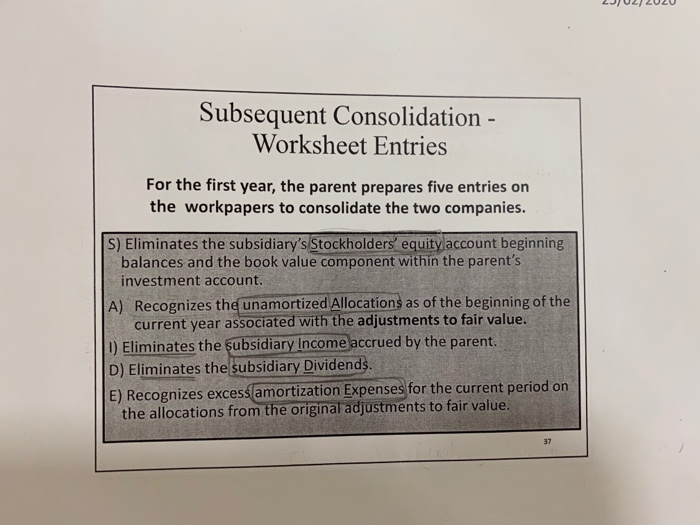

Learning Objective 7 Prepare consolidated financial statements subsequent to acquisition when the parent has applied in its internal records: a. the equity method. b. the initial value method. c. the partial equity method. Subsequent Consolidation - Equity Method During the year, the parent will adjust its investment account for the Subsidiary under application of the equity method. The original investment, recorded at the date of acquisition, is adjusted for: 1. FMV adjustments and other intangible assets, 2. The parent's share of the sub's income (loss), 3. The receipt of dividends from the sub. 2J02) 2020 Subsequent Consolidation - Worksheet Entries For the first year, the parent prepares five entries on the workpapers to consolidate the two companies. S) Eliminates the subsidiary's Stockholders' equity account beginning balances and the book value component within the parent's investment account. A) Recognizes the unamortized Allocations as of the beginning of the current year associated with the adjustments to fair value. 1) Eliminates the subsidiary Income accrued by the parent. D) Eliminates the subsidiary Dividends. E) Recognizes excess amortization Expenses for the current period on the allocations from the original adjustments to fair value, Applying the Initial Value Method The parent company can use the initial value method or the partial equity method for internal record-keeping. Application of either alternative changes the balances recorded by the parent over time and the consolidation process, but neither of these approaches affect any of the final consolidated balances reported. Just three parent's accounts vary because of the method applied: Investment account. Income recognized from the subsidiary. Parent's retained earnings (periods after year of combination), Applying the Initial Value Method If the Initial Value Method is used by the parent to account for the investment in the first year, the consolidation entries will change slightly. The parent will record the sub's activity differently under this method, so the accounts will differ from the Equity Method. 1. No adjustments are recorded in the Investment account for current year income, dividends paid by the subsidiary, or amortization of purchase price allocations. Dividends received from the subsidiary are recorded as Dividend Revenue. 2. Consolidation Entries - Initial Value Method Two entries for the initial value method are different than those for the equity method. Entry S is the same as the Equity Method. Entry A is the same as the Equity Method. Entry I is different using Initial Value Method: It eliminates the Parent's Dividend Income account and the Sub's Dividends Paid account. There is no Entry D. Entry E is the same as the Equity Method. Consolidation Entries - Partial Equity Method The same two entries differ for the Partial Equity Method. Entry S is the same as the Equity Method. Entry A is the same as the Equity Method. Entry 1 is different using Partial Equity Method: eliminates the Parent's equity in the sub's income and reduces the investment account. Entry D eliminates the dividend income account. Entry E is the same as the Equity Method. Consolidation Entries - Other than Equity Method Remember... Entries S, A, and E are the same for all three methods. The parent's record-keeping is limited to two periodic journal entries: annual accrual of subsidiary income and receipt of dividends. So, the Investment and Income account balances differ for the other methods, and so will the worksheet Entries I and D. Consolidation Entries - Subsequent Years Neither the Initial Value or Partial Equity Method provides a full- accrual-based measure of the subsidiary activities on the parent's income. The initial value method uses the cash basis for income recognition. The partial equity method only partially accrues subsidiary income. A new worksheet adjustment is needed to convert the parent's beginning of the year retained earnings balance to a full-accrual basis. Consolidation Entries - Subsequent Years For consolidation purposes, the beginning retained earnings account must be increased (Initial Value Method) or decreased (Partial Equity Method) to create the same effect as the equity method. Entry *C. The C refers to the Conversion being made to equity method (full accrual) totals. The asterisk indicates that this entry relates solely to transactions of prior periods. Entry *C should be recorded before other worksheet entries to align the beginning balances for the year. Consolidation Entries - Subsequent Years For consolidation purposes, the beginning retained earnings account must be increased (Initial Value Method) or decreased (Partial Equity Method) to create the same effect as the equity method. Entry *C. The C refers to the Conversion being made to equity method (full accrual) totals. The asterisk indicates that this entry relates solely to transactions of prior periods. Entry *C should be recorded before other worksheet entries to align the beginning balances for the year