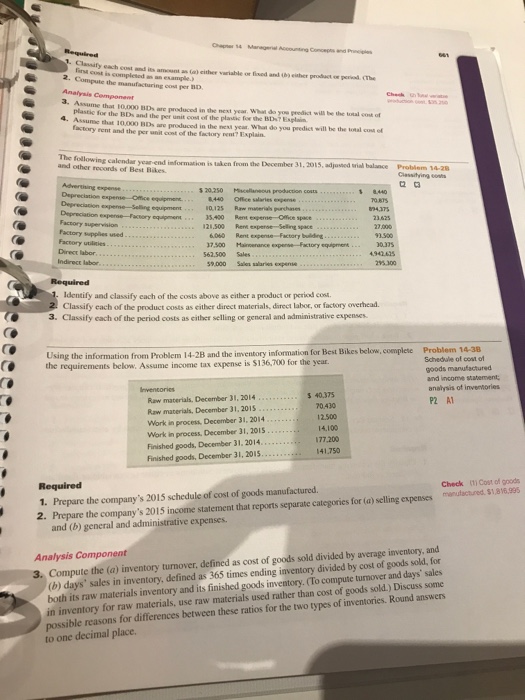

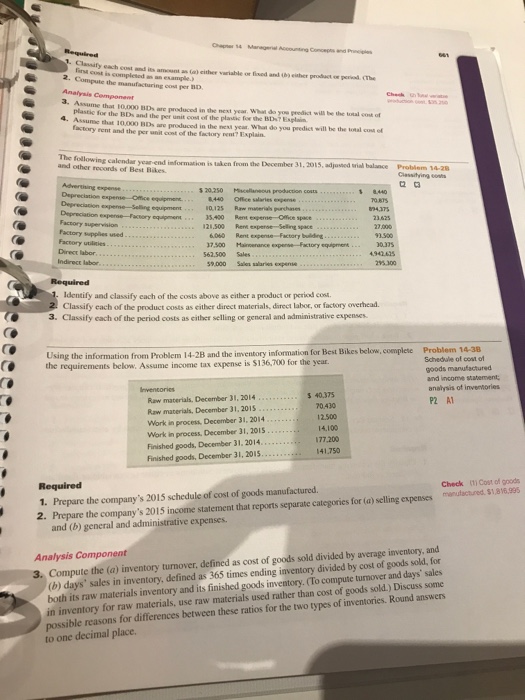

Problem 14-3b

Clanaify each cost and its amount as (a) cither variable or fixed and t) eisther product on perend T finsa cost is complesed an an eample 2. compute the manufacturing-per BD. plastic for the BDs and the per unit cost of the plastic for the BDs Esplan 4. Assume th.at 10,00 BDs aro proluced in the mi yea wh. do you peedict will be the unal com ed Iactory rent and the per unit cost of the factory rent? Explain. The following calendar year-end information is and other records of Best Bikes innom he Decemer 31, 2015,jused vrial balaseCrobdom 14-2 8440 0125 Raw maserias pourchanes 70.875 4,375 Depreciation experse-Facory equipment5.400 Rent expeme Office space Factory plies wed Direct labor 21,500 Ret experse Selling space 6.060 Rent expense Factory building 7,500 Maincenance experse-Factory equipmen30375 93.500 562.500 59.000 Identify and classify each of the costs above as either a product or period cos Classify each of the product costs as either direct materials, darect labor, or factory overhead 3. Classify each of the period costs as either selling or general and administrative expenses Using the information from Problem 14-2B and the inventory information for Best B ikes below, complete Problem 14-3B requirements below. Assume income tax expense is $136,700 for the year Schedule of cost of goods manufactured and income statement anahysis of inventories P2 A1 Raw materials, December 31, 2014 Raw materials, December 31, 201S work in process, December 31, 2014 work in process. December 31, 2015 40,375 70.430 12.500 14.100 177.200 41,750 Finished goods, December 31, 2015 Required 1. Prepare the company's 2015 schedule of cost of goods manufactured 2. Prepare the company's 2015 income statement that reports separate categories for (a) selling expenses Check 1) Cost of goods manufactured $1,8Y6.995 and (b) general and administrative expenses. Analysis Component Compute the (a) inventory turnover, defined as cost of goods (b) days' sales in inventory both its raw materials inventory and its finished goods i in inventory for raw materials, use raw materials used rasher than cost of goods sold.) Discuss some possible reasons for differences between these ratios for the two types of inventories. Round answers to one decimal place. sold divided by average inventory, and 65 times ending inventory divided by cost of goods sold, for (To compute turnover and days' sales y

Problem 14-3b

Problem 14-3b