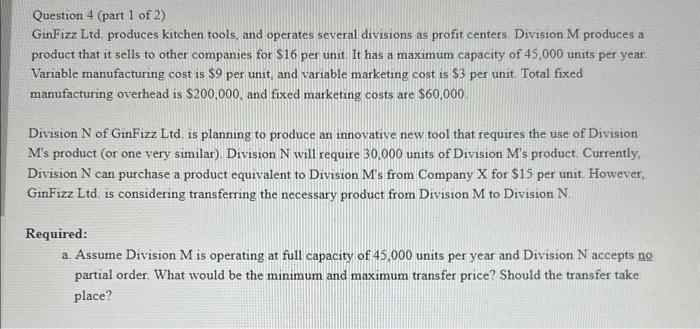

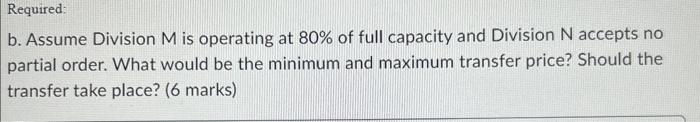

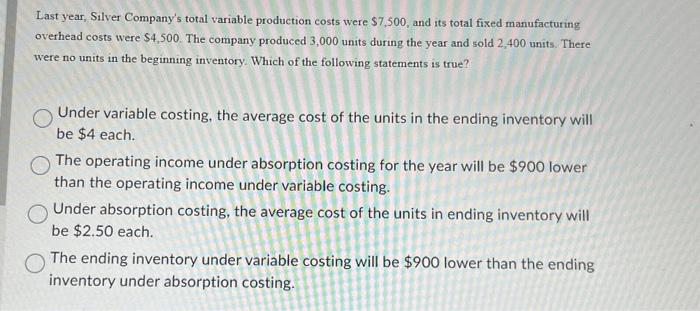

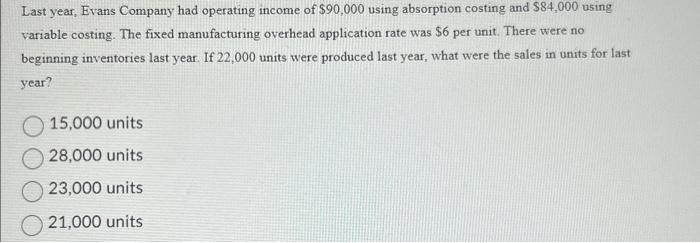

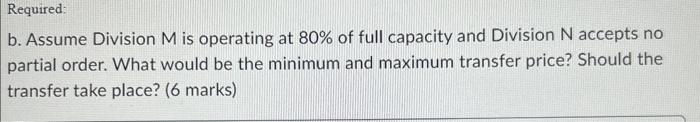

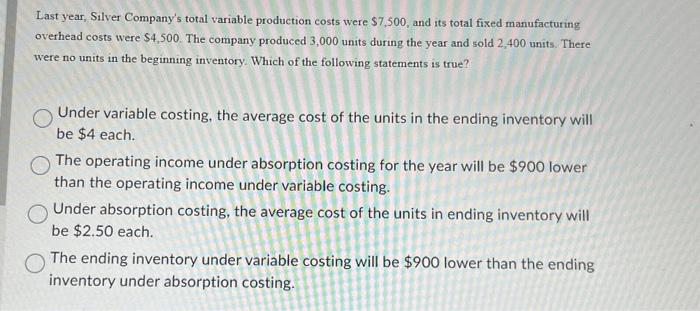

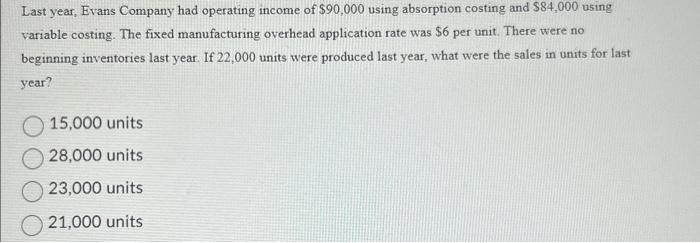

Last year, Silver Company's total variable production costs were \\( \\$ 7,500 \\), and its total fixed manufacturing overhead costs were \\( \\$ 4,500 \\). The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true? Under variable costing, the average cost of the units in the ending inventory will be \\( \\$ 4 \\) each. The operating income under absorption costing for the year will be \\( \\$ 900 \\) lower than the operating income under variable costing. Under absorption costing, the average cost of the units in ending inventory will be \\( \\$ 2.50 \\) each. The ending inventory under variable costing will be \\( \\$ 900 \\) lower than the ending inventory under absorption costing. Question 4 (part 1 of 2 ) GinFizz Ltd. produces kitchen tools, and operates several divisions as profit centers. Division \\( \\mathrm{M} \\) produces a product that it sells to other companies for \\( \\$ 16 \\) per unit. It has a maximum capacity of 45,000 units per year Variable manufacturing cost is \\( \\$ 9 \\) per unit, and variable marketing cost is \\( \\$ 3 \\) per unit. Total fixed manufacturing overhead is \\( \\$ 200,000 \\), and fixed marketing costs are \\( \\$ 60,000 \\). Division N of GinFizz Ltd, is planning to produce an innovative new tool that requires the use of Division M's product (or one very similar). Division N will require 30,000 units of Division M's product. Currently. Division N can purchase a product equivalent to Division M's from Company X for \\( \\$ 15 \\) per unit. However, GinFizz Ltd. is considering transferring the necessary product from Division M to Division N. Required: a. Assume Division M is operating at full capacity of 45,000 units per year and Division \\( \\mathrm{N} \\) accepts no partial order. What would be the minimum and maximum transfer price? Should the transfer take place? b. Assume Division M is operating at \80 of full capacity and Division \\( \\mathrm{N} \\) accepts no partial order. What would be the minimum and maximum transfer price? Should the transfer take place? (6 marks) Last year, Evans Company had operating income of \\( \\$ 90,000 \\) using absorption costing and \\( \\$ 84,000 \\) using variable costing. The fixed manufacturing overhead application rate was \\( \\$ 6 \\) per unit. There were no beginning inventories last year. If 22,000 units were produced last year, what were the sales in units for last year? 15,000 units 28,000 units 23,000 units 21,000 units