Question

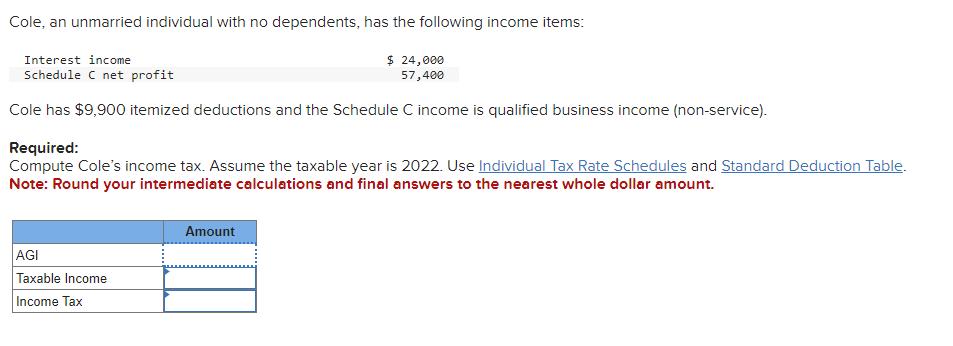

Cole, an unmarried individual with no dependents, has the following income items: $ 24,000 57,400 Interest income Schedule C net profit Cole has $9,900

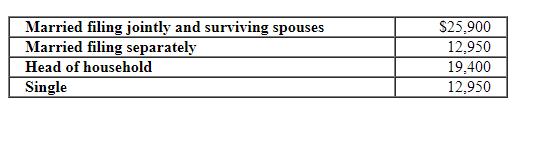

Cole, an unmarried individual with no dependents, has the following income items: $ 24,000 57,400 Interest income Schedule C net profit Cole has $9,900 itemized deductions and the Schedule C income is qualified business income (non-service). Required: Compute Cole's income tax. Assume the taxable year is 2022. Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. AGI Taxable Income Income Tax Amour Married filing jointly and surviving spouses Married filing separately Head of household Single $25,900 12,950 19,400 12,950

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To compute Coles income tax we first need to calculate his adjusted gross income AGI and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2019 Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

22nd Edition

9781259917097, 1259917096, 978-1260161472

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App