Answered step by step

Verified Expert Solution

Question

1 Approved Answer

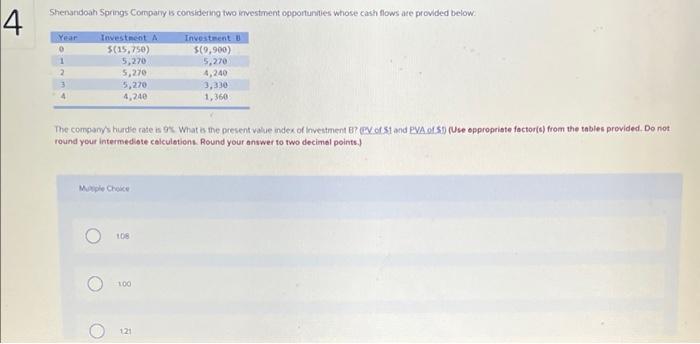

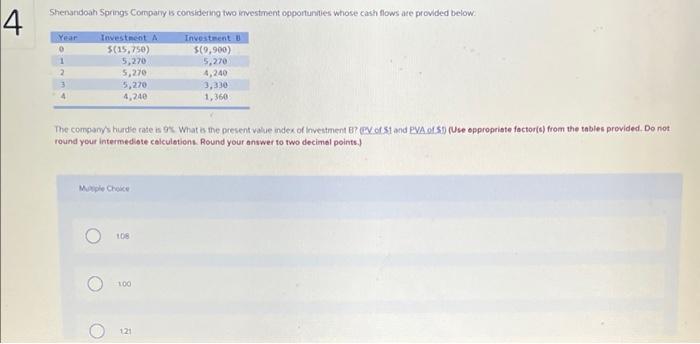

last choice is: d) none of these answers are correct 4 Shenandoah Springs Company is considering two investment opportunities whose cash flows are provided below.

last choice is:

4 Shenandoah Springs Company is considering two investment opportunities whose cash flows are provided below. Year Investment A Investment B 0 $(9,900) $(15,750) 5,270 1 5,270 2 5,270 4,240 5,270 3,330 4,240 1,360 The company's hurdie rate is 9%. What is the present value index of investment B7 PV of S1 and PVA of S1) (Use appropriate factor(s) from the tables provided. Do not round your intermediate calculations. Round your answer to two decimal points.) Multiple Choice 108 O 100 121 d) none of these answers are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started