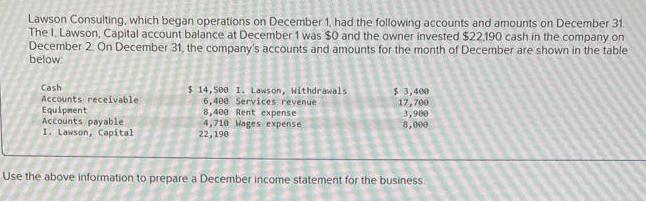

Lawson Consulting, which began operations on December 1, had the following accounts and amounts on December 31. The I. Lawson, Capital account balance at

Lawson Consulting, which began operations on December 1, had the following accounts and amounts on December 31. The I. Lawson, Capital account balance at December 1 was $0 and the owner invested $22.190 cash in the company on December 2. On December 31, the company's accounts and amounts for the month of December are shown in the table below: Cash Accounts receivable Equipment Accounts payable I. Lawson, Capital $ 14,500 1. Lawson, withdrawals 6,400 Services revenue 8,400 Rent expense 4,710 Hages expense 22,190 $ 3,400 17,700 3,900 8,000 Use the above information to prepare a December income statement for the business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare an income statement for Lawson Consulting based on the given information we n...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started