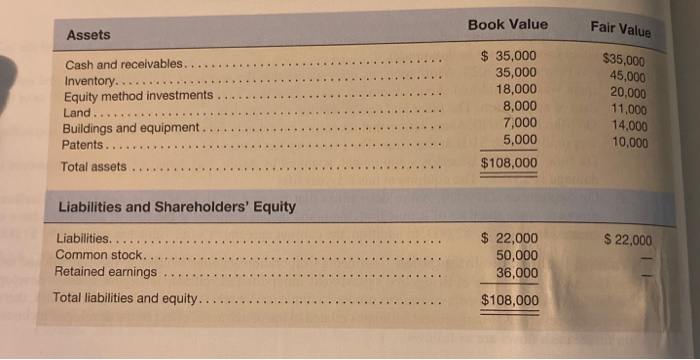

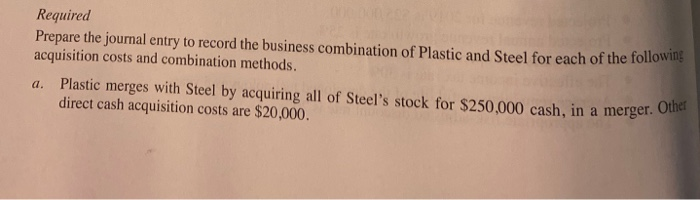

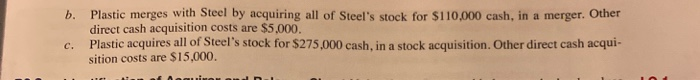

LC FL Acquisition with Stock Options In December 2013, FireEye, Inc. acquired all of the outstand- ing shares of privately held Mandiant Corporation, a provider of computer security products, for $106,538,000 in cash and 16,921,000 shares of Fire Eye common stock with a fair value of $704,414,000 and a par value of $0.0001/share. In addition, Mandiant's existing vested stock option and restricted stock awards were converted to awards denominated in FireEye stock, in the amount of 6,680,000 shares with a fair value of $86,703,000. These awards have the same terms as when they were issued by Mandiant. FireEye estimates that unvested equity awards relating to post combination services have a current fair value of $122,600,000. Out-of-pocket acquisition-related costs were $8,500,000. The following table summarizes the date-of-acquisition fair values of the identifiable net assets acquired. Book Value Fair Value Assets ..... Cash and receivables. Inventory... Equity method investments Land.... Buildings and equipment. Patents... Total assets $ 35,000 35,000 18,000 8,000 7,000 5,000 $108,000 $35,000 45,000 20,000 11,000 14,000 10,000 Liabilities and Shareholders' Equity $ 22,000 Liabilities... Common stock. Retained earnings Total liabilities and equity. $ 22,000 50,000 36,000 $108,000 Required Prepare the journal entry to record the business combination of Plastic and Steel for each of the following acquisition costs and combination methods. Plastic merges with Steel by acquiring all of Steel's stock for $250,000 cash, in a merger. Other direct cash acquisition costs are $20,000. a. b. Plastic merges with Steel by acquiring all of Steel's stock for $110,000 cash, in a merger. Other direct cash acquisition costs are $5,000. Plastic acquires all of Steel's stock for $275,000 cash, in a stock acquisition. Other direct cash acqui- sition costs are $15,000. c. LC FL Acquisition with Stock Options In December 2013, FireEye, Inc. acquired all of the outstand- ing shares of privately held Mandiant Corporation, a provider of computer security products, for $106,538,000 in cash and 16,921,000 shares of Fire Eye common stock with a fair value of $704,414,000 and a par value of $0.0001/share. In addition, Mandiant's existing vested stock option and restricted stock awards were converted to awards denominated in FireEye stock, in the amount of 6,680,000 shares with a fair value of $86,703,000. These awards have the same terms as when they were issued by Mandiant. FireEye estimates that unvested equity awards relating to post combination services have a current fair value of $122,600,000. Out-of-pocket acquisition-related costs were $8,500,000. The following table summarizes the date-of-acquisition fair values of the identifiable net assets acquired. Book Value Fair Value Assets ..... Cash and receivables. Inventory... Equity method investments Land.... Buildings and equipment. Patents... Total assets $ 35,000 35,000 18,000 8,000 7,000 5,000 $108,000 $35,000 45,000 20,000 11,000 14,000 10,000 Liabilities and Shareholders' Equity $ 22,000 Liabilities... Common stock. Retained earnings Total liabilities and equity. $ 22,000 50,000 36,000 $108,000 Required Prepare the journal entry to record the business combination of Plastic and Steel for each of the following acquisition costs and combination methods. Plastic merges with Steel by acquiring all of Steel's stock for $250,000 cash, in a merger. Other direct cash acquisition costs are $20,000. a. b. Plastic merges with Steel by acquiring all of Steel's stock for $110,000 cash, in a merger. Other direct cash acquisition costs are $5,000. Plastic acquires all of Steel's stock for $275,000 cash, in a stock acquisition. Other direct cash acqui- sition costs are $15,000. c