Question

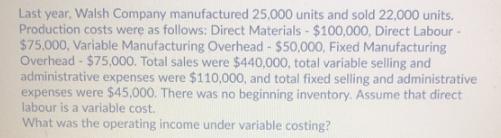

Last year, Walsh Company manufactured 25.000 units and sold 22,000 units. Production costs were as follows: Direct Materials - $100,000, Direct Labour - $75.000,

Last year, Walsh Company manufactured 25.000 units and sold 22,000 units. Production costs were as follows: Direct Materials - $100,000, Direct Labour - $75.000, Variable Manufacturing Overhead - $50,000, Fixed Manufacturing Overhead - $75,000. Total sales were $440,000, total variable selling and administrative expenses were $110,000, and total fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labour is a variable cost. What was the operating income under variable costing?

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

A 1 WALSH COMPANY 2 Variable Costing Income Statement 3 Sales 440000 4 Less Variable expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk

14th edition

978-1305887725, 1305887727, 1305636619, 978-1305636613

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App