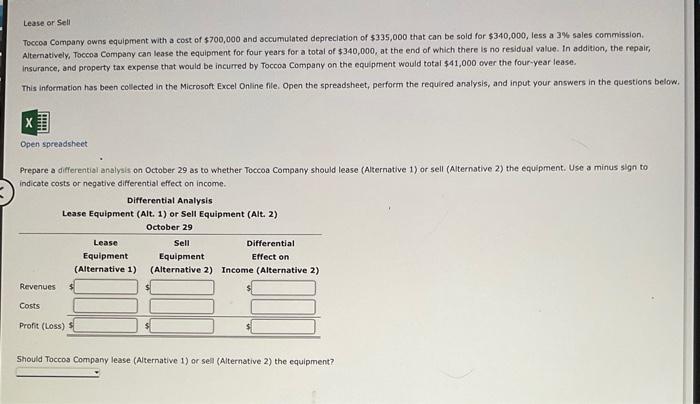

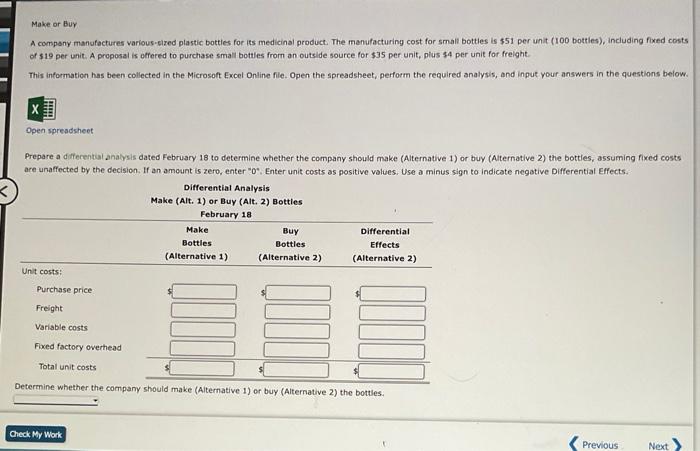

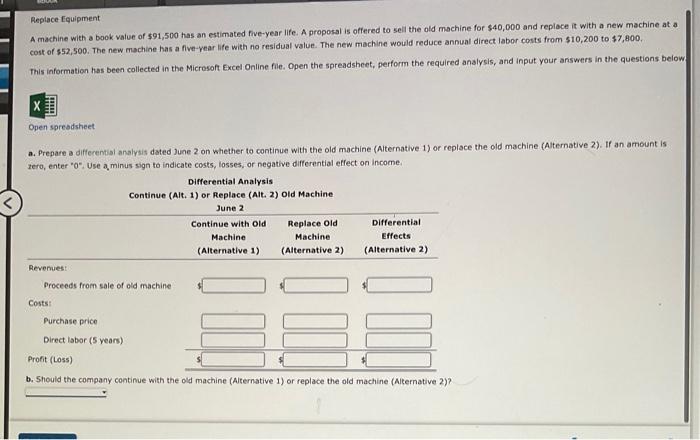

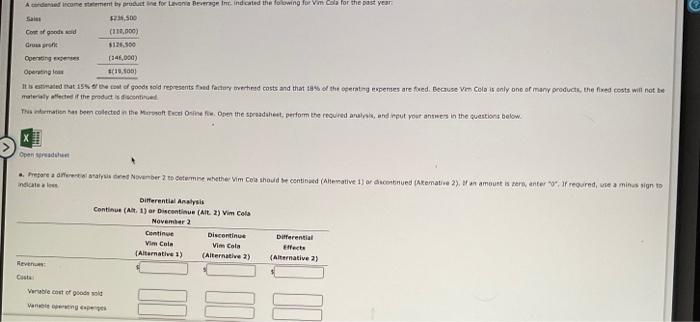

Lease or Sell Toccos Company owns equipment with a cost of $700,000 and accumulated depreciation of $335,000 that can be sold for $340,000, less a 3% sales commission. Alternatively, Toccos Company can lease the equipment for four years for a total of $340,000, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Toccos Company on the equilpment would total $41,000 over the four-year lease. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions belon Open spreadsheet Prepare a differential analysis on October 29 as to whether Toccoa Company should lease (Alternative 1) or sell (Alternative 2) the equipment. Use a minus sign to indicate costs or negative differential effect on income. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) ortaher 90 Should Toccos Company lease (Aiternative 1) or sea (Aiternative 2) the equipment? Make or Buy of $19 per unit. A proposal is otfered to purchase small bottles from an outside source for $35 per unit, plus $4 per unit for frelght. Open spreadsheet Prepare a differentul analysis dated February 18 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the bottles, assuming fixed costs are unaffected by the decision. If an amount is zero, enter " 0. Enter unit costs as positive values. Use a minus sign to indicate negative Differential Effects. Determine whether the company should make (Aiternative 1) or buy (Alternative 2) the bottles. Repiace Equipment A machine with a book value of $91,500 has an estimated five-year life. A proposal is offered to sell the old machine for $40,000 and reploce it with a new machine at a cost of 552,500 . The new machine has a flve-year life with no residual value. The new machine would reduce annual direct labor costs from 510,200 to $7,800. This information has been collected in the Microsof Excel Online file. Open the spreadshect, perform the required analysis, and input your ariswers in the questions beloy Open spresdsheet a. Prepare a differential analysis dated June 2 on whether to continue with the old machine (Alternative 1 ) or replace the old machine (Alternative 2 ). If an amount is zero, enter " 0 ", Use as minus sign to indicate costs, losses, or negative differential effect on income. b. Should the company contimue with the old machine (Alternative 1) or replace the old machine (Alternative 2)? Gpenthisuduent nekcale i lowe materimly athent if the propuct is dscontinued