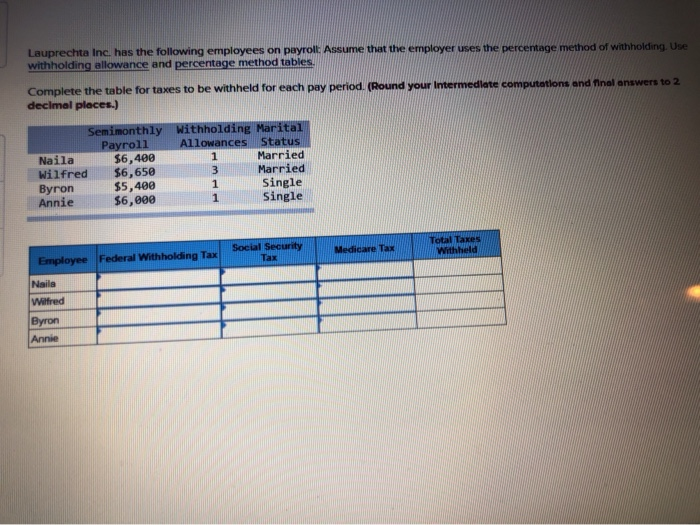

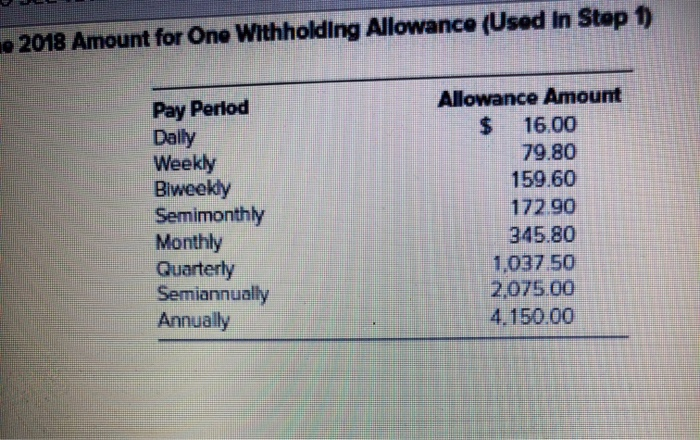

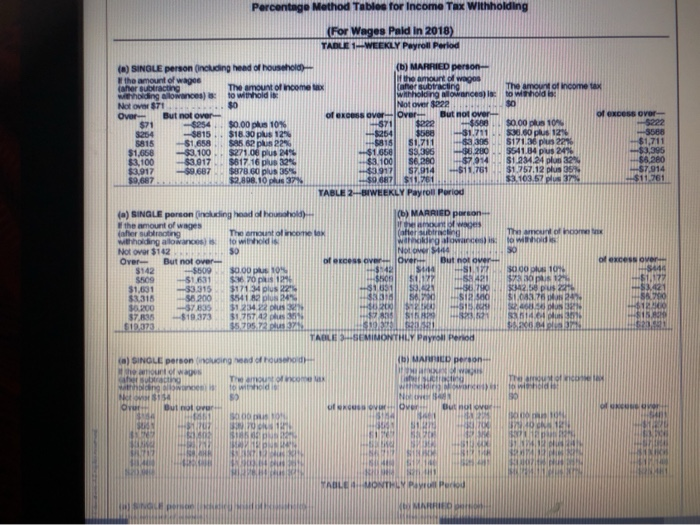

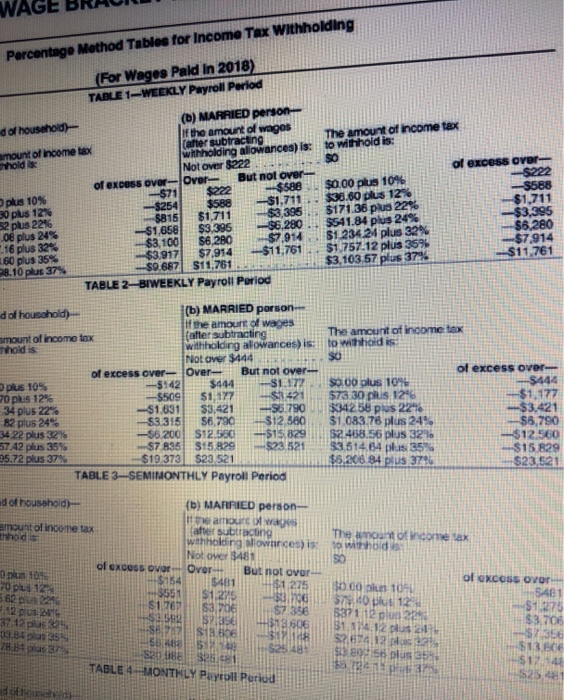

Lauprechta Inc. has the following employees on payroll: Assume that the employer uses the percentage method of withholding. Use withholding allowance and percentage method tables. Complete the table for taxes to be withheld for each pay period. (Round your Intermedlate computations and final answers to 2 declmal places.) Semimonthly Withholding Marital ayro11 $6,400 $6,650 $5,400 $6,000 Status Married Married Single single Allowances Naila Wilfred on Annie 1 Total Taxes Withheld Social Security Tax Medicare Tax Employee Federal Withholding Tax Naila Wilfred on Annie ne 2018 Amount for One Withholding Allowance (Used in Step 1) Allowance Amount Pay Perlod Dally Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually $ 79.80 159.60 16.00 172.90 345.80 1,037.50 2,075.00 4.150.00 Percentage Mothod Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1-WEEKLY Payroll Perlod (b) MARRIED person H the amount of wogos aher subtracting wthholding allowances) is Not over $222 Over- $222 $588 S1,71 S3.395 S6280 $7.914 $11.761 (a) SINOLE person (including head of household) the amount of wagee (aher subracting wihholding alloR Not over $71 Over $71 $254 5815 The amount of income tax to Mhold is The amount of income tax to withhold is nces) is of excess over- -$222 -5568 $1,711 $3,395 66.280 67.914 $11.761 of excess over But not over But not over- 671 $0.00 plus 10% $3000 plus 12% $171.36 pun 22% S541.84 pus 24% $1.234.24 plun 32% $1757.12 plus 35 $3.103.57 plus 37% $254 $815 -$1,658 -3.100 $3017 -69.687 s0.00 plus 10 % $18.30plus 12% s85.62 plus 22%% $271.06 pus 24% $617.16 plus 32% $878 60 plus 35 % $2.898.10 plus 37% $264 815 $1.656 $3.100 49.917 $9 687 $1.711 63 305 96 280 $7.914 $11.761 $1,658 $3,100 $3.917 $0,687 TABLE 2-BIWEEKLY Payroll Poriod (b) MARRIED parson (a) SINGLE porson (incluing hoad of housohold) the amount of wages afer subtracting whholding allowances) s Not over $142 Over $142 5509 $1,631 $3315 $6200 $7 835 $19.373 the (atter f wogs tracing alowarces) in The amcunt of income t to wiioid is The amount of income lex to wihhold of excess over of excess over Oven 442 But not over But not over $509 -$1.631 $3.315 200 37 835 -$19.373 S44 so 00 plus 10% s0.00 pus 10% $36 70 pkis 12% $171.34 plus 22 $541 82 plus 24% $1234 22 lus3 $1.757 42 p % $5705.72 plus 32 -68 421 6 790 $73 12 C3412 58 pus 22 M24 lu lu 30% $0604 plin $1851 $3421 86700 $1250 $1.083 S15. 4 35 TABLE -SEMINONTHLY Payroll Period (b) MARRIED person ingad of househoid (a) SINGLE person( wages THe amoutioficse The amu to withold is Noto154 But not uf wxouss ovr not over AIN TABLE MONTHLY (t MARRDRn t WAGE Percentage Method Tables for Income Tax Withholding (For Wages Pald In 2018) TABLE 1-WEEKLY Payroll Period (b) MARRIED person- If the amount of wagos after subtracting wthholding allowances) is: to withhold is: Not over $222 d of household) The amount of income tax mount of income tax hold is of excess oVer -$222 -$588 $1.711 $3,395 $6.280 $7.914 $11,761 But not over $588 $1,711 $3,395 $6.280 $7.914 -$11.761 $0.00 plus 10% $36.60 plus 12% $171.36 plus 22% $541.84 plus 24% $1.234 24 plus 32% $1.757.12 plus 35% $3,103.57 plus 37% of excess ovor Over $222 $588 $1,711 $3.395 $6,280 $7.914 $9.687 $11.761 -$71 $254 $815 -$1658 $3,100 $3.917 Oplus 10% 30 plus 12% 52 plus 22% 08 plus 24% 16 plus 32% 60 plus 35% 8.10 plus 37 % TABLE 2-BIWEEKLY Payroll Poriod (b) MARRIED porson If the amourt of wages (after subtracting withholding alowances) is: Not over $444 d of housahold) The amcunit of inoome tex mount of income tax hhold is to withhoid is S0 of excess over $444 $1,177 -$3,421 $6,790 $12.560 $15.829 $23.521 of excess over-Over- -$142 -5509 -$1.631 $3.315 $6.200 $7 835 $19.373 TABLE 3-SEMIMONTHLY Payroll Period But not over $1177 -$3421 -S6.790 $12,560 $15,829 $23.521 so.00 plus 10 $73.30 plus 12% $34258 pus 22% $1.083.76 plus 24% $2.468.56 plus 32% $3514.64 plus 35% $6.206 84 plus 37 $444 $1,177 $3,421 S6,790 S12.560 $15.829 $23,521 plus 10% 70 plus 12% 34 plus 22% 82 plus 24% 34 22 plus 32% 57.42 plus 35 % 95.72 plus 37 % ed of household) (b) MARRIED person- he amourt of wags lafer subtracting withholding sllownnces) is Not over 848 1 mount of inceme tax Hhodis The amount of income tax to withhoid i of excess ovar Over But not ovor- $1 275 of excoss ovor $481 $1.275 $3.706 7356 $13606 17.14 $25 481 $481 $1.275 $3.706 70 pus 12 562 pus 22 24 S0 co plun 10 $79 40 p 12 5371 $551 $1767 $3.592 $7 356 S13.606 plus 22 37 03 84 s 355 78 84 37 81 2 S18806 48 $80dis6 lus35 S20 988 825 81 TABLE 4-MONTHLY Payroll Period