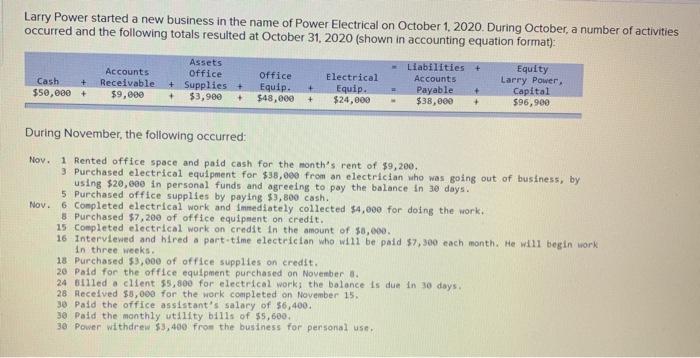

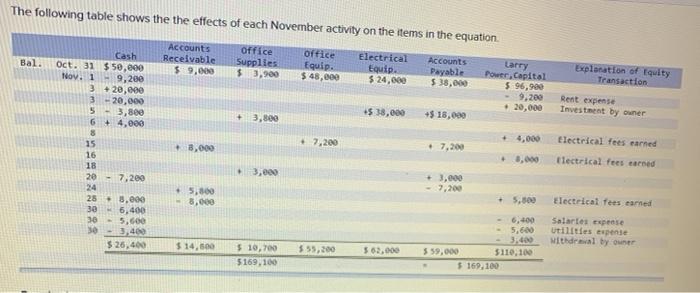

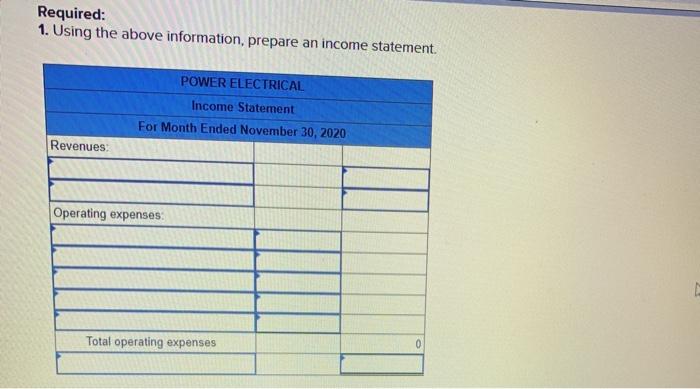

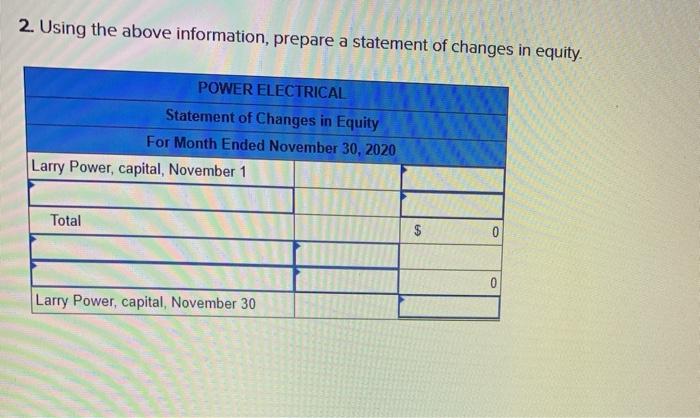

Larry Power started a new business in the name of Power Electrical on October 1, 2020. During October, a number of activities occurred and the following totals resulted at October 31, 2020 (shown in accounting equation format): Assets Accounts Office Cash + Receivable + Supplies + $50,000+ $9,000 $3,900 + office Equip. $48,000 Electrical Equip. $24,000 Liabilities Accounts Payable $38,000 Equity Larry Power, Capital $96,900 + + + During November, the following occurred: Nov. 1 Rented office space and paid cash for the month's rent of $9, 200. 3 Purchased electrical equipment for $38,000 from an electrician who was going out of business, by using $20,000 in personal funds and agreeing to pay the balance in 30 days. 5 Purchased office supplies by paying $3,800 cash. Nov. 6 Completed electrical work and immediately collected $4,000 for doing the work. 8Purchased $7,200 of office equipment on credit. 15 Completed electrical work on credit in the amount of $8,000. 16 Interviewed and hired a part-time electrician who will be paid $7,300 each month. He will begin work in three weeks 18 Purchased $3,000 of office supplies on credit. 20 Paid for the office equipment purchased on November 3. 24 Billed a client 55,800 for electrical work, the balance is due in 30 days 28 Received 38,000 for the work completed on November 15. 30 Paid the office assistant's salary of 56,400. 30 paid the monthly utility bills of $5,600 38 Power withdrew $3,400 from the business for personal use. The following table shows the the effects of each November activity on the items in the equation Bal. Accounts Receivable $ 9.000 Office Supplies $ 3,900 office Equip. $ 48,000 Electrical Equip $ 24,000 Accounts Payable $ 38,000 Larry Power, Capital $ 96,900 9,200 20,000 Explanation of Equity Transaction Rent expense Investment by owner + 3,800 +$ 38,000 +$ 18,000 + 7,200 + 4,000 Cash Oct. 31 $50,000 Nov. 1 9,200 +20,000 3 -20,000 5 3,800 6 + 4.000 8 15 16 18 20 7.200 24 25 8.000 30 6,400 30 5,500 30 3,400 $ 26,400 + 3,000 7.200 Electrical fees earned Electrical fees and + 3,000 + 3,000 5,800 - 8.000 + 5,500 Electrical fees med - 5,600 Salaries expense utilities expense withdrawal by owner $14.500 5.59,200 $ 10,00 $169,100 562.000 359,000 $110,100 $169,100 Required: 1. Using the above information, prepare an income statement. POWER ELECTRICAL Income Statement For Month Ended November 30, 2020 Revenues: Operating expenses Total operating expenses 0 2. Using the above information, prepare a statement of changes in equity. POWER ELECTRICAL Statement of Changes in Equity For Month Ended November 30, 2020 Larry Power, capital, November 1 Total $ 0 0 Larry Power, capital, November 30 3. Using the above information, prepare a balance sheet POWER ELECTRICAL Balance Sheet November 30, 2020 Assets Liabilities Equity Total assets $ 0 Total liabilities and equity $