Leased Assets

Koffman and Sons signed a four-year lease for a forklift on January 1, 2017. Annual lease payments of $1,278, based on an interest rate of 6%, are to be made every December 31, beginning with December 31, 2017.

PV of Annuity of $1

Required:

Refer to the table above for present value factors.

Question Content Area

1. Assume that the lease is treated as an operating lease.

a. Will the value of the forklift appear on Koffman's balance sheet?

No

b. What account will indicate that lease payments have been made?

Lease expense

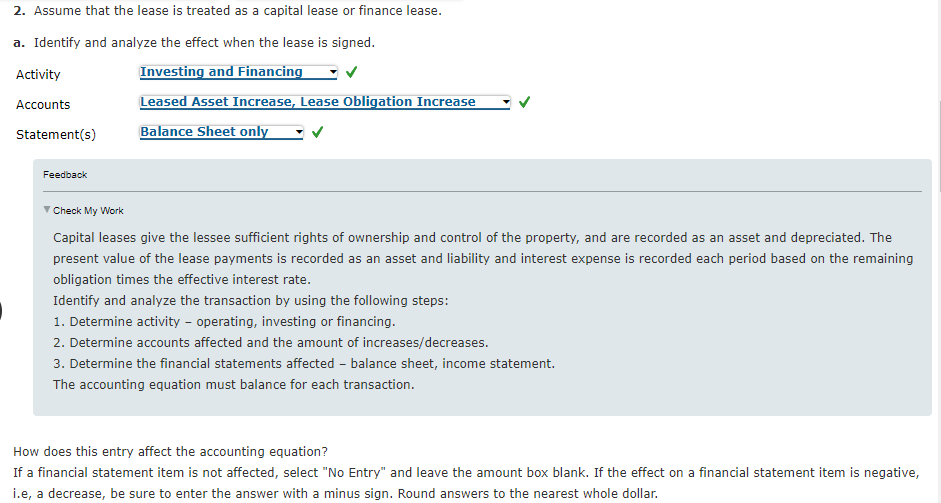

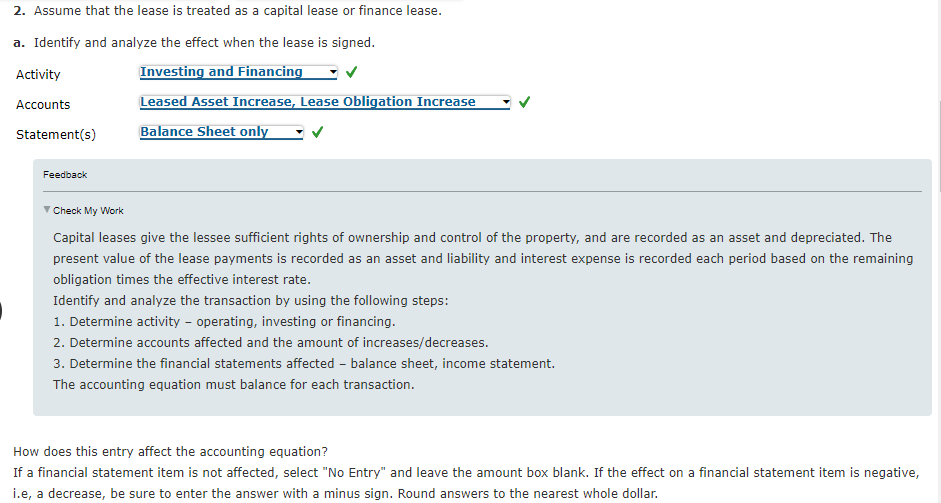

2. Assume that the lease is treated as a capital lease or finance lease.

a. Identify and analyze the effect when the lease is signed.

| Activity | Investing and Financing |

| Accounts | Leased Asset Increase, Lease Obligation Increase |

| Statement(s) | Balance Sheet only |

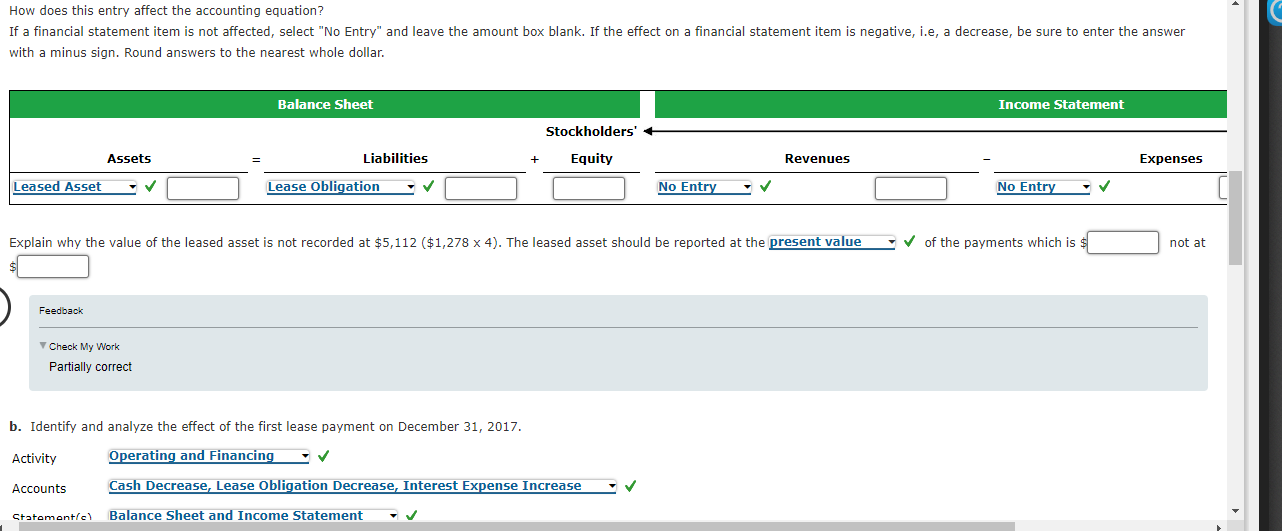

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar.

Explain why the value of the leased asset is not recorded at $5,112 ($1,278 x 4). The leased asset should be reported at the Present Value

of the payments which is $_______ not at $_____

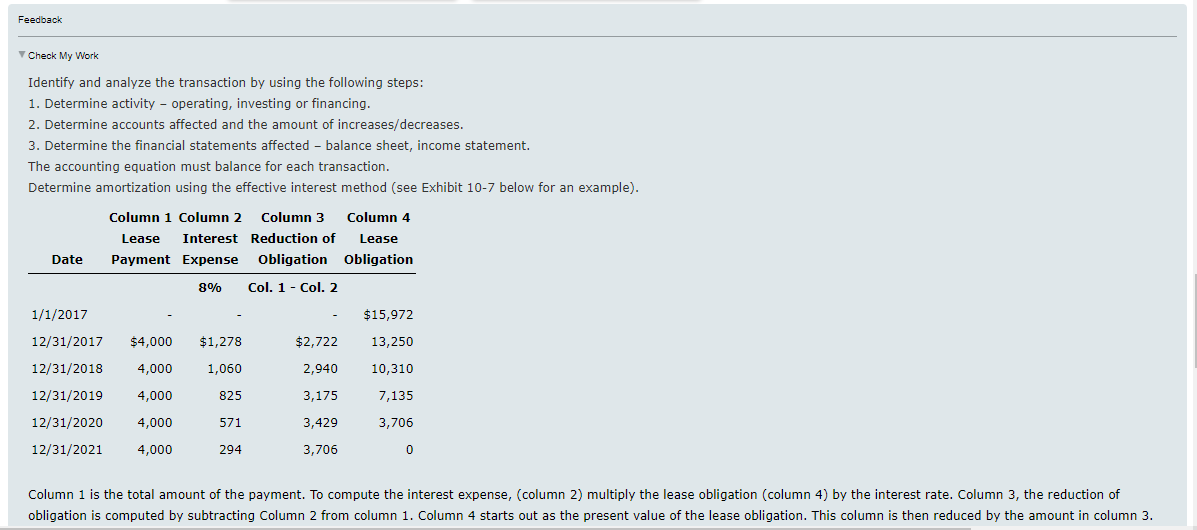

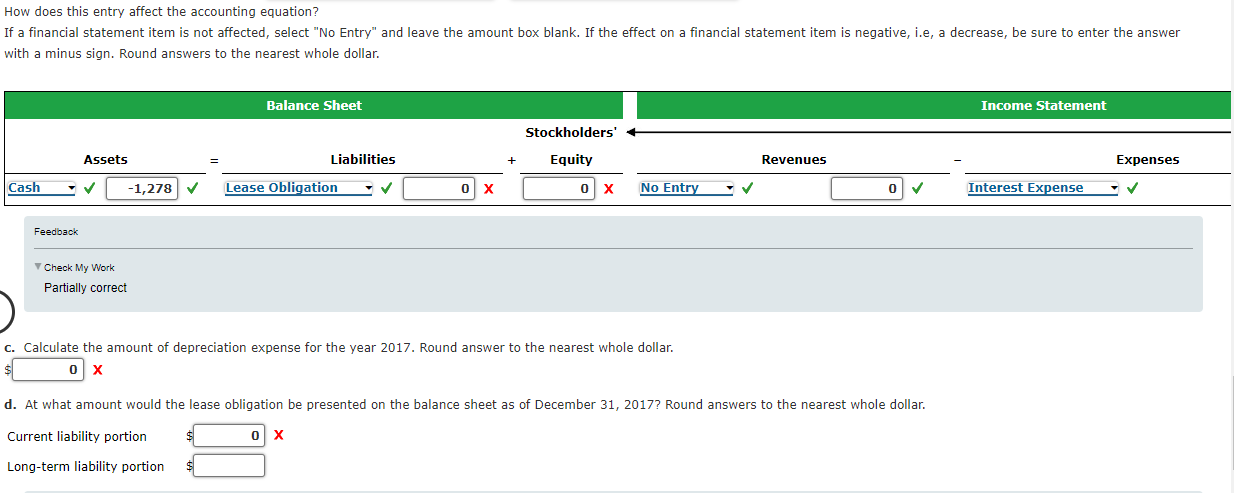

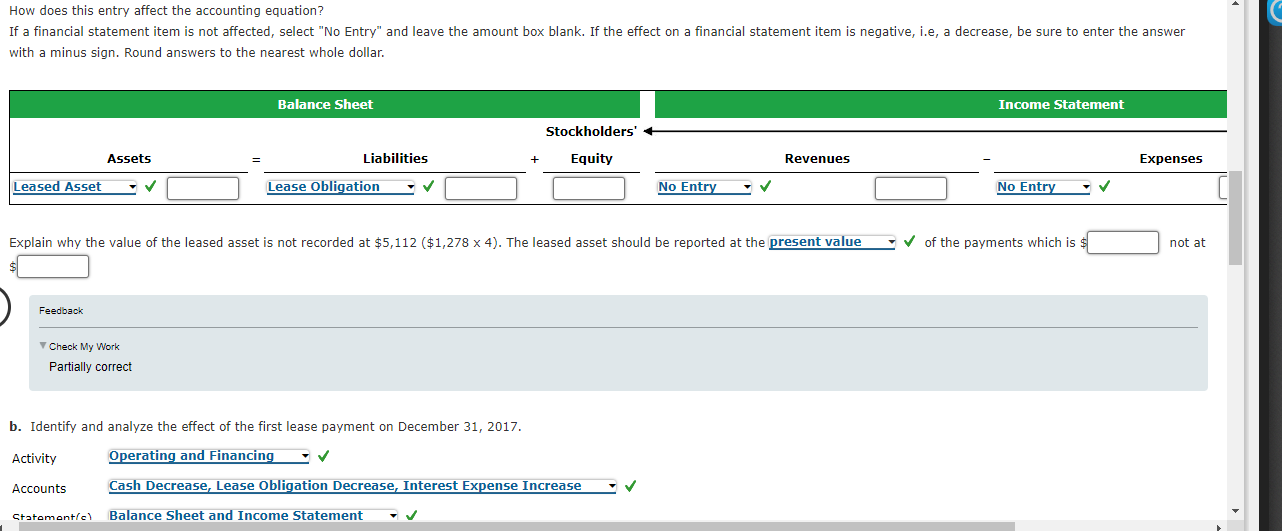

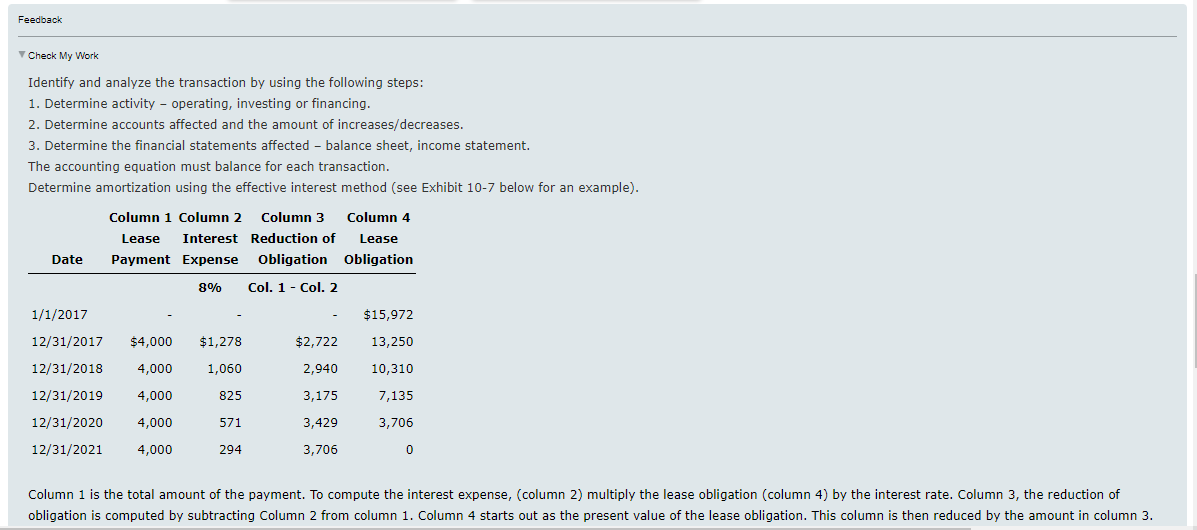

b. Identify and analyze the effect of the first lease payment on December 31, 2017.

| Activity | Operating and Financing |

| Accounts | Cash Decrease, Lease Obligation Decrease, Interest Expense Decrease |

| Statement(s) | Balance Sheet and Income Statement |

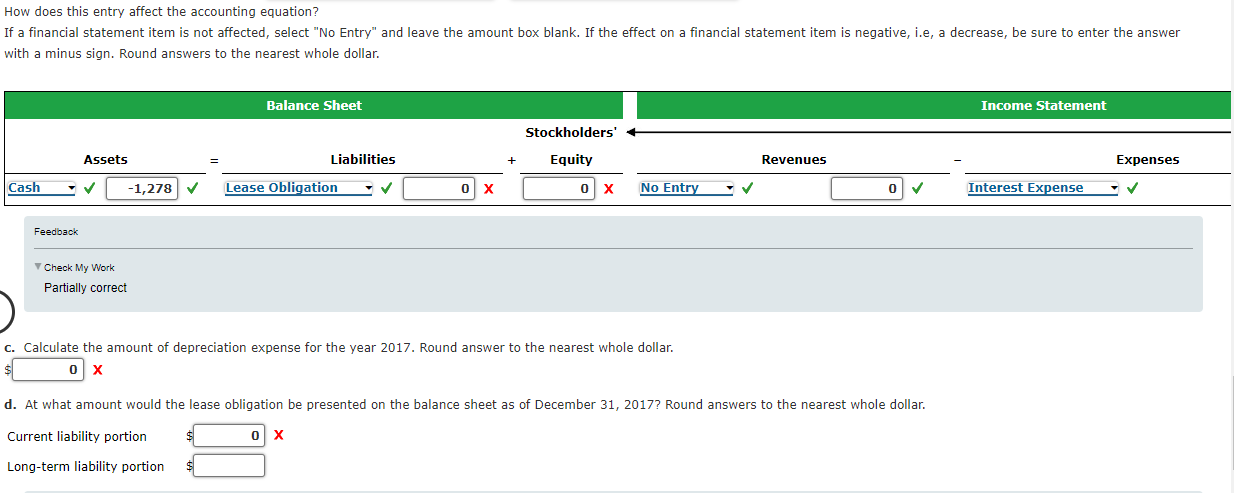

How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar.

c. Calculate the amount of depreciation expense for the year 2017. Round answer to the nearest whole dollar. $____

d. At what amount would the lease obligation be presented on the balance sheet as of December 31, 2017? Round answers to the nearest whole dollar.

| Current liability portion | $___ |

| Long-term liability portion | $____     |

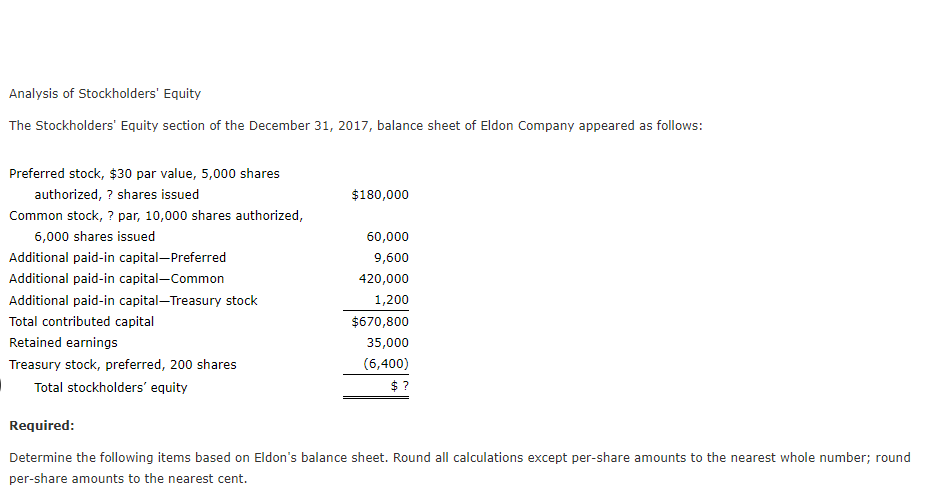

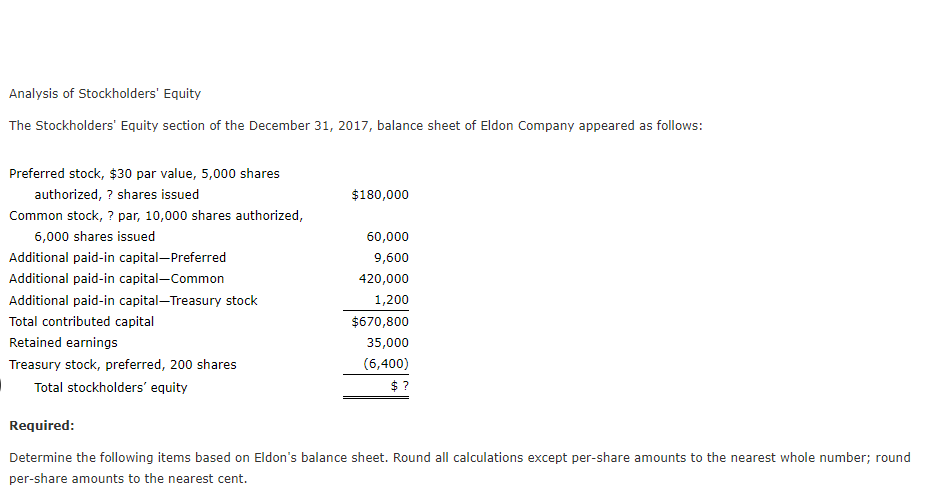

Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance sheet of Eldon Company appeared as follows: Required: Determine the following items based on Eldon's balance sheet. Round all calculations except per-share amounts to the nearest whole number; round per-share amounts to the nearest cent. 2. Assume that the lease is treated as a capital lease or finance lease. a. Identify and analyze the effect when the lease is signed. Activity Accounts Leased Asset Increase, Lease Obligation Increase Statement(s) Feedback Check My Work Capital leases give the lessee sufficient rights of ownership and control of the property, and are recorded as an asset and depreciated. The present value of the lease payments is recorded as an asset and liability and interest expense is recorded each period based on the remaining obligation times the effective interest rate. Identify and analyze the transaction by using the following steps: 1. Determine activity - operating, investing or financing. 2. Determine accounts affected and the amount of increases/decreases. 3. Determine the financial statements affected - balance sheet, income statement. The accounting equation must balance for each transaction. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. How does this entry affect the accounting equation? with a minus sign. Round answers to the nearest whole dollar. Explain why the value of the leased asset is not recorded at $5,112($1,2784). The leased asset should be reported at the of the payments which is $ not at $ Feedback v Check My Work Partially correct b. Identify and analyze the effect of the first lease payment on December 31, 2017. Activity Accounts Cash Decrease, Lease Obligation Decrease, Interest I V Check My Work Identify and analyze the transaction by using the following steps: 1. Determine activity - operating, investing or financing. 2. Determine accounts affected and the amount of increases/decreases. 3. Determine the financial statements affected - balance sheet, income statement. The accounting equation must balance for each transaction. Determine amortization using the effective interest method (see Exhibit 10-7 below for an example). How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. Feedback Check My Work Partially correct c. Calculate the amount of depreciation expense for the year 2017. Round answer to the nearest whole dollar. X d. At what amount would the lease obligation be presented on the balance sheet as of December 31,2017 ? Round answers to the nearest whole dollar. Current liability portion $X Long-term liability portion $ Analysis of Stockholders' Equity The Stockholders' Equity section of the December 31, 2017, balance sheet of Eldon Company appeared as follows: Required: Determine the following items based on Eldon's balance sheet. Round all calculations except per-share amounts to the nearest whole number; round per-share amounts to the nearest cent. 2. Assume that the lease is treated as a capital lease or finance lease. a. Identify and analyze the effect when the lease is signed. Activity Accounts Leased Asset Increase, Lease Obligation Increase Statement(s) Feedback Check My Work Capital leases give the lessee sufficient rights of ownership and control of the property, and are recorded as an asset and depreciated. The present value of the lease payments is recorded as an asset and liability and interest expense is recorded each period based on the remaining obligation times the effective interest rate. Identify and analyze the transaction by using the following steps: 1. Determine activity - operating, investing or financing. 2. Determine accounts affected and the amount of increases/decreases. 3. Determine the financial statements affected - balance sheet, income statement. The accounting equation must balance for each transaction. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. How does this entry affect the accounting equation? with a minus sign. Round answers to the nearest whole dollar. Explain why the value of the leased asset is not recorded at $5,112($1,2784). The leased asset should be reported at the of the payments which is $ not at $ Feedback v Check My Work Partially correct b. Identify and analyze the effect of the first lease payment on December 31, 2017. Activity Accounts Cash Decrease, Lease Obligation Decrease, Interest I V Check My Work Identify and analyze the transaction by using the following steps: 1. Determine activity - operating, investing or financing. 2. Determine accounts affected and the amount of increases/decreases. 3. Determine the financial statements affected - balance sheet, income statement. The accounting equation must balance for each transaction. Determine amortization using the effective interest method (see Exhibit 10-7 below for an example). How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Round answers to the nearest whole dollar. Feedback Check My Work Partially correct c. Calculate the amount of depreciation expense for the year 2017. Round answer to the nearest whole dollar. X d. At what amount would the lease obligation be presented on the balance sheet as of December 31,2017 ? Round answers to the nearest whole dollar. Current liability portion $X Long-term liability portion $