Answered step by step

Verified Expert Solution

Question

1 Approved Answer

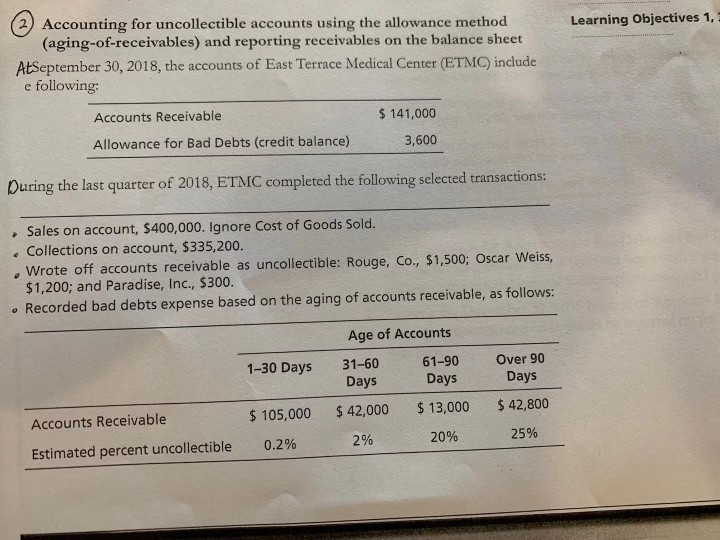

Learning Objectives 1 (2) Accounting for uncollectible accounts using the allowance method (aging-of-receivables) and reporting receivables on the balance sheet AtSeptember 30, 2018, the accounts

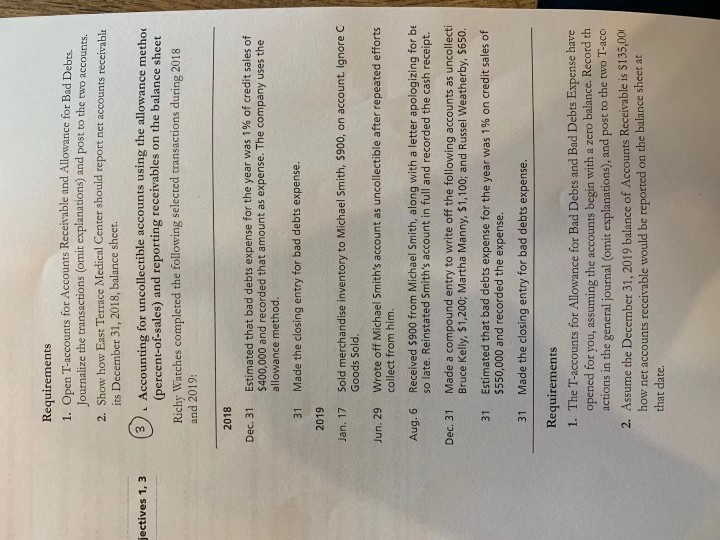

Learning Objectives 1 (2) Accounting for uncollectible accounts using the allowance method (aging-of-receivables) and reporting receivables on the balance sheet AtSeptember 30, 2018, the accounts of East Terrace Medical Center (ETMC) include e following: Accounts Receivable Allowance for Bad Debts (credit balance) $ 141,000 3,600 During the last quarter of 2018, ETMC completed the following selected transactions: Sales on account, $400,000. Ignore Cost of Goods Sold. . Collections on account, $335,200. . Wrote off accounts receivable as uncollectible: Rouge, Co., $1,500; Oscar Weiss, $1,200; and Paradise, Inc., $300. . Recorded bad debts expense based on the aging of accounts receivable, as follows: 1-30 Days Age of Accounts 31-60 61-90 Days Days $ 42,000 $13,000 2% 20% Over 90 Days $ 42,800 25% Accounts Receivable Estimated percent uncollectible $ 105,000 0.2% Requirements 1. Open T-accounts for Accounts Receivable and Allowance for Bad Debts. Journalize the transactions (omit explanations) and post to the two accounts. 2. Show how East Terrace Medical Center should report net accounts receivable its December 31, 2018, balance sheet. (3) Accounting for uncollectible accounts using the allowance method (percent-of-sales) and reporting receivables on the balance sheet Richy Watches completed the following selected transactions during 2018 and 2019: jectives 1,3 2018 Dec. 31 Estimated that bad debts expense for the year was 1% of credit sales of $400,000 and recorded that amount as expense. The company uses the allowance method. 31 Made the closing entry for bad debts expense. 2019 Jan. 17 Sold merchandise inventory to Michael Smith, 5900, on account. Ignore Goods Sold. Jun29 Wrote off Michael Smith's account as uncollectible after repeated efforts collect from him. Aug. 6 Received $900 from Michael Smith, along with a letter apologizing for be so late. Reinstated Smith's account in full and recorded the cash receipt. Dec 31 Made a compound entry to write off the following accounts as uncollecti Bruce Kelly, $1,200; Martha Manny, $1,100; and Russel Weatherby, $650. 31 Estimated that bad debts expense for the year was 1% on credit sales of $550,000 and recorded the expense. 31 Made the closing entry for bad debts expense. Requirements 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have opened for you, assuming the accounts begin with a zero balance. Record th actions in the general journal (omit explanations, and post to the two T-ace 2. Assume the December 31, 2019 balance of Accounts Receivable is $135,000 how net accounts receivable would be reported on the balance sheet at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started