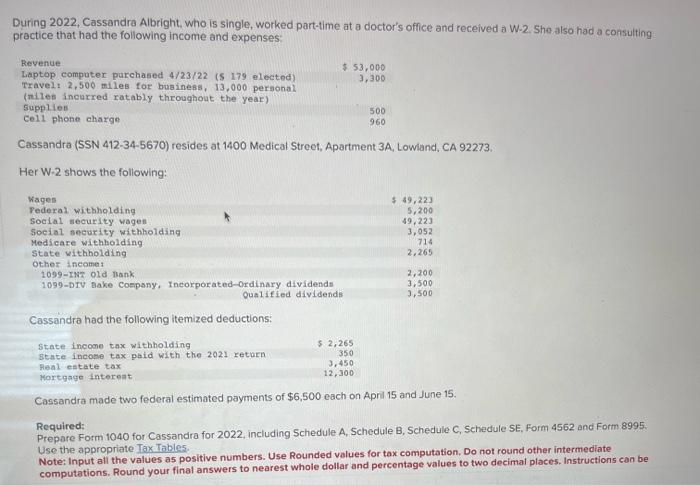

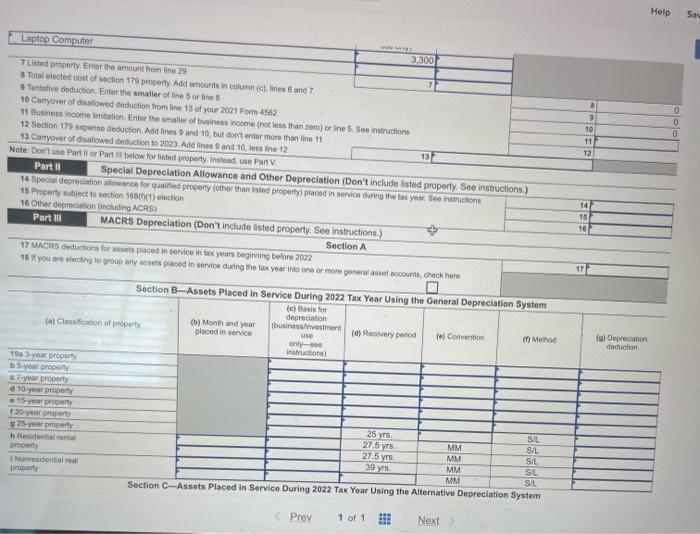

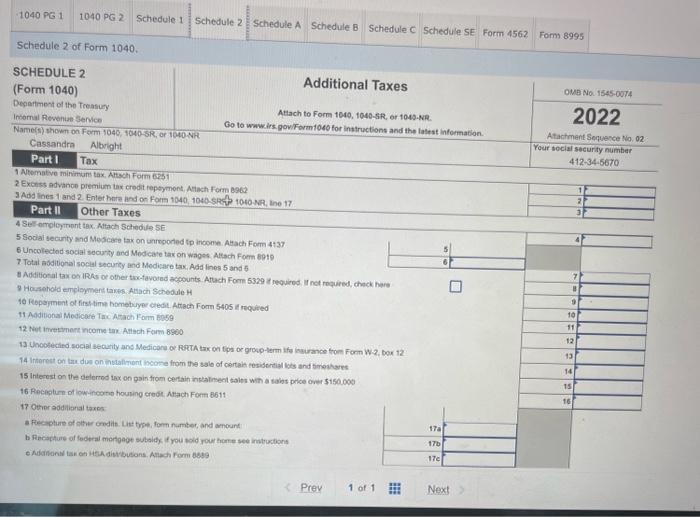

Laptop Computer Help 7 Listed property: Entor the amount from tine 29 B Total eiocted cost of section 170 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Entor the smaller of line 5 or line 8 10 Canyover of disalowed deduction trom line 13 of your 2021 Form 4562 11 Business income timitation, tinter the smailer of business inoome (not less than zero) or lne 5 . Set intructions 12. Section 179 expense desuction, Add lines 7 and 10 , but dont eritar mom than line 11 13 Caryover of dsaliowed dediction to 2003, Ads lines 9 and 10, less the 12. Note: Don't use Part 11 or Part il below for listed proparty. Instesd, vee Part V Part II Special Depreciation Allowance and Other Depreciation (Don't include lated property. See instructions.) 14 Special depreciatioe attowance for qualfed broce 15 Propery subject to nection 16000(1) elocion. 16 Other depreciation (ineludeng ACRS). Part III MACRS Depreciation (Don't include listed property, See instructions.) Section A 17 Macies deductions for assuts paced in sorvice in tax years begining belore 2002 15 if you ere siectng to group any arsess pactd in service during the tax year into one or more general asset acocunts, check hen Sat During 2022, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a consulting practice that had the following income and expenses: Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowiand, CA 92273. Her W-2 shows the following: Cassandra had the following itemized deductions: Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15 . Required: Prepare Form 1040 for Cassandra for 2022, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995 . Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar and percentage values to two decimal places. Instructions can be Laptop Computer 7 Listed property, Enier the amount from tine 29 E Totel elocied cost of section 179 property Add amourits is column (c), lines 6 and 7 9 Tentative doduction. Enter the smaller of line 5 or like 8 . 10 Camyover of disallowbd deduction from line 13 of yeur 2021 Form 4562 12 Section 179 exponse desuction, Ndd lines 7 and 10 , but dont eritar more than line 11 13 Carryover of digaliowed dedvetich to 2003 , Ads linas 9 and 10 , lesa \$he 12 . Nete:Don't use Part il or Part 19 below for listed property. Instesd, wae Part V. 15 Property subject to section 160(0)1) election 16 Other deprecution inclutech Acrs) Part III MACRS Depreciation (Don't include listed property, See instructions.) 17 MACRS cedurtiors for assuts paced in sarvice in tax yeaf beginning betoreachas 18 if you bre siecting fo groug any darsess placed in sersc years beginning belare 2022 Prey 1 of 1 III Next 1040PG11040PG2 Schedule 1 1 Schedule 2 Schedule A Schedule B Schedule C Schedule SE Form 4562 Form 8995 Schedule 2 of Form 1040 SCHEDULE 2 (Form 1040) Additional Taxes Degartment of the Treasury intornal Revenia senice Atlach to Form 1040, 1040-sR, or 1045 -NR. Name(s) shown on Ferm 1040,10405R, or 1040 NH Go to wwwirs govi Formioso for intiructions and the latest information. OME No. 15450074 Cassandra Albright 2022 Atactment Sequence No, 02 Partl Tax Your tocial socurity number 412345670 1 Nomatve minimunt tax, Altach Form west 2 Excriss advance premium tax credit repsyment, A Fach form 8962 3. Add lines 1 and 2. Enter hne and on Form 1040. 1040. SFs? 1060 NF, lne 17 Part II Other Taxes 4 Selinmoloyment tax. Altach Schedile SE 5 Social securty and Mescige tax on unreported tp income. AHach Form 4437 6Uncolected social seciarty and Modicate tax on wages, Altach Foem 8919 7. Total abditional social securty And Medicare tax, Adt lines 5 and 15 8 Additiotal tax os IRts or other twi-favoted ackounts. Aftach For 5329 if required, if net roquired, ahack hare 7 Hossehold empleymeri taxps: Atiach Schedule H to feparment of first time hemehyer credit. Attach Foam 5405 if recuted 11 Aditional Mediclece Trx Arach Form bose 12 Net itruetimert income tax. Atiach Farm 8560 16 Recigturn of iowincortio houning erebit, Arach Form 8611 17 Otheredilional taxes a Fecapture of other emdits. Lite tyot, form fumber, and anount e Ndalian tak en ituh distrueons. Anach Form 8099 Prev 1 of 1 Ift Next Laptop Computer Help 7 Listed property: Entor the amount from tine 29 B Total eiocted cost of section 170 property. Add amounts in column (c), lines 6 and 7 9 Tentative deduction. Entor the smaller of line 5 or line 8 10 Canyover of disalowed deduction trom line 13 of your 2021 Form 4562 11 Business income timitation, tinter the smailer of business inoome (not less than zero) or lne 5 . Set intructions 12. Section 179 expense desuction, Add lines 7 and 10 , but dont eritar mom than line 11 13 Caryover of dsaliowed dediction to 2003, Ads lines 9 and 10, less the 12. Note: Don't use Part 11 or Part il below for listed proparty. Instesd, vee Part V Part II Special Depreciation Allowance and Other Depreciation (Don't include lated property. See instructions.) 14 Special depreciatioe attowance for qualfed broce 15 Propery subject to nection 16000(1) elocion. 16 Other depreciation (ineludeng ACRS). Part III MACRS Depreciation (Don't include listed property, See instructions.) Section A 17 Macies deductions for assuts paced in sorvice in tax years begining belore 2002 15 if you ere siectng to group any arsess pactd in service during the tax year into one or more general asset acocunts, check hen Sat During 2022, Cassandra Albright, who is single, worked part-time at a doctor's office and received a W-2. She also had a consulting practice that had the following income and expenses: Cassandra (SSN 412-34-5670) resides at 1400 Medical Street, Apartment 3A, Lowiand, CA 92273. Her W-2 shows the following: Cassandra had the following itemized deductions: Cassandra made two federal estimated payments of $6,500 each on April 15 and June 15 . Required: Prepare Form 1040 for Cassandra for 2022, including Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562 and Form 8995 . Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to nearest whole dollar and percentage values to two decimal places. Instructions can be Laptop Computer 7 Listed property, Enier the amount from tine 29 E Totel elocied cost of section 179 property Add amourits is column (c), lines 6 and 7 9 Tentative doduction. Enter the smaller of line 5 or like 8 . 10 Camyover of disallowbd deduction from line 13 of yeur 2021 Form 4562 12 Section 179 exponse desuction, Ndd lines 7 and 10 , but dont eritar more than line 11 13 Carryover of digaliowed dedvetich to 2003 , Ads linas 9 and 10 , lesa \$he 12 . Nete:Don't use Part il or Part 19 below for listed property. Instesd, wae Part V. 15 Property subject to section 160(0)1) election 16 Other deprecution inclutech Acrs) Part III MACRS Depreciation (Don't include listed property, See instructions.) 17 MACRS cedurtiors for assuts paced in sarvice in tax yeaf beginning betoreachas 18 if you bre siecting fo groug any darsess placed in sersc years beginning belare 2022 Prey 1 of 1 III Next 1040PG11040PG2 Schedule 1 1 Schedule 2 Schedule A Schedule B Schedule C Schedule SE Form 4562 Form 8995 Schedule 2 of Form 1040 SCHEDULE 2 (Form 1040) Additional Taxes Degartment of the Treasury intornal Revenia senice Atlach to Form 1040, 1040-sR, or 1045 -NR. Name(s) shown on Ferm 1040,10405R, or 1040 NH Go to wwwirs govi Formioso for intiructions and the latest information. OME No. 15450074 Cassandra Albright 2022 Atactment Sequence No, 02 Partl Tax Your tocial socurity number 412345670 1 Nomatve minimunt tax, Altach Form west 2 Excriss advance premium tax credit repsyment, A Fach form 8962 3. Add lines 1 and 2. Enter hne and on Form 1040. 1040. SFs? 1060 NF, lne 17 Part II Other Taxes 4 Selinmoloyment tax. Altach Schedile SE 5 Social securty and Mescige tax on unreported tp income. AHach Form 4437 6Uncolected social seciarty and Modicate tax on wages, Altach Foem 8919 7. Total abditional social securty And Medicare tax, Adt lines 5 and 15 8 Additiotal tax os IRts or other twi-favoted ackounts. Aftach For 5329 if required, if net roquired, ahack hare 7 Hossehold empleymeri taxps: Atiach Schedule H to feparment of first time hemehyer credit. Attach Foam 5405 if recuted 11 Aditional Mediclece Trx Arach Form bose 12 Net itruetimert income tax. Atiach Farm 8560 16 Recigturn of iowincortio houning erebit, Arach Form 8611 17 Otheredilional taxes a Fecapture of other emdits. Lite tyot, form fumber, and anount e Ndalian tak en ituh distrueons. Anach Form 8099 Prev 1 of 1 Ift Next