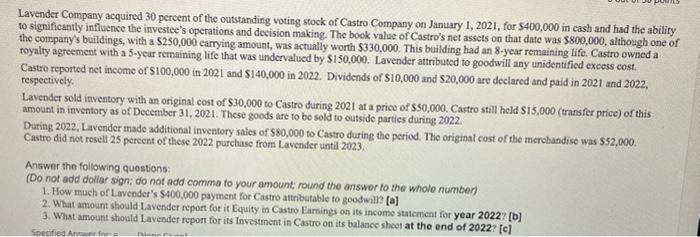

Lavender Company acquired 30 percent of the outstanding voting stock of Castro Company on January 1, 2021, for $400,000 in cash and had the ability to significantly influence the investee's operations and decision making. The book value of Castro's net assets on that date was $800,000, although one of the company's buildings, with a $250,000 carrying amount, was actually worth $330,000. This building had an 8-year remaining life. Castro owned a royalty agreement with a 5-year remaining life that was undervalued by $150,000. Lavender attributed to goodwill any unidentified excess cost. Castro reported net income of S100,000 in 2021 and $140,000 in 2022. Dividends of $10,000 and $20,000 are declared and paid in 2021 and 2022, respectively. Lavender sold inventory with an original cost of $30,000 to Castro during 2021 at a price of $50,000. Castro still held $15,000 (transfer price) of this amount in inventory as of December 31, 2021. These goods are to be sold to outside parties during 2022. During 2022, Lavender made additional inventory sales of $80,000 to Castro during the period. The original cost of the merchandise was $52,000. Castro did not resell 25 percent of these 2022 purchase from Lavender until 2023. Answer the following questions: (Do not add dollar sign; do not add comma to your amount round the answer to the whole number) 1. How much of Lavender's $400,000 payment for Castro attributable to goodwill [a] 2. What amount should Lavender report for it Equity in Castro Earnings on its income statement for year 2022? [b] 3. What amount should Lavender report for its Investment in Castro on its balance sheet at the end of 2022? [e] Specified Antun Lavender Company acquired 30 percent of the outstanding voting stock of Castro Company on January 1, 2021, for $400,000 in cash and had the ability to significantly influence the investee's operations and decision making. The book value of Castro's net assets on that date was $800,000, although one of the company's buildings, with a $250,000 carrying amount, was actually worth $330,000. This building had an 8-year remaining life. Castro owned a royalty agreement with a 5-year remaining life that was undervalued by $150,000. Lavender attributed to goodwill any unidentified excess cost. Castro reported net income of S100,000 in 2021 and $140,000 in 2022. Dividends of $10,000 and $20,000 are declared and paid in 2021 and 2022, respectively. Lavender sold inventory with an original cost of $30,000 to Castro during 2021 at a price of $50,000. Castro still held $15,000 (transfer price) of this amount in inventory as of December 31, 2021. These goods are to be sold to outside parties during 2022. During 2022, Lavender made additional inventory sales of $80,000 to Castro during the period. The original cost of the merchandise was $52,000. Castro did not resell 25 percent of these 2022 purchase from Lavender until 2023. Answer the following questions: (Do not add dollar sign; do not add comma to your amount round the answer to the whole number) 1. How much of Lavender's $400,000 payment for Castro attributable to goodwill [a] 2. What amount should Lavender report for it Equity in Castro Earnings on its income statement for year 2022? [b] 3. What amount should Lavender report for its Investment in Castro on its balance sheet at the end of 2022? [e] Specified Antun