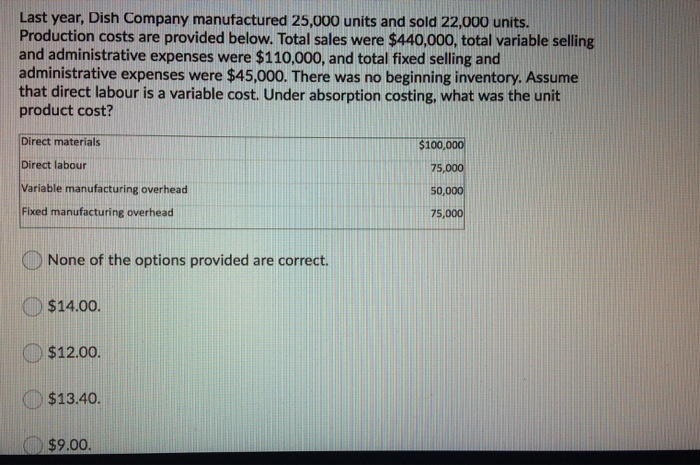

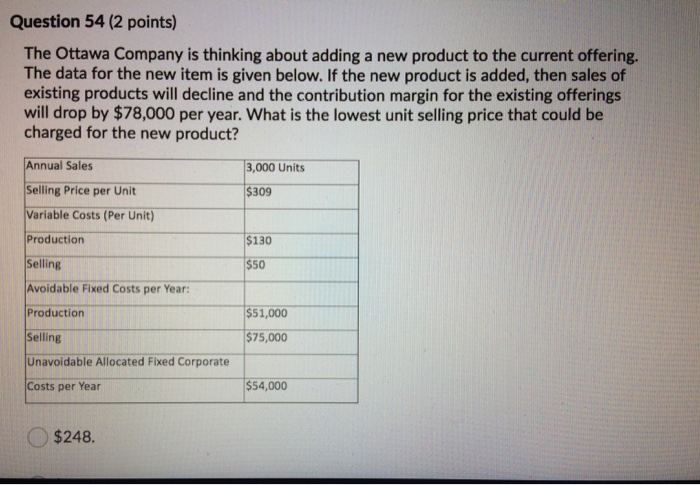

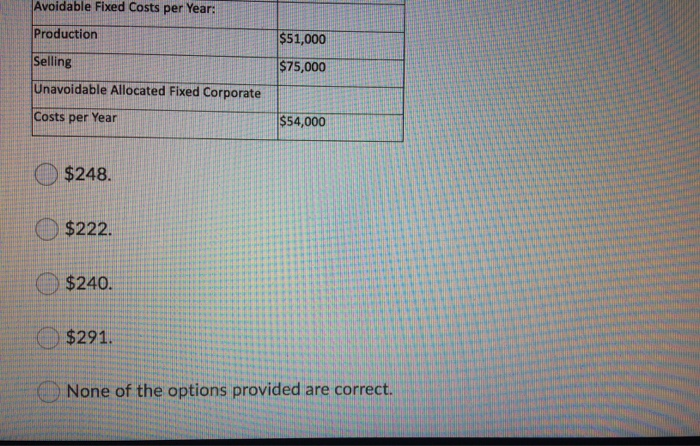

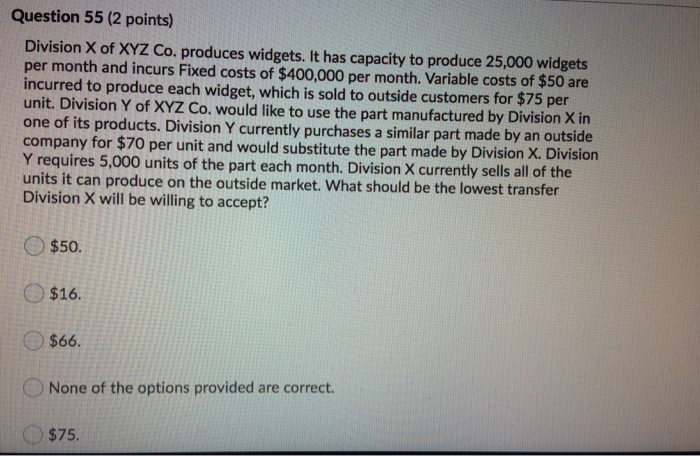

Last year, Dish Company manufactured 25,000 units and sold 22,000 units. Production costs are provided below. Total sales were $440,000, total variable selling and administrative expenses were $110,000, and total fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labour is a variable cost. Under absorption costing, what was the unit product cost? $100,000 75,000 Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead 50,000 75,000 None of the options provided are correct. $14.00. $12.00 $13.40. $9.00. Question 54 (2 points) The Ottawa Company is thinking about adding a new product to the current offering. The data for the new item is given below. If the new product is added, then sales of existing products will decline and the contribution margin for the existing offerings will drop by $78,000 per year. What is the lowest unit selling price that could be charged for the new product? 3,000 Units $309 $130 $50 Annual Sales Selling Price per Unit Variable Costs (Per Unit) Production Selling Avoidable Fixed Costs per Year: Production Selling Unavoidable Allocated Fixed Corporate Costs per Year $51,000 $75,000 $54,000 $248. Avoidable Fixed Costs per Year: Production $51,000 $75,000 Selling Unavoidable Allocated Fixed Corporate Costs per Year $54,000 $248. $222. $240. $291. None of the options provided are correct. Question 55 (2 points) Division X of XYZ Co. produces widgets. It has capacity to produce 25,000 widgets per month and incurs Fixed costs of $400,000 per month. Variable costs of $50 are incurred to produce each widget, which is sold to outside customers for $75 per unit. Division Y of XYZ Co. would like to use the part manufactured by Division X in one of its products. Division Y currently purchases a similar part made by an outside company for $70 per unit and would substitute the part made by Division X. Division Y requires 5,000 units of the part each month. Division X currently sells all of the units it can produce on the outside market. What should be the lowest transfer Division X will be willing to accept? $50. $16. $66. None of the options provided are correct. $75