Answered step by step

Verified Expert Solution

Question

1 Approved Answer

May I know what are the journal entries required for this? No solutions involve revaluation reserve are greatly appreciated because it was not taught to

May I know what are the journal entries required for this? No solutions involve revaluation reserve are greatly appreciated because it was not taught to us yet. Thanks.

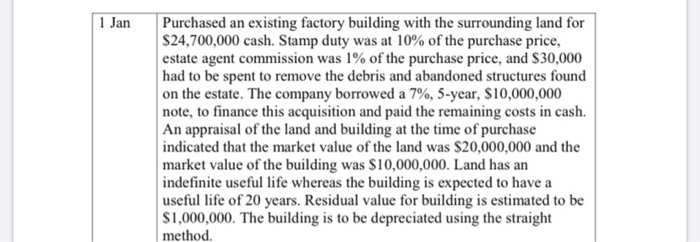

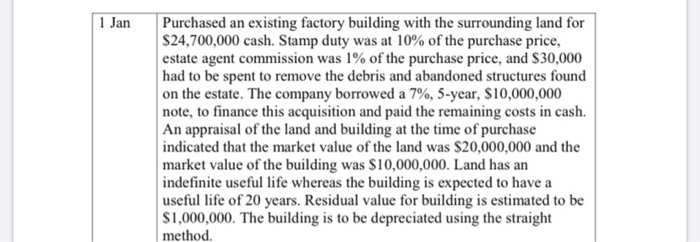

1 Jan Purchased an existing factory building with the surrounding land for $24,700,000 cash. Stamp duty was at 10% of the purchase price, estate agent commission was 1% of the purchase price, and $30,000 had to be spent to remove the debris and abandoned structures found on the estate. The company borrowed a 7%, 5-year, $10,000,000 note, to finance this acquisition and paid the remaining costs in cash. An appraisal of the land and building at the time of purchase indicated that the market value of the land was $20,000,000 and the market value of the building was $10,000,000. Land has an indefinite useful life whereas the building is expected to have a useful life of 20 years. Residual value for building is estimated to be $1,000,000. The building is to be depreciated using the straight method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started