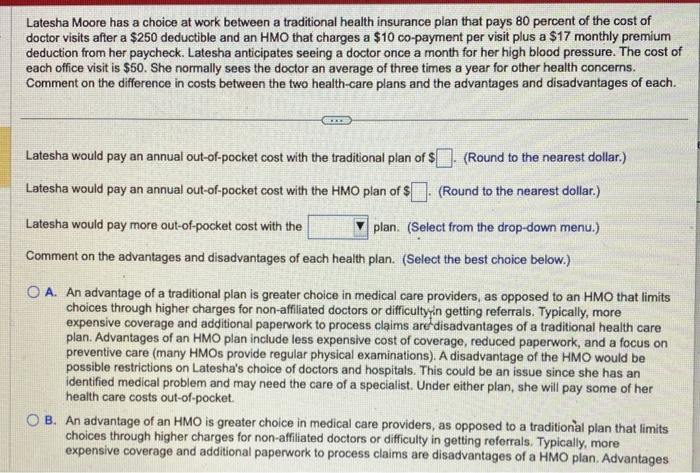

Latesha Moore has a choice at work between a traditional health insurance plan that pays 80 percent of the cost of doctor visits after a $250 deductible and an HMO that charges a $10 co-payment per visit plus a $17 monthly premium deduction from her paycheck. Latesha anticipates seeing a doctor once a month for her high blood pressure. The cost of each office visit is $50. She normally sees the doctor an average of three times a year for other health concerns. Comment on the difference in costs between the two health-care plans and the advantages and disadvantages of each. Latesha would pay an annual out-of-pocket cost with the traditional plan of $ (Round to the nearest dollar.) Latesha would pay an annual out-of-pocket cost with the HMO plan of $ (Round to the nearest dollar.) Latesha would pay more out-of-pocket cost with the plan. (Select from the drop-down menu.) Comment on the advantages and disadvantages of each health plan. (Select the best choice below.) A. An advantage of a traditional plan is greater choice in medical care providers, as opposed to an HMO that limits choices through higher charges for non-affiliated doctors or difficultyin getting referrals. Typically, more expensive coverage and additional paperwork to process claims are disadvantages of a traditional health care plan. Advantages of an HMO plan include less expensive cost of coverage, reduced paperwork, and a focus on preventive care (many HMOs provide regular physical examinations). A disadvantage of the HMO would be possible restrictions on Latesha's choice of doctors and hospitals. This could be an issue since she has an identified medical problem and may need the care of a specialist. Under either plan, she will pay some of her health care costs out-of-pocket. B. An advantage of an HMO is greater choice in medical care providers, as opposed to a traditional plan that limits choices through higher charges for non-affiliated doctors or difficulty in getting reforrals. Typically, more expensive coverage and additional paperwork to process claims are disadvantages of a HMO plan. Advantages