Answered step by step

Verified Expert Solution

Question

1 Approved Answer

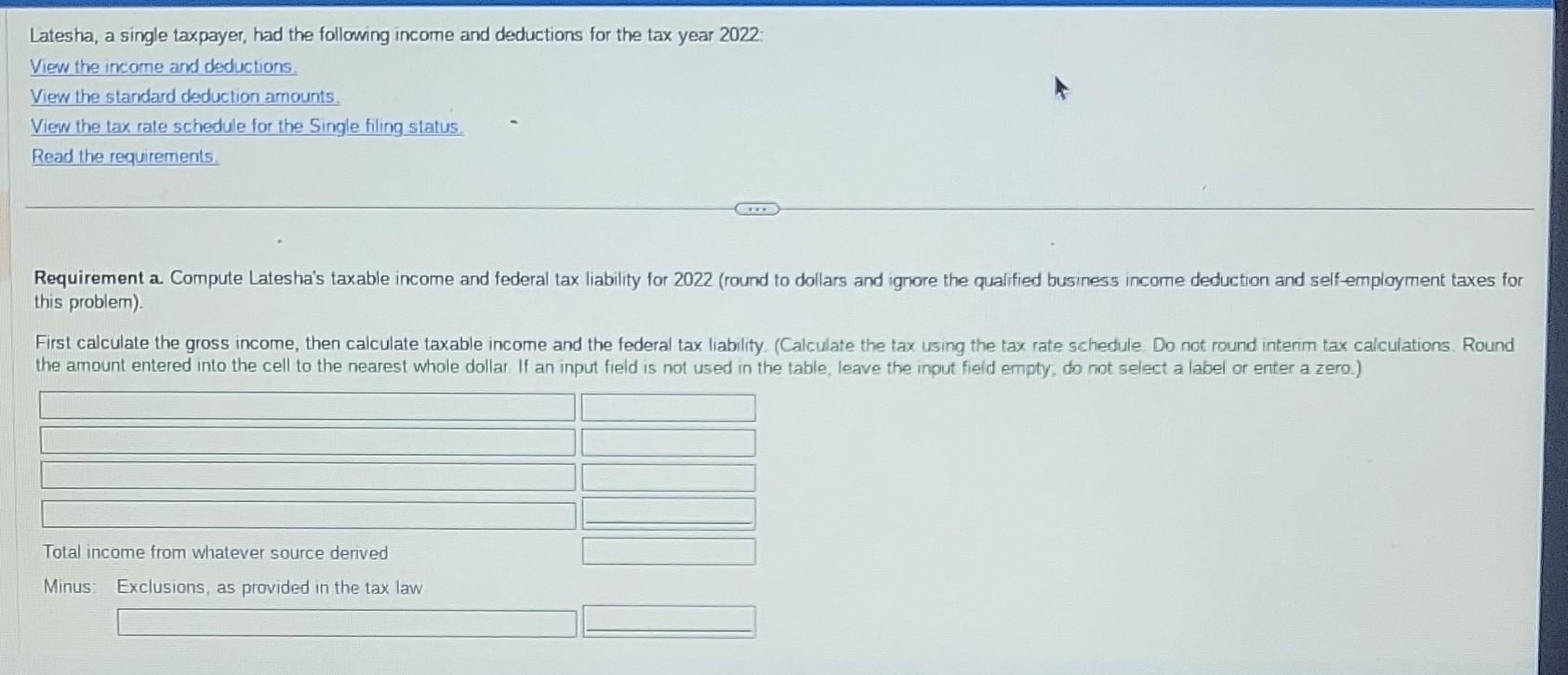

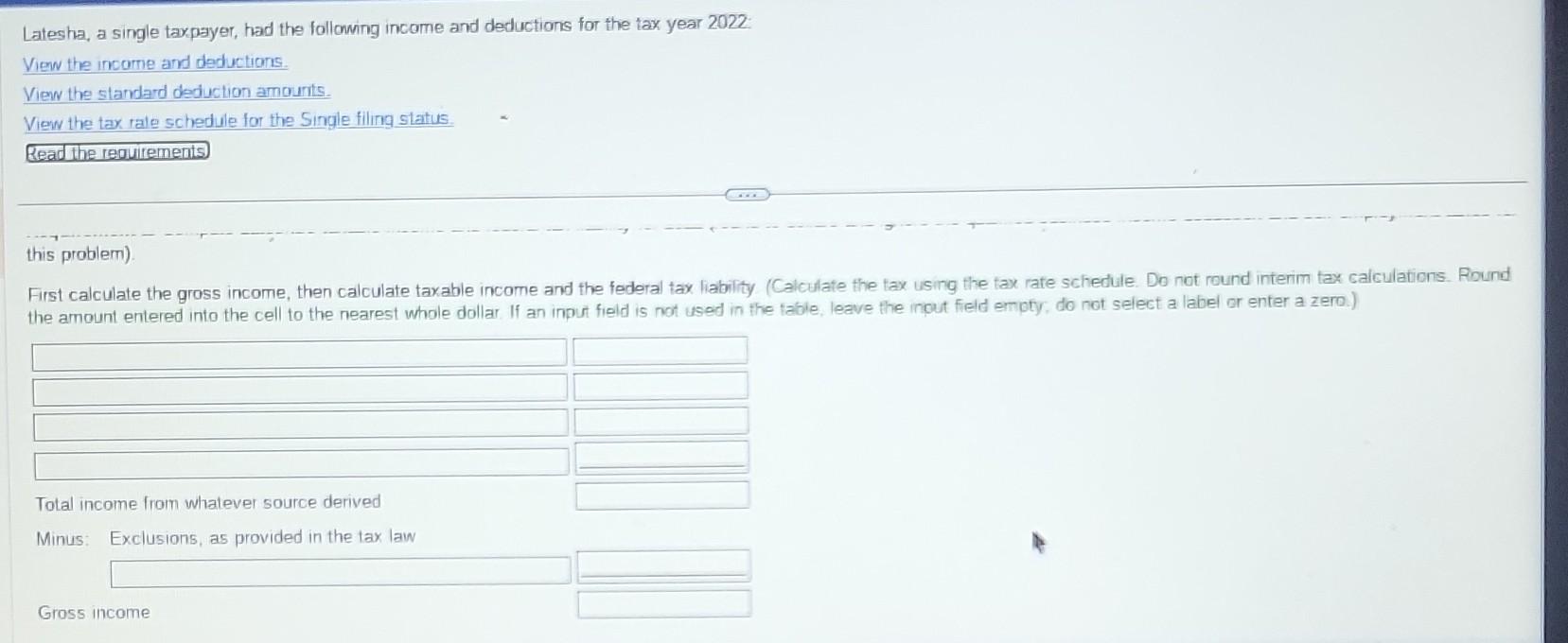

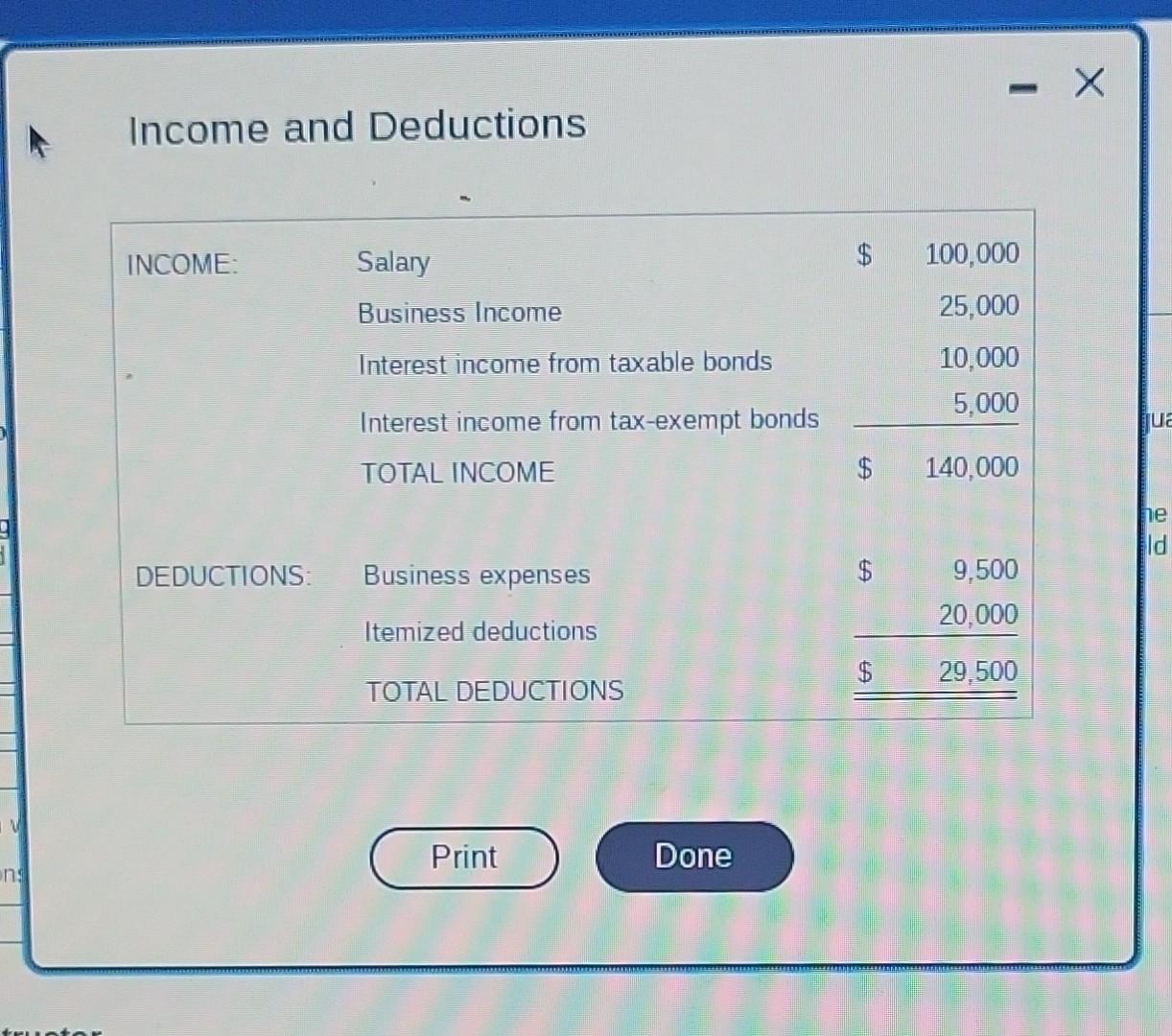

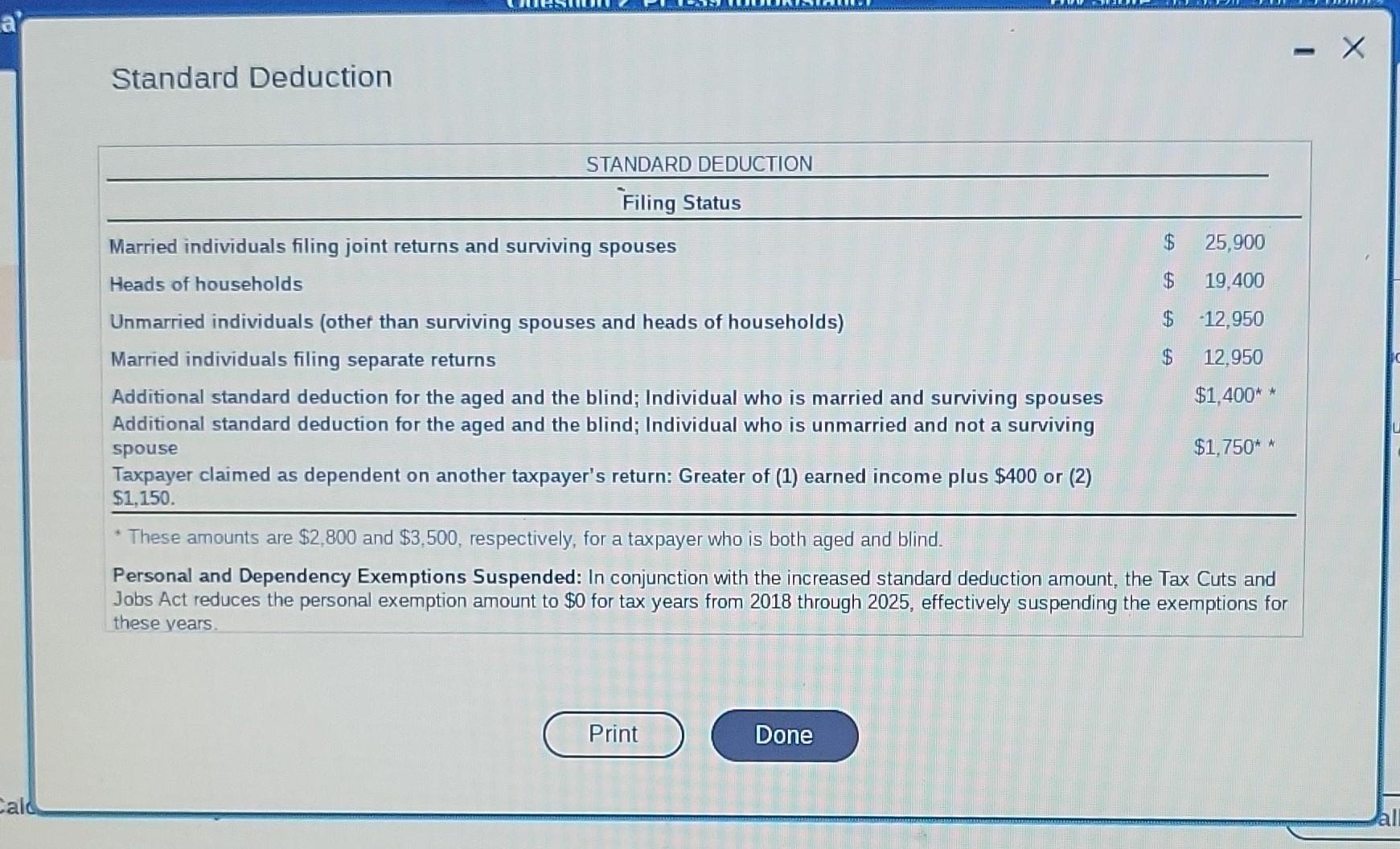

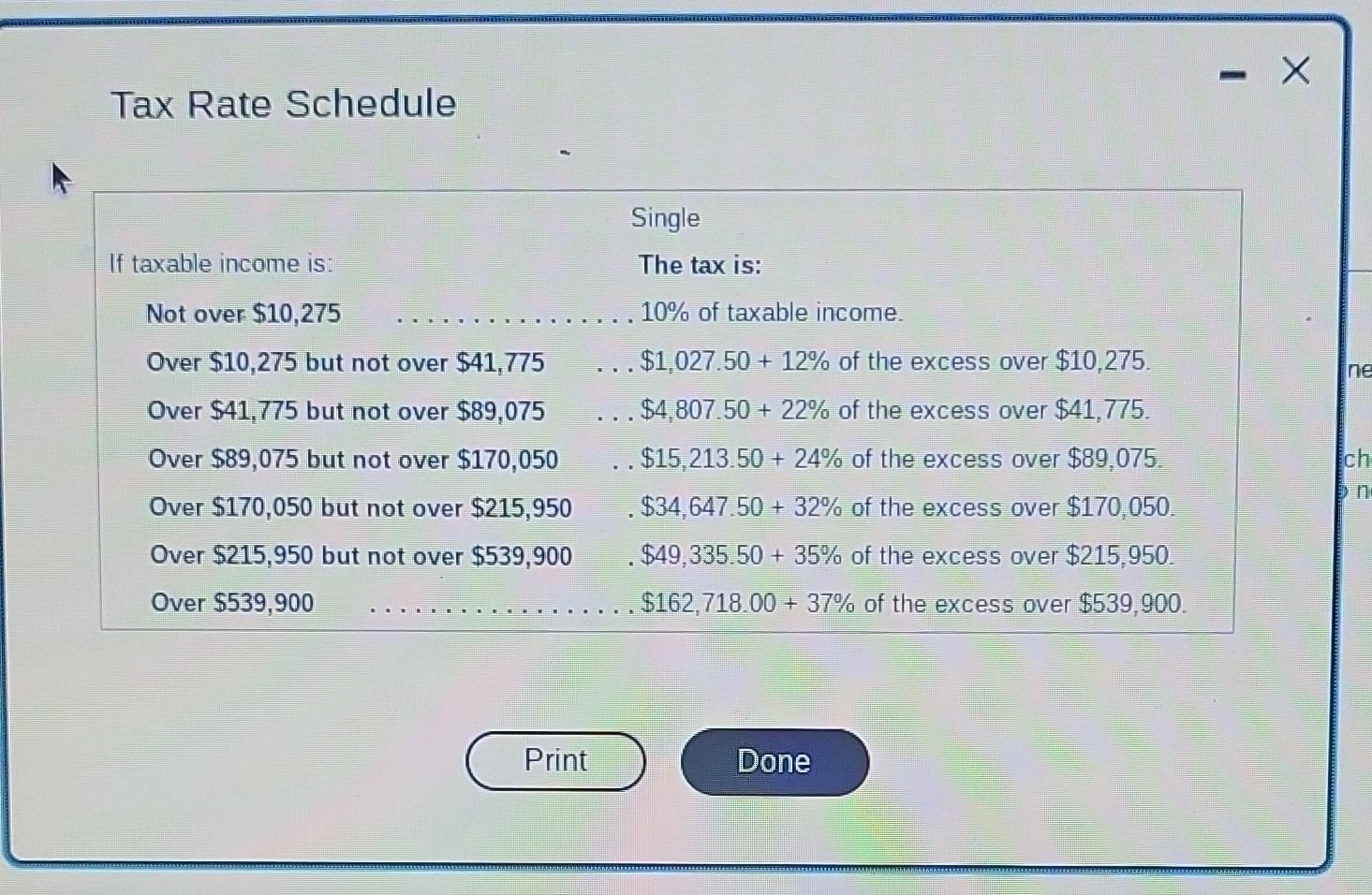

Latesha, a single taxpayer, had the following income and deductions for the tax year 2022 : View the income and deductions. View the standard deduction

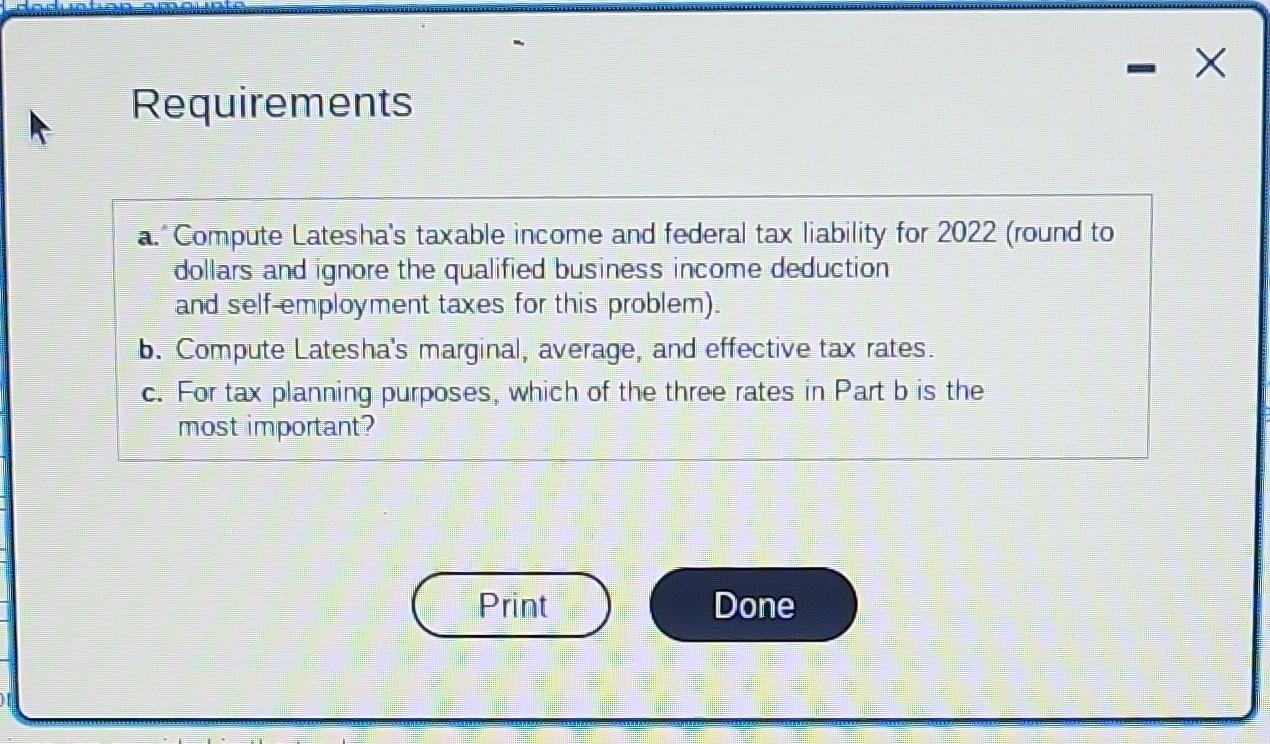

Latesha, a single taxpayer, had the following income and deductions for the tax year 2022 : View the income and deductions. View the standard deduction amounts. View the tax rate schedule for the Single filing status. Read the requirements. Requirement a. Compute Latesha's taxable income and federal tax liability for 2022 (round to dollars and ignore the qualified business income deduction and self-employment taxes for this problem). First calculate the gross income, then calculate taxable income and the federal tax liability. (Calculate the tax using the tax rate schedule. Do not round interim tax calculations. Round the amount entered into the cell to the nearest whole dollar If an input field is not used in the table, leave the input field empty, do not select a label or enter a zero.) Latesha, a single taxpayer, had the following income and deductions for the tax year 2022 : View the income and deductions. View the standard deduction amounts. View the tax rale schedule for the Single filing status. kead the requirements this problem) First calculate the gross income, then calculate taxable income and the federal tax liability. (Calculate the tax using the tax rate schedule. Do not round interim tax caiculations. Round the amount entered into the cell to the nearest whole dollar. If an input field is not used in the table, leave the incut field empty, do not select a label or enter a zero.) Income and Deductions Standard Deduction Tax Rate Schedule Requirements a. ' Compute Latesha's taxable income and federal tax liability for 2022 (round to dollars and ignore the qualified business income deduction and self-employment taxes for this problem). b. Compute Latesha's marginal, average, and effective tax rates. c. For tax planning purposes, which of the three rates in Part b is the most important

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started