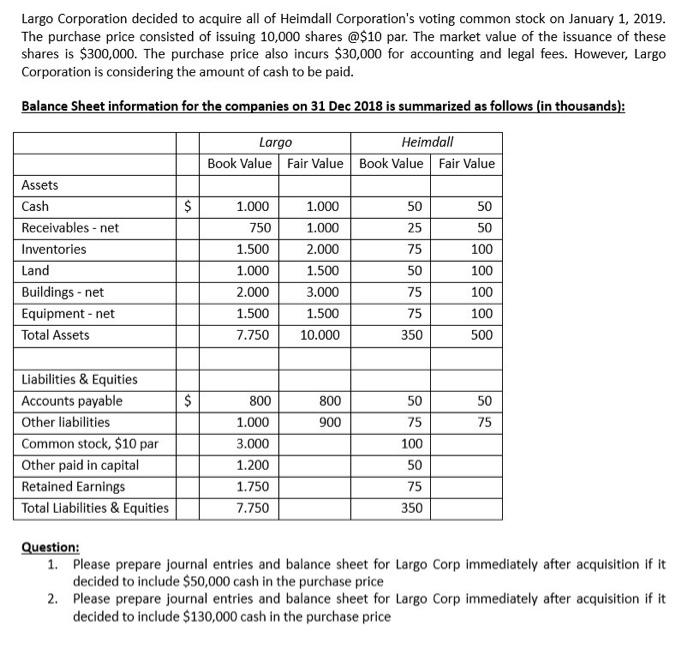

Largo Corporation decided to acquire all of Heimdall Corporation's voting common stock on January 1, 2019. The purchase price consisted of issuing 10,000 shares @$10 par. The market value of the issuance of these shares is $300,000. The purchase price also incurs $30,000 for accounting and legal fees. However, Largo Corporation is considering the amount of cash to be paid. Balance Sheet information for the companies on 31 Dec 2018 is summarized as follows (in thousands): Largo Heimdall Book Value Fair Value Book Value Fair Value $ Assets Cash Receivables - net Inventories Land Buildings - net Equipment - net Total Assets 1.000 750 1.500 1.000 2.000 1.500 7.750 1.000 1.000 2.000 1.500 3.000 1.500 10.000 50 25 75 50 75 75 350 50 50 100 100 100 100 500 $ 800 900 50 75 50 75 Liabilities & Equities Accounts payable Other liabilities Common stock, $10 par Other paid in capital Retained Earnings Total Liabilities & Equities 100 800 1.000 3.000 1.200 1.750 7.750 50 75 350 Question: 1. Please prepare journal entries and balance sheet for Largo Corp immediately after acquisition if it decided to include $50,000 cash in the purchase price 2. Please prepare journal entries and balance sheet for Largo Corp immediately after acquisition if it decided to include $130,000 cash in the purchase price Largo Corporation decided to acquire all of Heimdall Corporation's voting common stock on January 1, 2019. The purchase price consisted of issuing 10,000 shares @$10 par. The market value of the issuance of these shares is $300,000. The purchase price also incurs $30,000 for accounting and legal fees. However, Largo Corporation is considering the amount of cash to be paid. Balance Sheet information for the companies on 31 Dec 2018 is summarized as follows (in thousands): Largo Heimdall Book Value Fair Value Book Value Fair Value $ Assets Cash Receivables - net Inventories Land Buildings - net Equipment - net Total Assets 1.000 750 1.500 1.000 2.000 1.500 7.750 1.000 1.000 2.000 1.500 3.000 1.500 10.000 50 25 75 50 75 75 350 50 50 100 100 100 100 500 $ 800 900 50 75 50 75 Liabilities & Equities Accounts payable Other liabilities Common stock, $10 par Other paid in capital Retained Earnings Total Liabilities & Equities 100 800 1.000 3.000 1.200 1.750 7.750 50 75 350 Question: 1. Please prepare journal entries and balance sheet for Largo Corp immediately after acquisition if it decided to include $50,000 cash in the purchase price 2. Please prepare journal entries and balance sheet for Largo Corp immediately after acquisition if it decided to include $130,000 cash in the purchase price