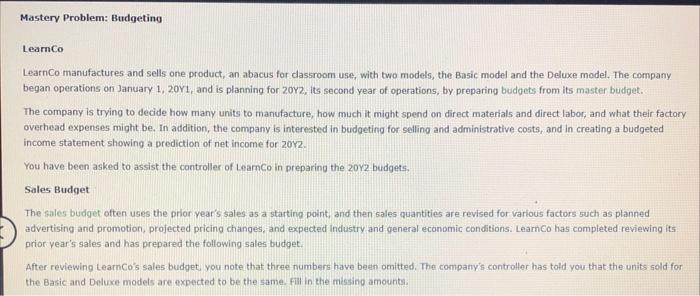

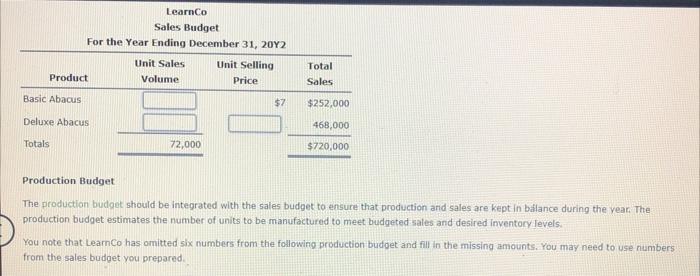

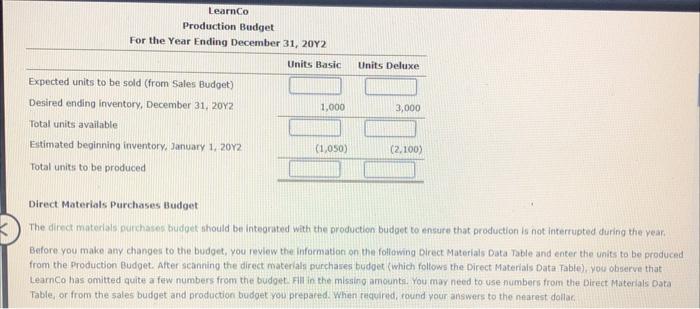

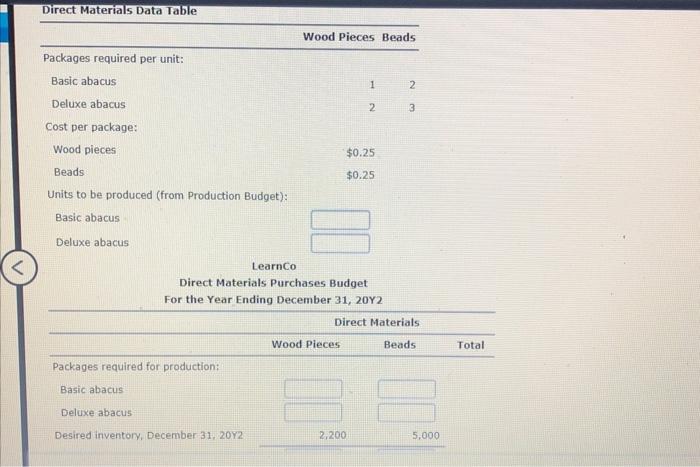

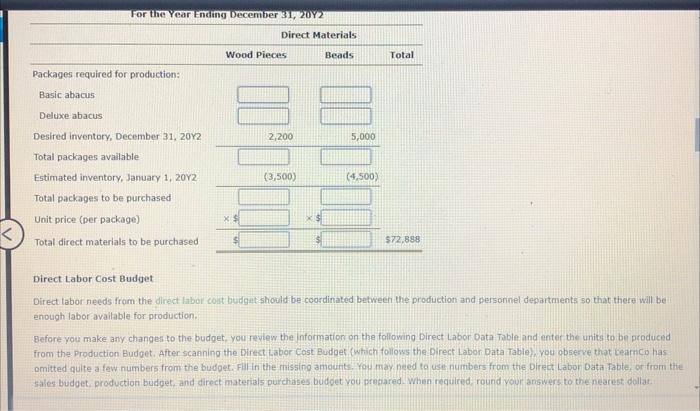

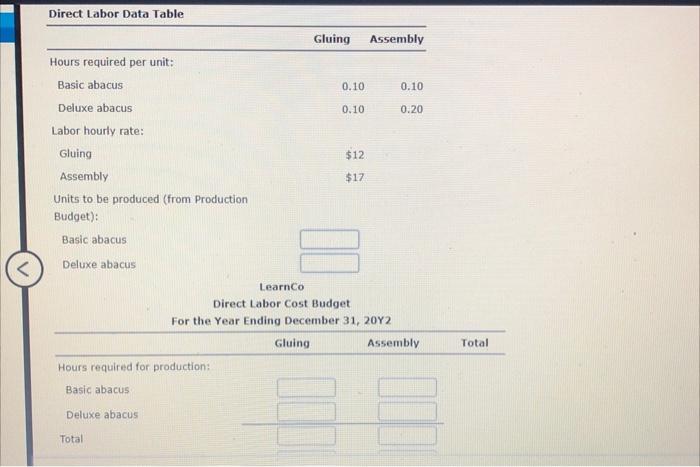

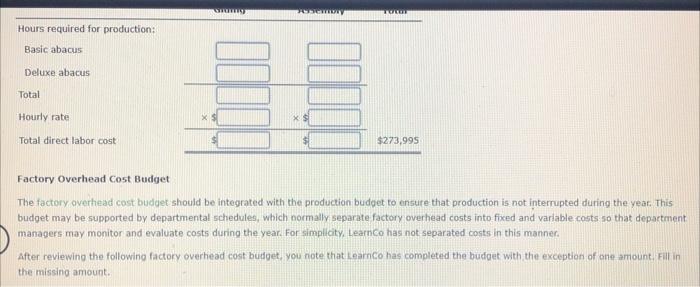

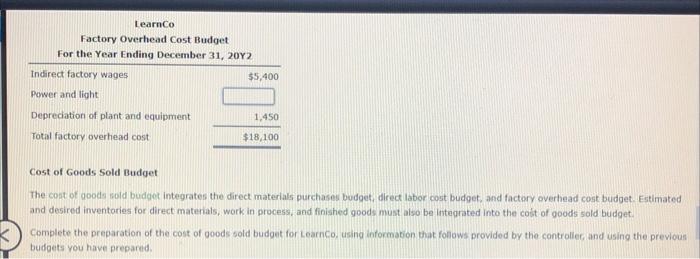

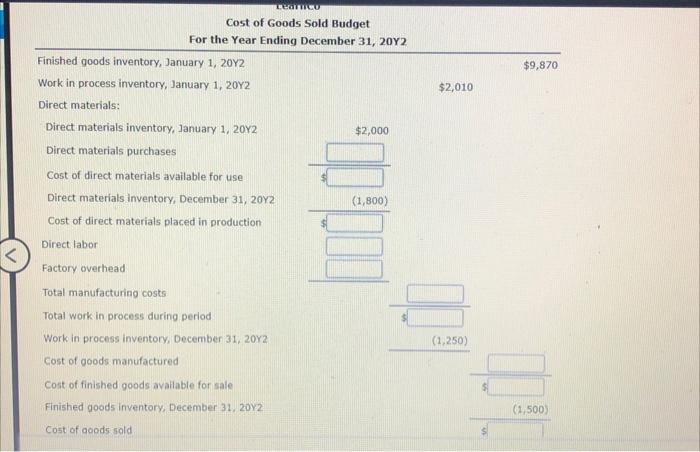

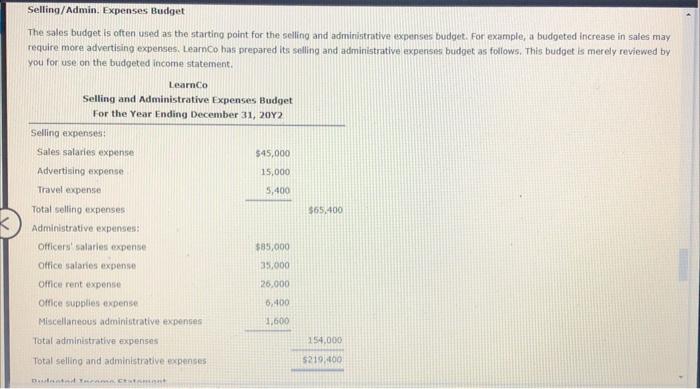

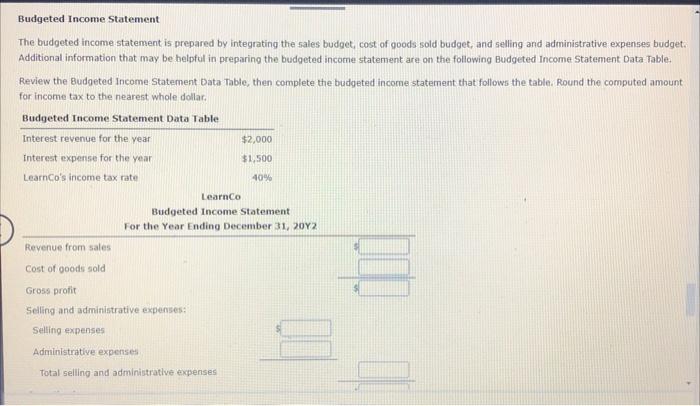

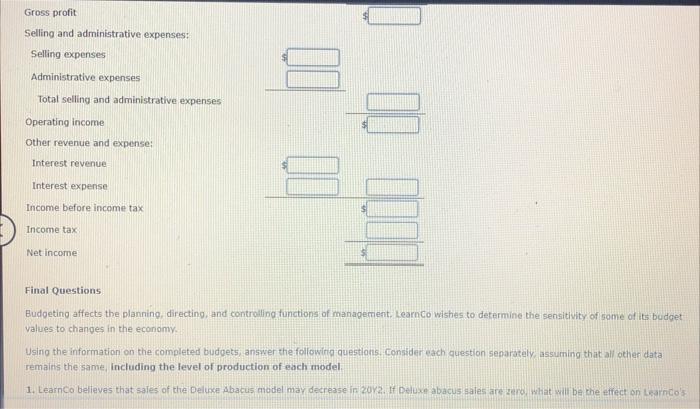

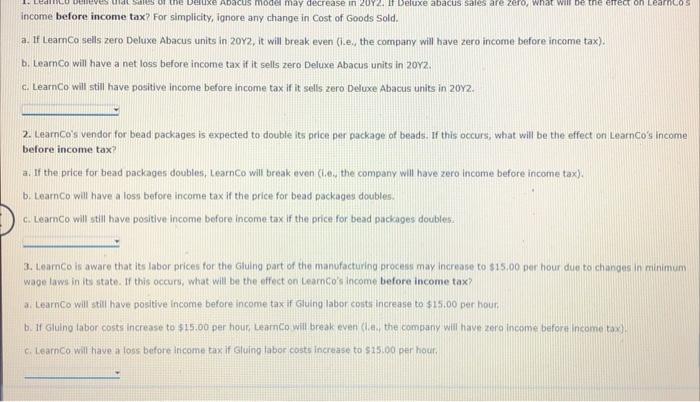

LearmCo LearnCo manufactures and sells one product, an abacus for dassroom use, with two models, the Basic model and the Deluxe model. The company began operations on January 1,20y1, and is planning for 20r2, its second year of operations, by preparing budgets from its master budget. The company is trying to decide how many units to manufacture, how much it might spend on direct materials and direct labor, and what their factory overhead expenses might be. In addition, the company is interested in budgeting for selling and administrative costs, and in creating a budgeted income statement showing a prediction of net income for 20Z. You have been asked to assist the controller of LeamCo in preparing the 20 2 budgets. Sales, Budget The sales budget often uses the prior year's sales as a starting point, and then sales quantities are revised for various factors such as planned advertising and promotion, projected pricing changes, and expected Industry and general economic conditions: LearnCo has completed reviewing its. prior:year's sales and has prepared the following sales budget. After reviewing LearnCo's sales budget, you note that three numbers have beqh omitted. The company's controller has told you that the units sold for. the Basic and Doluxe models are expected to be the same. Fill in the missing amounts. LearnCo Sales Budget For the Year Ending December 31,20Y2 Production Budget The production budget should be integrated with the sales budget to ensure that production and sales are kept in balance during the year The production budget estimates the number of units to be manufactured to meet budgeted sales and desired imventory levels. You note that LearnCo has omitted six numbers from the following production budget and fill in the missing amounts. You may need to use numbers from the sales budget you prepared. Direct Materials Purchases Budget The direct materials purchases budget should be inteorated with the production budget to ensure that production is not interrupted during the vear. Before you make any changes to the budget, you review the Information on the fotlowing Direct Materiais Data Table and enter the units to be produced from the Producton Budget. After scanning the direct materials purchases budoet (which follows the Direct Materias Data Fabie). you observe that LearnCo has omitted quite a few numbers from the budget. Fill in the missing amounte. You may need to-use numbers froin the Direct Materials Data Table, or from the sales budget and production budget you prepared. When required, round your answers to the nearest dollac. Direct Materials Data Table \begin{tabular}{lcc} \hline & Wood Pieces & Beads \\ \hline Packages required per unit: & 1 & 2 \\ Basic abacus & 2 & 3 \\ Deluxe abacus & & \\ Cost per package: & $0.25 \\ Wood pieces & $0.25 \end{tabular} Units to be produced (from Production Budget): Basic abacus Deluxe abacus LearnCo Direct Materials Purchases Budget For the Year Ending December 31, 20Y2 Direct Labor Cost Budget Direct labor needs from the direct labor coutbudgat should be coordinated between the production and sersoninel departments so that there will be enough labor available for production. Before you make any changes to the budget, you review the information on the following Birect Labor Oata Table and enter the units to be produced from the Production Budget. After scaaning the Direct Labor Cost Budger (which follows the Direct Labor Data Tabie) vou observe that cearici has omitted quite a few numbers from the budper. Flil in the rinssing ameunt. You mar need to usit numbers from the oirect Labor Data fabte. of from the salen budoet production budget, and direct materials purchases budpet vou prepared. When tequired, round your answers to the nearest dellat. Direct Labor Data Table Gluing Assembly Hours required per unit: Basic abacus 0.100.100.100.20 Deluxe abacus Labor hourly rate: Gluing Assembly $12. Units to be produced (from Production Budget): Basic abacus Deluxe abacus LearnCo Direct Labor Cost Budget For the Year Ending December 31, 20 Y2 Hours required for production: Basic abacus Deluxe abacus Total Factory Overhead Cost Budget The factory overhead cost budget should be integrated with the production budget to ensure that production is not interrupted during the year. This budget may be supported by departmental schedules, which normally separate factory overhead costs into fixed and variable costs so that department managers may monitor and evaluate costs during the year. For simplicity, Learnco has not separated costs in this manner. After reviewing the following factory overhead cost budget, you note that Learnco has completed the budget with, the exception of one amount. Fill in the missing amount. Cost of Goods Sold Budget The cost of aoods sold budgot integrates the direct materials purchases budget, direct labor cost budget, and factory overhead cost budget. Eistimated and desired inventories for direct materials; work in process, and finished goods must also be inteprated into the coct of goods sold budget. Complete the preparation of the cost of goods sold budget for Learnco. using information that follows provided by the controlieci and using the previous budgets you have prepared. Cost of Goods Sold Budget For the Year Ending December 31, 20Y2. Finished goods inventory, January 1, 20Y2 Work in process inventory, January 1, 20Y2 $2,010 Direct materials: Direct materials inventory, January 1,20Y2 Direct materials purchases Cost of direct materials available for use Direct materials inventory, December 31, 20 Y2 Cost of direct materials placed in production Direct labor Factory overhead Total manufacturing costs Total work in process during period Work in process inventory, December 31, 2022 Cost of goods manufactured Cost of finished goods available for sale Finished goods inventory, December 31, 20Y2 Cost of aoods sold. Selling/Admin. Expenses Budget The sales budget is often used as the starting point for the selling and administrative expenses budget. For example, a budgeted increase in sales may require more advertising expenses, Learnco has-prepared its selling and administrative experses budget as follows. This budget is merely reviewed by you for use on the budgeted income statement. Budgeted Income Statement The budgeted income statement is prepared by integrating the sales budget, cost of goods sold budget, and selling and administrative expenses budget. Additional information that may be belpful in preparing the budgeted income statement are on the following Budgeted Income Statement Data Table. Review the Budgeted Income Statement Data Table, then complete the budgeted income statement that follows the table. Round the computed amount. for income tax to the nearent whole dollar. Budgeting affects the planning, directing, and controlling functions of management. Learnco wishes to determine the sensitlvity of same of its budget valuesto chandes in the economy. Using the information on the completed budoets, answer the followirig questions Fonsider each question separazely, assuming that all other data remains the same, including the level of production of each model. income before income tax? For simplicity, ignore any change in Cost of Goods Sold. a. If LeamCo sells zero Deluxe Abacus units in 20Y2, it will break even (i.e, the company will have zero income before income tax). b. Learnco will have a net loss before income tax if it sells zero Deluxe Abacus units in 20 2. C. Learnco will still have positive income before income tax if it sells zero Deluxe Abacus units in 20y2. 2. Learnco's vendor for bead packages is expected to double its price per package of beads. If this occurs, what will be the effect on Learnco's income before income tax? a. If the price for bead packages doubles, Learnco will break even (L. .4 the company will have zero income before income tax). b. Learnco will have a loss before income tax if the price for bead packages doubles.- c. LearnCo will still have positive income bofore income-tax if the price for bead paciages doubles. 3. Learnco is aware that its labor prices for the Gluing part of the manufacturing process may increase to $15,00 per hour due to changes in minimum wage laws in its state. If this occurs, what will be the effect on Learnco's income before income tax? a. Learnco Will still have positive income before income tax if Gluing labor costs increase to $15.00 per hour. b. If Gluino labor costs increase to $15.00 per houf Leamep will break even (i.t. the combany wiil have zera inceme befora income tax]. c. Learnco Will have a loss before income tax if sluing labor costs increase to $15.00 per houf