Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QS 12-7 (Algo) Indirect: Computing cash from operations LO P2 A comparative balance sheet and income statement is shown for Cruz, Incorporated. CRUZ, INCORPORATED Comparative

QS 12-7 (Algo) Indirect: Computing cash from operations LO P2

A comparative balance sheet and income statement is shown for Cruz, Incorporated.

| CRUZ, INCORPORATED | ||

|---|---|---|

| Comparative Balance Sheets | ||

| At December 31 | 2021 | 2020 |

| Assets | ||

| Cash | $ 62,800 | $ 15,700 |

| Accounts receivable, net | 27,000 | 33,300 |

| Inventory | 56,600 | 62,500 |

| Prepaid expenses | 3,500 | 2,900 |

| Total current assets | 149,900 | 114,400 |

| Furniture | 70,500 | 82,200 |

| Accumulated depreciationFurniture | (10,900) | (6,200) |

| Total assets | $ 209,500 | $ 190,400 |

| Liabilities and Equity | ||

| Accounts payable | $ 9,900 | $ 14,000 |

| Wages payable | 5,900 | 3,300 |

| Income taxes payable | 1,000 | 1,800 |

| Total current liabilities | 16,800 | 19,100 |

| Notes payable (long-term) | 20,700 | 47,800 |

| Total liabilities | 37,500 | 66,900 |

| Equity | ||

| Common stock, $5 par value | 150,000 | 121,000 |

| Retained earnings | 22,000 | 2,500 |

| Total liabilities and equity | $ 209,500 | $ 190,400 |

| CRUZ, INCORPORATED | |

|---|---|

| Income Statement | |

| For Year Ended December 31, 2021 | |

| Sales | $ 326,000 |

| Cost of goods sold | 209,800 |

| Gross profit | 116,200 |

| Operating expenses (excluding depreciation) | 59,500 |

| Depreciation expense | 25,100 |

| Income before taxes | 31,600 |

| Income taxes expense | 11,500 |

| Net income | $ 20,100 |

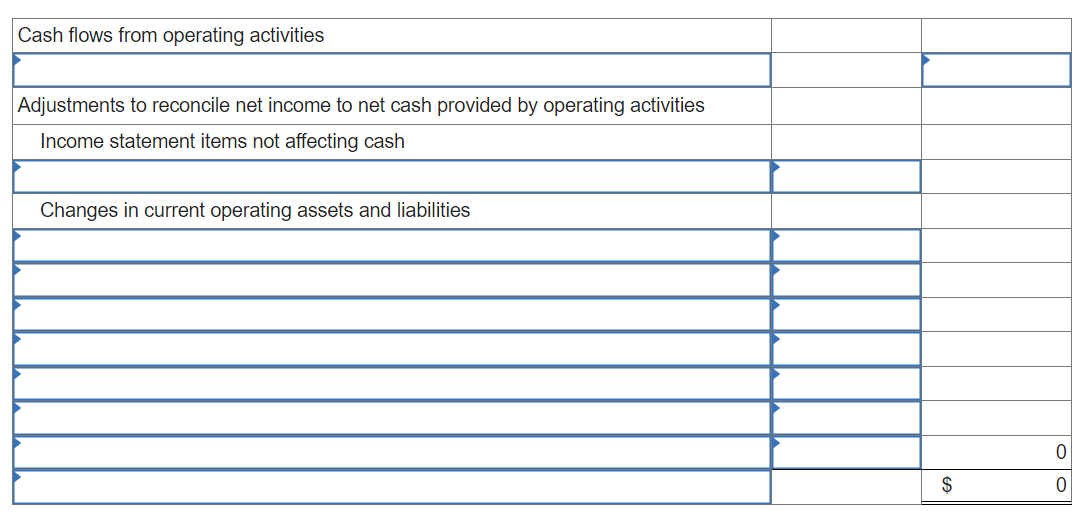

Use the indirect method to prepare the operating activities section of Cruzs statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started