Answered step by step

Verified Expert Solution

Question

1 Approved Answer

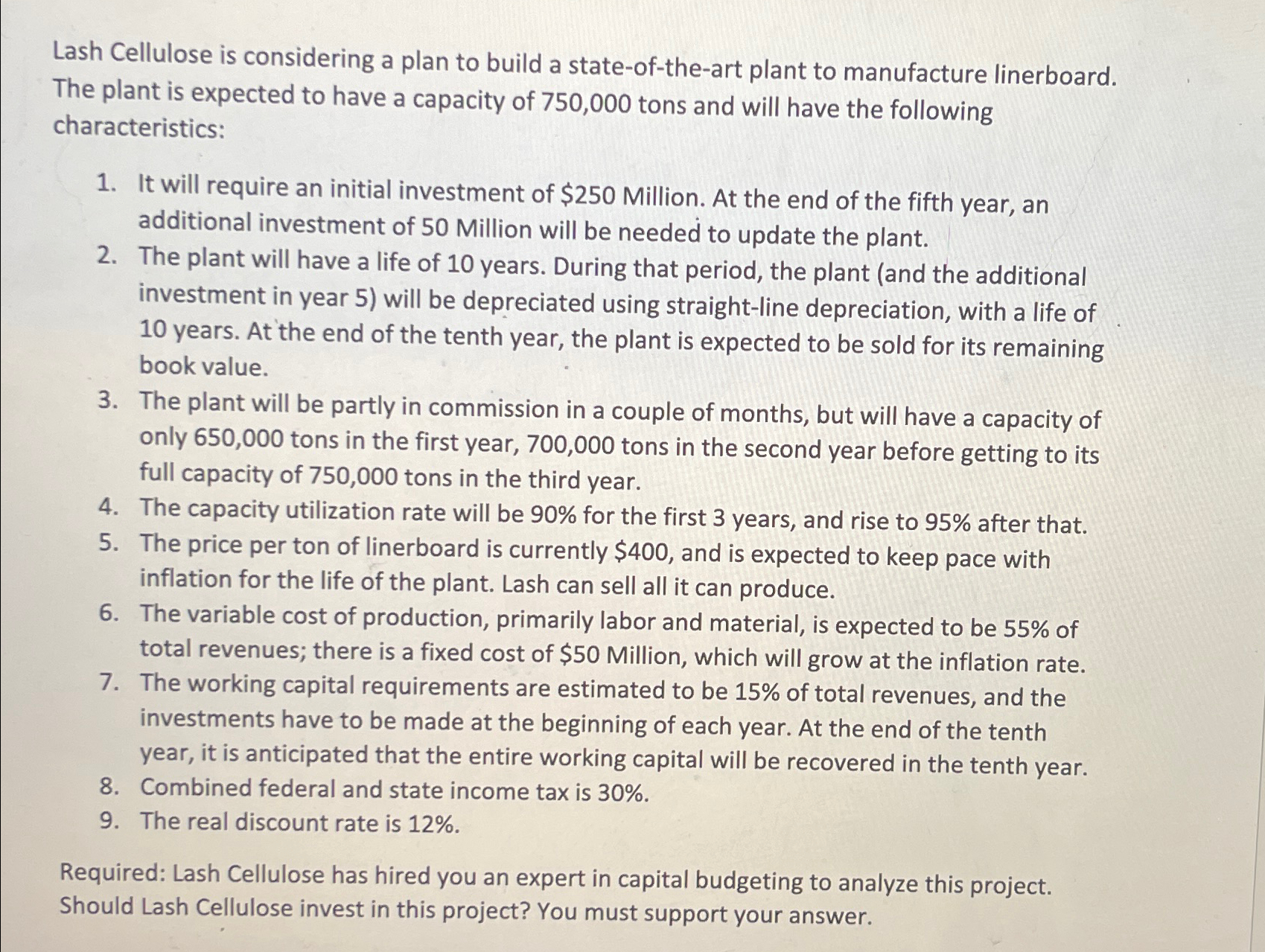

Lash Cellulose is considering a plan to build a state - of - the - art plant to manufacture linerboard. The plant is expected to

Lash Cellulose is considering a plan to build a stateoftheart plant to manufacture linerboard. The plant is expected to have a capacity of tons and will have the following characteristics:

It will require an initial investment of $ Million. At the end of the fifth year, an additional investment of Million will be needed to update the plant.

The plant will have a life of years. During that period, the plant and the additional investment in year will be depreciated using straightline depreciation, with a life of years. At the end of the tenth year, the plant is expected to be sold for its remaining book value.

The plant will be partly in commission in a couple of months, but will have a capacity of only tons in the first year, tons in the second year before getting to its full capacity of tons in the third year.

The capacity utilization rate will be for the first years, and rise to after that.

The price per ton of linerboard is currently $ and is expected to keep pace with inflation for the life of the plant. Lash can sell all it can produce.

The variable cost of production, primarily labor and material, is expected to be of total revenues; there is a fixed cost of $ Million, which will grow at the inflation rate.

The working capital requirements are estimated to be of total revenues, and the investments have to be made at the beginning of each year. At the end of the tenth year, it is anticipated that the entire working capital will be recovered in the tenth year.

Combined federal and state income tax is

The real discount rate is

Required: Lash Cellulose has hired you an expert in capital budgeting to analyze this project. Should Lash Cellulose invest in this project? You must support your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started