Answered step by step

Verified Expert Solution

Question

1 Approved Answer

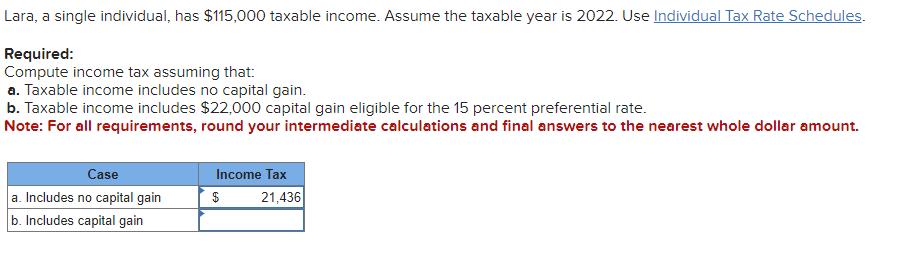

Lara, a single individual, has $115,000 taxable income. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Required: Compute income tax assuming

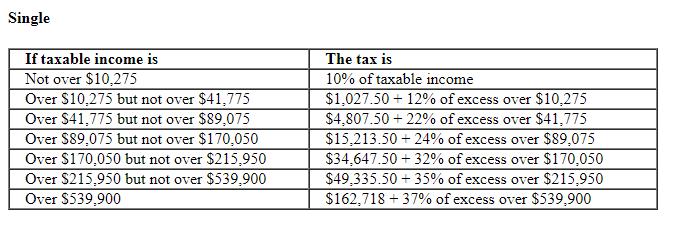

Lara, a single individual, has $115,000 taxable income. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Required: Compute income tax assuming that: a. Taxable income includes no capital gain. b. Taxable income includes $22,000 capital gain eligible for the 15 percent preferential rate. Note: For all requirements, round your intermediate calculations and final answers to the nearest whole dollar amount. Case a. Includes no capital gain b. Includes capital gain Income Tax $ 21,436 Single If taxable income is Not over $10,275 Over $10,275 but not over $41,775 Over $41,775 but not over $89,075 Over $89,075 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 The tax is 10% of taxable income $1,027.50 +12% of excess over $10,275 $4,807.50 +22% of excess over $41,775 $15,213.50 +24% of excess over $89,075 $34,647.50+32% of excess over $170,050 $49,335.50 +35% of excess over $215,950 $162,718 +37% of excess over $539,900

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started