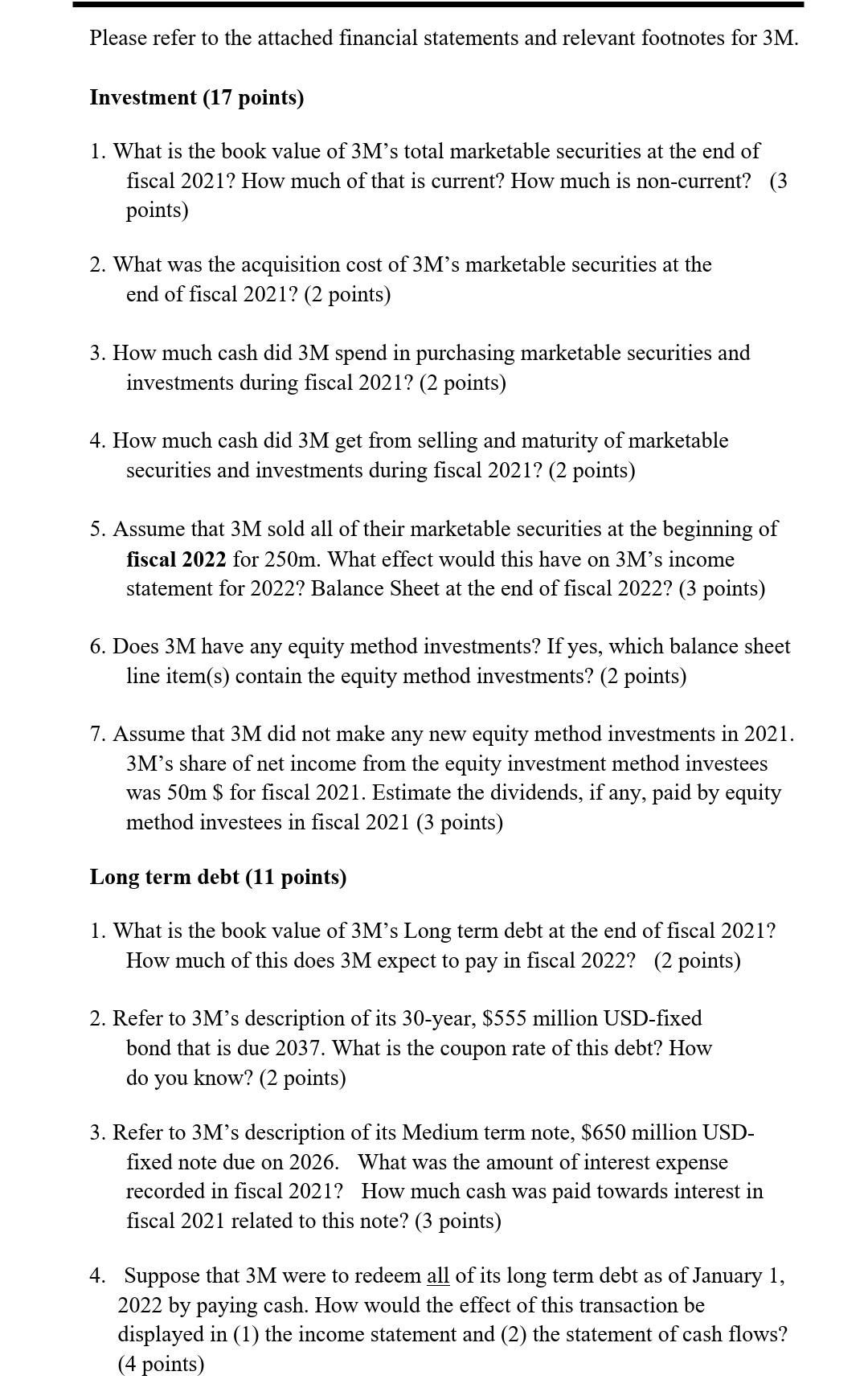

Question

Leases (17 points) 1. As of the end of 2021, what is 3Ms obligation (i.e., the balance sheet amount) on its capital (finance) leases? How

Leases (17 points)

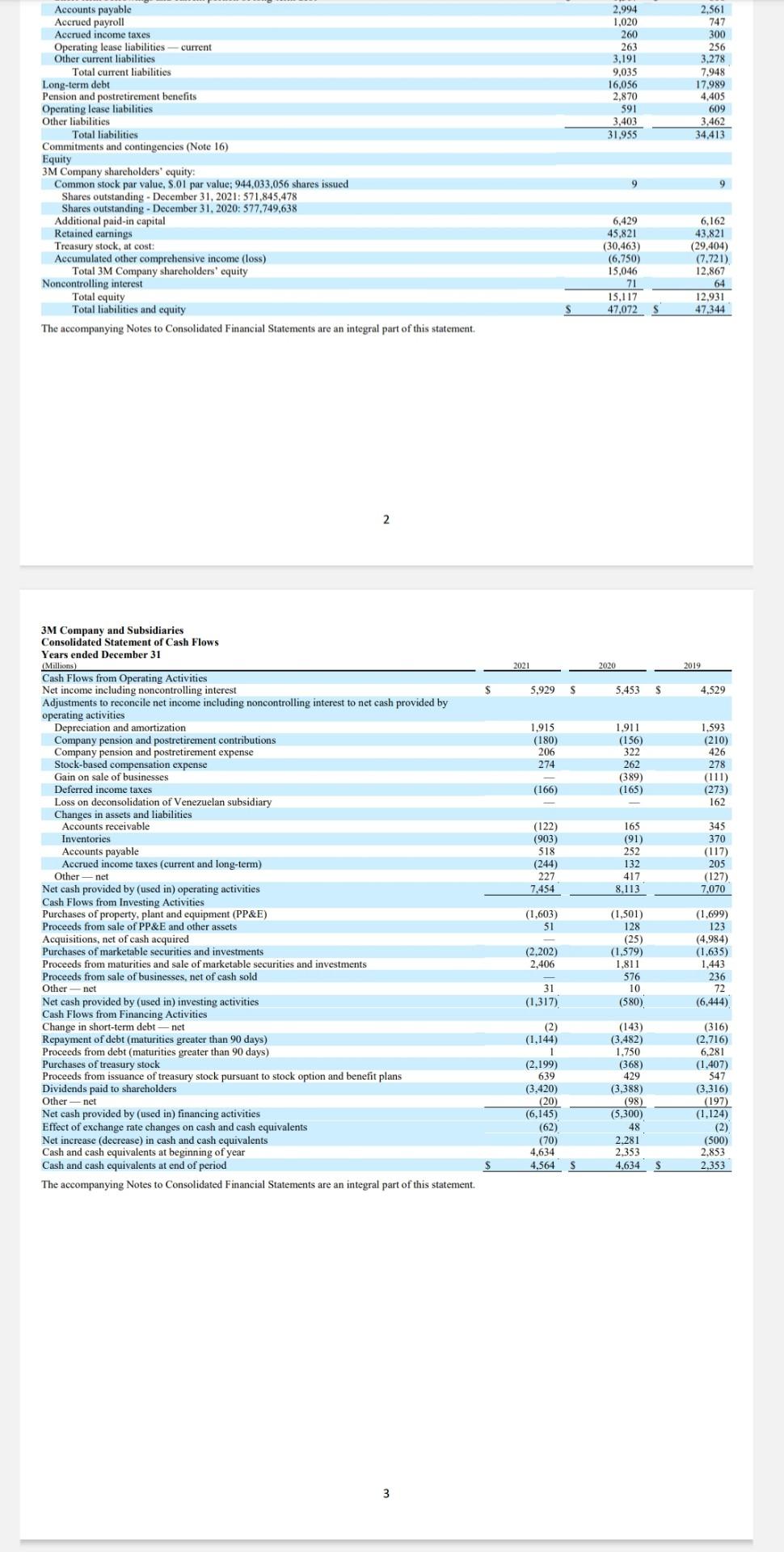

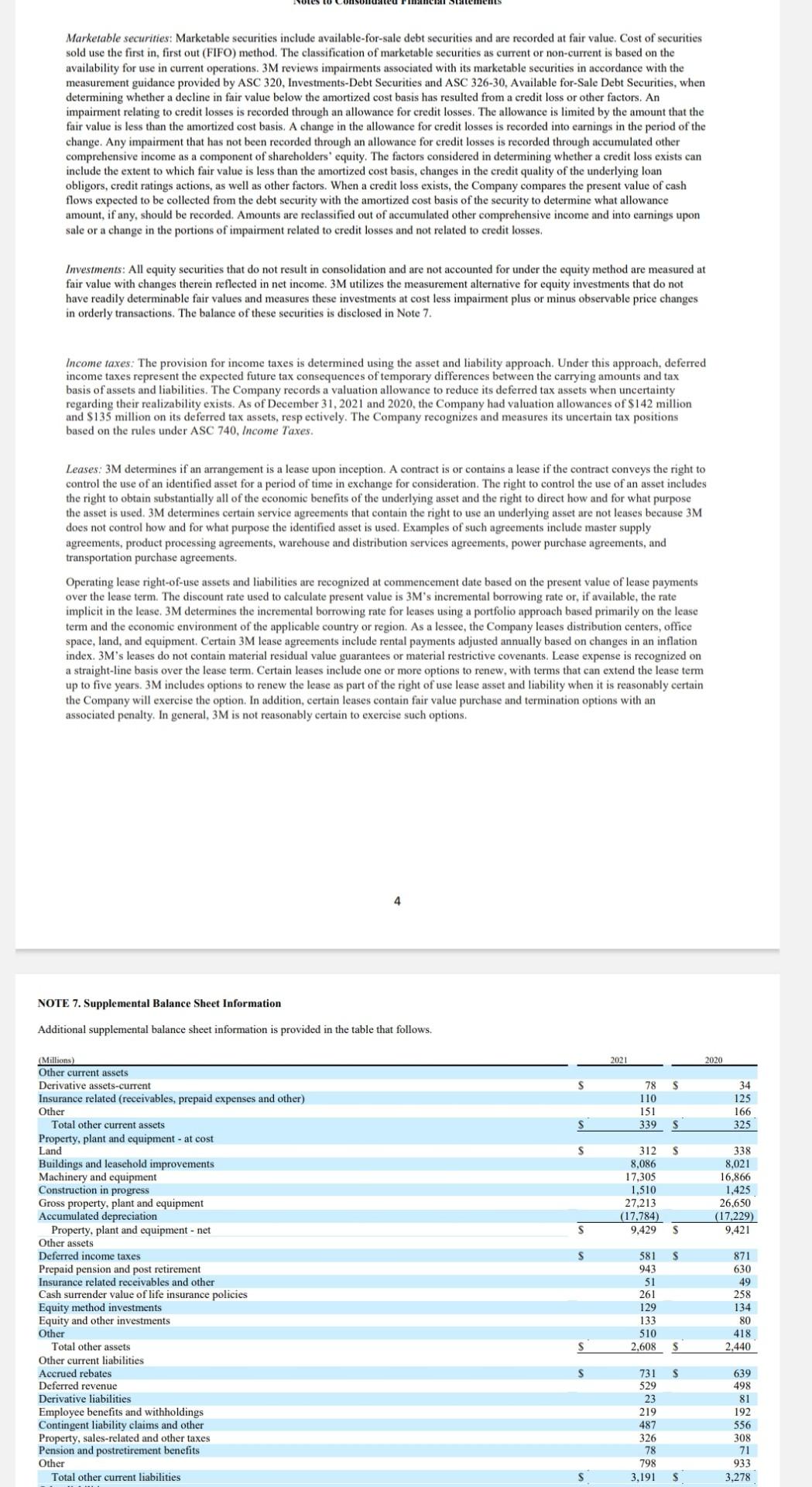

1. As of the end of 2021, what is 3Ms obligation (i.e., the balance sheet amount) on its capital (finance) leases? How much of this amount is due in 2022? Where (in what balance sheet account or accounts) does 3M display its long-term obligations on its capital leases? (3 points)

2. As of the end of 2021, what is the gross value of 3Ms capital (finance) lease assets and what is the net book value? Where (in what balance sheet accounts) are these amounts displayed? (3 points)

3. In fiscal 2022, how much will 3M pay for its capital (finance) leases? Of this amount, how much is principal and how much is interest? (3 points)

4. What is the approximate effective interest rate on 3Ms capital (finance) leases? (2 points)

5. Suppose on the last day of fiscal 2021, 3M switched back to the old lease accounting standard, what would be the effect on 3Ms Total Assets at the end of fiscal 2021? Effect on Total Liabilities at the end of fiscal 2021? Effect on Income Statement for fiscal 2021? Please be specific as to amounts. (6 points)

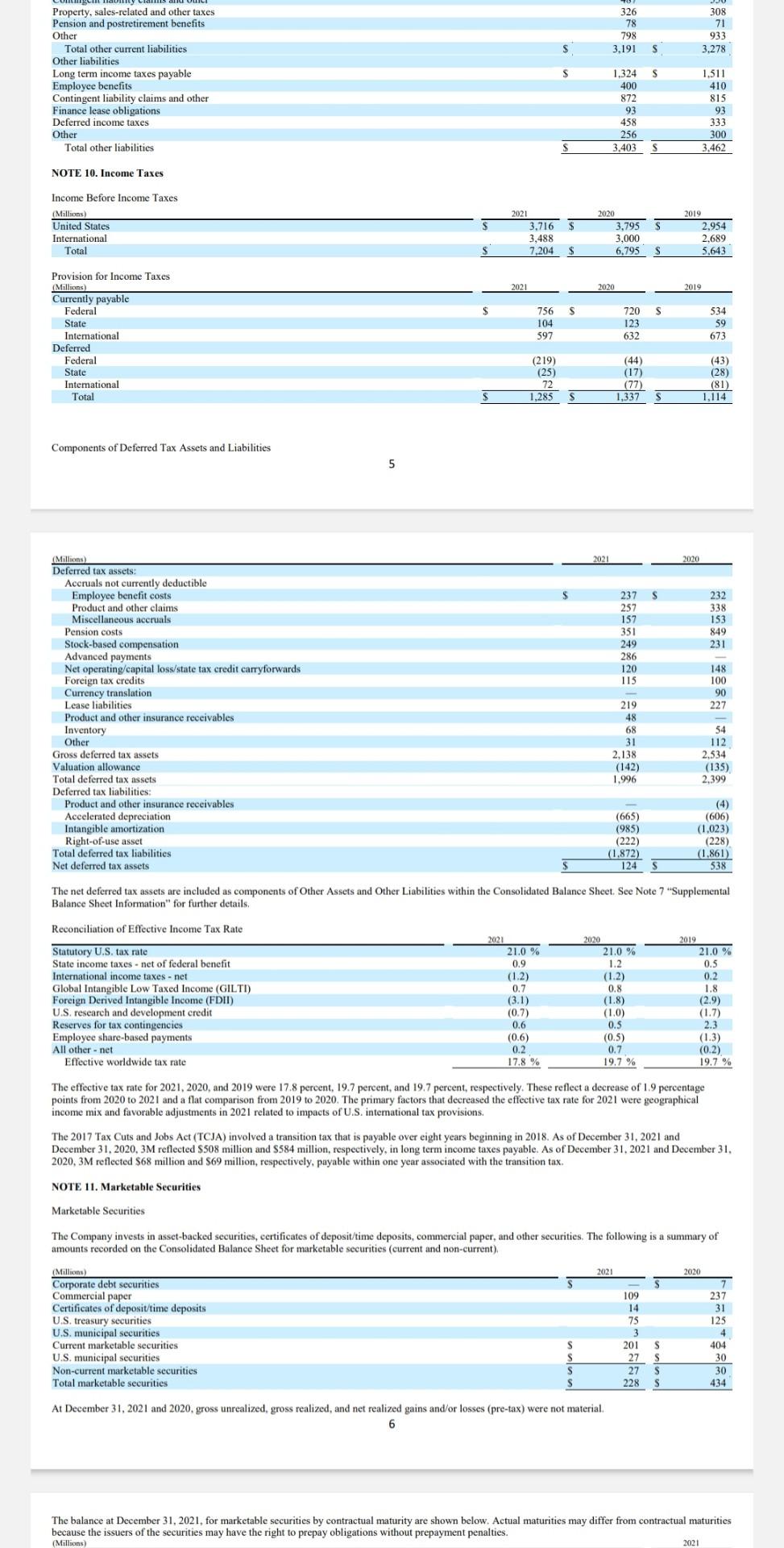

Income taxes (15 points)

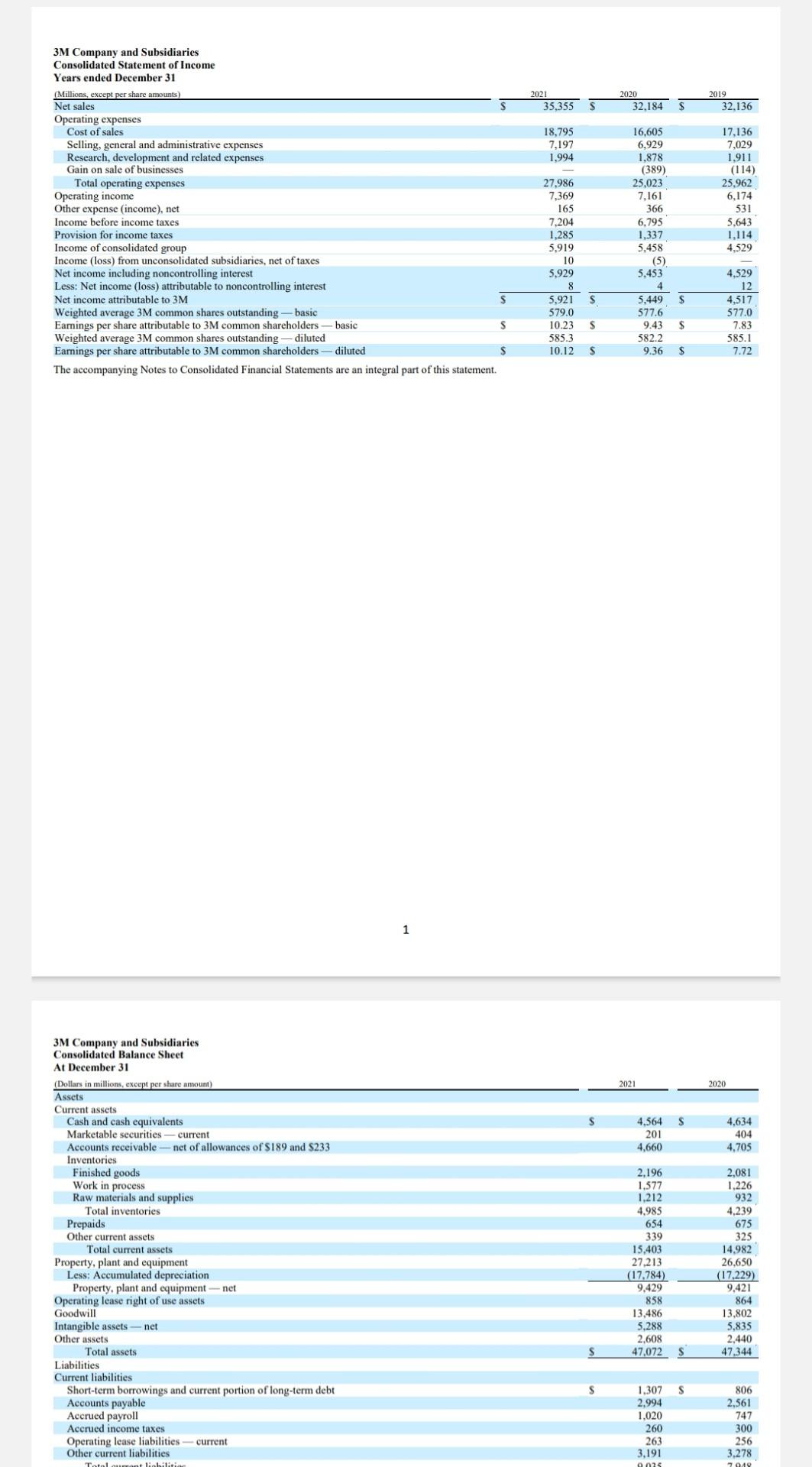

1. What is 3Ms 2021 effective tax rate as stated in the footnotes? Verify that this is correct by computing the same using the financial statements. (2 points)

2. What is the amount that 3M record as its 2021 provision for income taxes? Of this amount, how much is the current portion payable to the tax authorities? (6 points)

3. At the end of fiscal 2021, does 3M have a net deferred tax asset position or a net deferred tax liability position? What is the amount? Where (that is, in what balance sheet accounts) is the net tax position displayed? (4 points)

4. 3M operates in multiple jurisdictions. In its non-US operations, (on average) did 3M face a tax rate in 2021 that is higher than, lower than, or the same as the US statutory tax rate? What about 2019? (3 points)

refer every images and questions properly and answer all questions accurately, with good explanations for all questions.

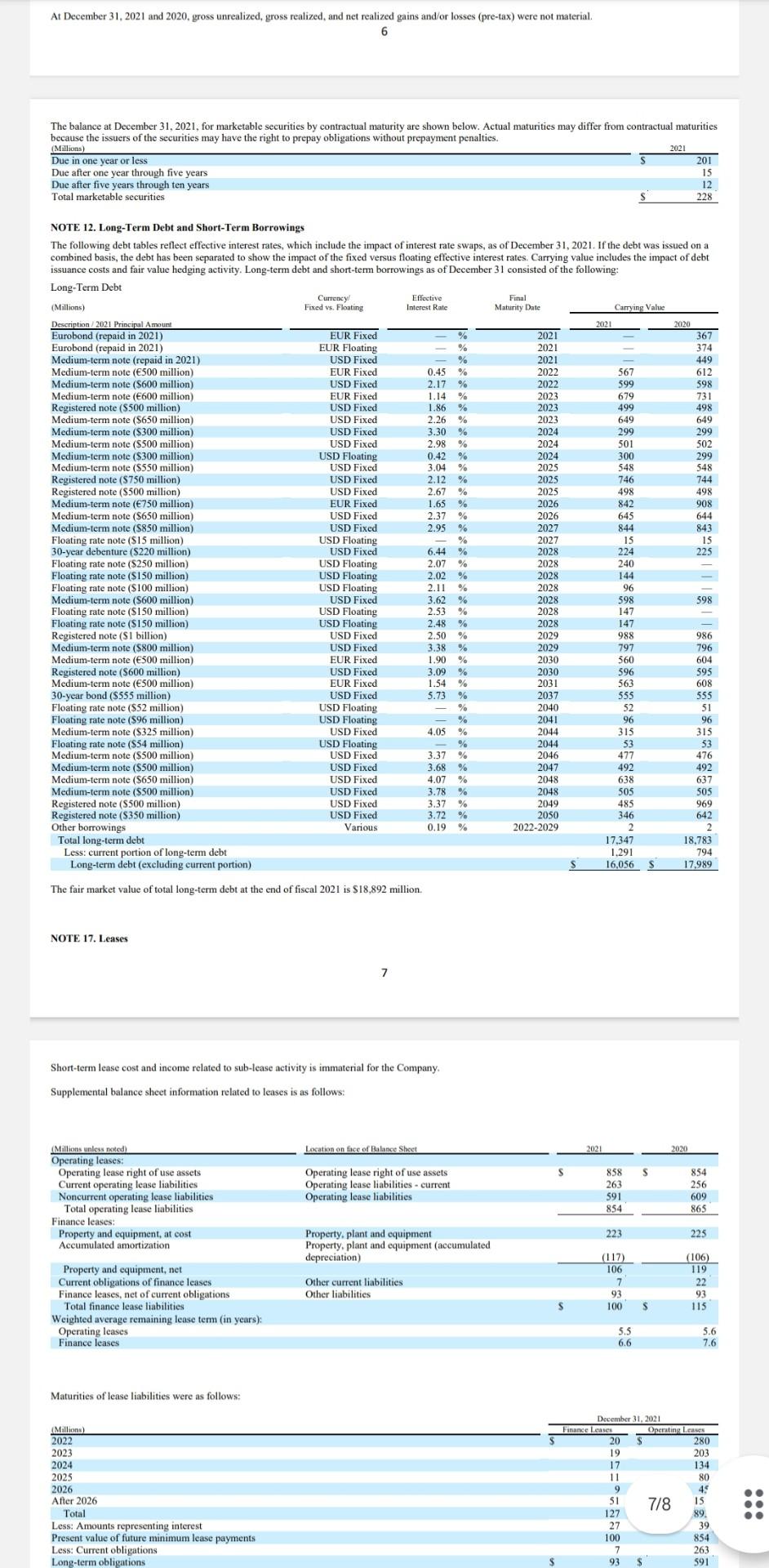

At December 31, 2021 and 2020, gross unrealized, gross realized, and net realized gains and/or losses (pre-tax) were not material. The balance at December 31, 2021, for marketable securities by contractual maturity are shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have the right to prepay obligations without prepayment penalties. (Millions) Due in one year or less Due after one year through five years Due after five years throug Total marketable securities NOTE 12. Long-Term Debt and Short-Term Borrowings The following debt tables reflect effective interest rates, which include the impact of interest rate swaps, as of December 31, 2021. If the debt was issued on a NOTE 17. Leases 7 Short-term lease cost and income related to sub-lease activity is immaterial for the Company. Supplemental balance sheet information related to leases is as follows: Maturities of lease liabilities were as follows: Marketable securities: Marketable securities include available-for-sale debt securities and are recorded at fair value. Cost of securities sold use the first in, first out (FIFO) method. The classification of marketable securities as current or non-current is based on the availability for use in current operations. 3M reviews impairments associated with its marketable securities in accordance with the measurement guidance provided by ASC 320, Investments-Debt Securities and ASC 326-30, Available for-Sale Debt Securities, when determining whether a decline in fair value below the amortized cost basis has resulted from a credit loss or other factors. An impairment relating to credit losses is recorded through an allowance for credit losses. The allowance is limited by the amount that the fair value is less than the amortized cost basis. A change in the allowance for credit losses is recorded into earnings in the period of the change. Any impairment that has not been recorded through an allowance for credit losses is recorded through accumulated other comprehensive income as a component of shareholders' equity. The factors considered in determining whether a credit loss exists can include the extent to which fair value is less than the amortized cost basis, changes in the credit quality of the underlying loan obligors, credit ratings actions, as well as other factors. When a credit loss exists, the Company compares the present value of cash flows expected to be collected from the debt security with the amortized cost basis of the security to determine what allowance amount, if any, should be recorded. Amounts are reclassified out of accumulated other comprehensive income and into earnings upon sale or a change in the portions of impairment related to credit losses and not related to credit losses. Investments: All equity securities that do not result in consolidation and are not accounted for under the equity method are measured at fair value with changes therein reflected in net income. 3M utilizes the measurement alternative for equity investments that do not have readily determinable fair values and measures these investments at cost less impairment plus or minus observable price changes in orderly transactions. The balance of these securities is disclosed in Note 7. Income taxes: The provision for income taxes is determined using the asset and liability approach. Under this approach, deferred income taxes represent the expected future tax consequences of temporary differences between the carrying amounts and tax basis of assets and liabilities. The Company records a valuation allowance to reduce its deferred tax assets when uncertainty regarding their realizability exists. As of December 31,2021 and 2020, the Company had valuation allowances of \$142 million and $135 million on its deferred tax assets, resp ectively. The Company recognizes and measures its uncertain tax positions based on the rules under ASC 740, Income Taxes. Leases: 3M determines if an arrangement is a lease upon inception. A contract is or contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The right to control the use of an asset includes the right to obtain substantially all of the economic benefits of the underlying asset and the right to direct how and for what purpose the asset is used. 3M determines certain service agreements that contain the right to use an underlying asset are not leases because 3M does not control how and for what purpose the identified asset is used. Examples of such agreements include master supply agreements, product processing agreements, warehouse and distribution services agreements, power purchase agreements, and transportation purchase agreements. Operating lease right-of-use assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. The discount rate used to calculate present value is 3M 's incremental borrowing rate or, if available, the rate implicit in the lease. 3M determines the incremental borrowing rate for leases using a portfolio approach based primarily on the lease term and the economic environment of the applicable country or region. As a lessee, the Company leases distribution centers, office space, land, and equipment. Certain 3M lease agreements include rental payments adjusted annually based on changes in an inflation index. 3M's leases do not contain material residual value guarantees or material restrictive covenants. Lease expense is recognized on a straight-line basis over the lease term. Certain leases include one or more options to renew, with terms that can extend the lease term up to five years. 3M includes options to renew the lease as part of the right of use lease asset and liability when it is reasonably certain the Company will exercise the option. In addition, certain leases contain fair value purchase and termination options with an associated penalty. In general, 3M is not reasonably certain to exercise such options. 4 The effective tax rate for 2021,2020 , and 2019 were 17.8 percent, 19.7 pereent, and 19.7 percent, respectively. These reflect a decrease of 1.9 percentage points from 2020 to 2021 and a flat comparison from 2019 to 2020 . The primary factors that decreased the effective tax rate for 2021 were geographical income mix and favorable adjustments in 2021 related to impacts of U.S. intemational tax provisions. The 2017 Tax Cuts and Jobs Act (TCJA) involved a transition tax that is payable over eight years beginning in 2018. As of December 31 , 2021 and December 31, 2020,3M reflected \$508 million and \$584 million, respectively, in long term income taxes payable. As of December 31 , 2021 and December 31 , 2020,3M reflected $68 million and $69 million, respectively, payable within one year associated with the transition tax. NOTE 11. Marketable Securities Marketable Securities The Company invests in asset-backed securities, certificates of deposit/time deposits, commercial paper, and other securities. The following is a summary of amounts recorded on the Consolidated Balance Sheet for marketable securities (current and non-current) At December 31, 2021 and 2020, gross unrealized, gross realized, and net realized gains and/or losses (pre-tax) were not material. 6 The balance at December 31,2021, for marketable securities by contractual maturity are shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have the right to prepay obligations without prepayment penalties. (Millions) Please refer to the attached financial statements and relevant footnotes for 3M. Investment (17 points) 1. What is the book value of 3M's total marketable securities at the end of fiscal 2021? How much of that is current? How much is non-current? (3 points) 2. What was the acquisition cost of 3M's marketable securities at the end of fiscal 2021? (2 points) 3. How much cash did 3M spend in purchasing marketable securities and investments during fiscal 2021? ( 2 points) 4. How much cash did 3M get from selling and maturity of marketable securities and investments during fiscal 2021? (2 points) 5. Assume that 3M sold all of their marketable securities at the beginning of fiscal 2022 for 250m. What effect would this have on 3M's income statement for 2022? Balance Sheet at the end of fiscal 2022? (3 points) 6. Does 3M have any equity method investments? If yes, which balance sheet line item(s) contain the equity method investments? ( 2 points) 7. Assume that 3M did not make any new equity method investments in 2021. 3M 's share of net income from the equity investment method investees was 50m$ for fiscal 2021 . Estimate the dividends, if any, paid by equity method investees in fiscal 2021 (3 points) Long term debt (11 points) 1. What is the book value of 3M's Long term debt at the end of fiscal 2021 ? How much of this does 3M expect to pay in fiscal 2022? (2 points) 2. Refer to 3M's description of its 30-year, $555 million USD-fixed bond that is due 2037. What is the coupon rate of this debt? How do you know? (2 points) 3. Refer to 3M's description of its Medium term note, $650 million USDfixed note due on 2026. What was the amount of interest expense recorded in fiscal 2021? How much cash was paid towards interest in fiscal 2021 related to this note? (3 points) 4. Suppose that 3M were to redeem all of its long term debt as of January 1 , 2022 by paying cash. How would the effect of this transaction be displayed in (1) the income statement and (2) the statement of cash flows? (4 points) At December 31, 2021 and 2020, gross unrealized, gross realized, and net realized gains and/or losses (pre-tax) were not material. The balance at December 31, 2021, for marketable securities by contractual maturity are shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have the right to prepay obligations without prepayment penalties. (Millions) Due in one year or less Due after one year through five years Due after five years throug Total marketable securities NOTE 12. Long-Term Debt and Short-Term Borrowings The following debt tables reflect effective interest rates, which include the impact of interest rate swaps, as of December 31, 2021. If the debt was issued on a NOTE 17. Leases 7 Short-term lease cost and income related to sub-lease activity is immaterial for the Company. Supplemental balance sheet information related to leases is as follows: Maturities of lease liabilities were as follows: Marketable securities: Marketable securities include available-for-sale debt securities and are recorded at fair value. Cost of securities sold use the first in, first out (FIFO) method. The classification of marketable securities as current or non-current is based on the availability for use in current operations. 3M reviews impairments associated with its marketable securities in accordance with the measurement guidance provided by ASC 320, Investments-Debt Securities and ASC 326-30, Available for-Sale Debt Securities, when determining whether a decline in fair value below the amortized cost basis has resulted from a credit loss or other factors. An impairment relating to credit losses is recorded through an allowance for credit losses. The allowance is limited by the amount that the fair value is less than the amortized cost basis. A change in the allowance for credit losses is recorded into earnings in the period of the change. Any impairment that has not been recorded through an allowance for credit losses is recorded through accumulated other comprehensive income as a component of shareholders' equity. The factors considered in determining whether a credit loss exists can include the extent to which fair value is less than the amortized cost basis, changes in the credit quality of the underlying loan obligors, credit ratings actions, as well as other factors. When a credit loss exists, the Company compares the present value of cash flows expected to be collected from the debt security with the amortized cost basis of the security to determine what allowance amount, if any, should be recorded. Amounts are reclassified out of accumulated other comprehensive income and into earnings upon sale or a change in the portions of impairment related to credit losses and not related to credit losses. Investments: All equity securities that do not result in consolidation and are not accounted for under the equity method are measured at fair value with changes therein reflected in net income. 3M utilizes the measurement alternative for equity investments that do not have readily determinable fair values and measures these investments at cost less impairment plus or minus observable price changes in orderly transactions. The balance of these securities is disclosed in Note 7. Income taxes: The provision for income taxes is determined using the asset and liability approach. Under this approach, deferred income taxes represent the expected future tax consequences of temporary differences between the carrying amounts and tax basis of assets and liabilities. The Company records a valuation allowance to reduce its deferred tax assets when uncertainty regarding their realizability exists. As of December 31,2021 and 2020, the Company had valuation allowances of \$142 million and $135 million on its deferred tax assets, resp ectively. The Company recognizes and measures its uncertain tax positions based on the rules under ASC 740, Income Taxes. Leases: 3M determines if an arrangement is a lease upon inception. A contract is or contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The right to control the use of an asset includes the right to obtain substantially all of the economic benefits of the underlying asset and the right to direct how and for what purpose the asset is used. 3M determines certain service agreements that contain the right to use an underlying asset are not leases because 3M does not control how and for what purpose the identified asset is used. Examples of such agreements include master supply agreements, product processing agreements, warehouse and distribution services agreements, power purchase agreements, and transportation purchase agreements. Operating lease right-of-use assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. The discount rate used to calculate present value is 3M 's incremental borrowing rate or, if available, the rate implicit in the lease. 3M determines the incremental borrowing rate for leases using a portfolio approach based primarily on the lease term and the economic environment of the applicable country or region. As a lessee, the Company leases distribution centers, office space, land, and equipment. Certain 3M lease agreements include rental payments adjusted annually based on changes in an inflation index. 3M's leases do not contain material residual value guarantees or material restrictive covenants. Lease expense is recognized on a straight-line basis over the lease term. Certain leases include one or more options to renew, with terms that can extend the lease term up to five years. 3M includes options to renew the lease as part of the right of use lease asset and liability when it is reasonably certain the Company will exercise the option. In addition, certain leases contain fair value purchase and termination options with an associated penalty. In general, 3M is not reasonably certain to exercise such options. 4 The effective tax rate for 2021,2020 , and 2019 were 17.8 percent, 19.7 pereent, and 19.7 percent, respectively. These reflect a decrease of 1.9 percentage points from 2020 to 2021 and a flat comparison from 2019 to 2020 . The primary factors that decreased the effective tax rate for 2021 were geographical income mix and favorable adjustments in 2021 related to impacts of U.S. intemational tax provisions. The 2017 Tax Cuts and Jobs Act (TCJA) involved a transition tax that is payable over eight years beginning in 2018. As of December 31 , 2021 and December 31, 2020,3M reflected \$508 million and \$584 million, respectively, in long term income taxes payable. As of December 31 , 2021 and December 31 , 2020,3M reflected $68 million and $69 million, respectively, payable within one year associated with the transition tax. NOTE 11. Marketable Securities Marketable Securities The Company invests in asset-backed securities, certificates of deposit/time deposits, commercial paper, and other securities. The following is a summary of amounts recorded on the Consolidated Balance Sheet for marketable securities (current and non-current) At December 31, 2021 and 2020, gross unrealized, gross realized, and net realized gains and/or losses (pre-tax) were not material. 6 The balance at December 31,2021, for marketable securities by contractual maturity are shown below. Actual maturities may differ from contractual maturities because the issuers of the securities may have the right to prepay obligations without prepayment penalties. (Millions) Please refer to the attached financial statements and relevant footnotes for 3M. Investment (17 points) 1. What is the book value of 3M's total marketable securities at the end of fiscal 2021? How much of that is current? How much is non-current? (3 points) 2. What was the acquisition cost of 3M's marketable securities at the end of fiscal 2021? (2 points) 3. How much cash did 3M spend in purchasing marketable securities and investments during fiscal 2021? ( 2 points) 4. How much cash did 3M get from selling and maturity of marketable securities and investments during fiscal 2021? (2 points) 5. Assume that 3M sold all of their marketable securities at the beginning of fiscal 2022 for 250m. What effect would this have on 3M's income statement for 2022? Balance Sheet at the end of fiscal 2022? (3 points) 6. Does 3M have any equity method investments? If yes, which balance sheet line item(s) contain the equity method investments? ( 2 points) 7. Assume that 3M did not make any new equity method investments in 2021. 3M 's share of net income from the equity investment method investees was 50m$ for fiscal 2021 . Estimate the dividends, if any, paid by equity method investees in fiscal 2021 (3 points) Long term debt (11 points) 1. What is the book value of 3M's Long term debt at the end of fiscal 2021 ? How much of this does 3M expect to pay in fiscal 2022? (2 points) 2. Refer to 3M's description of its 30-year, $555 million USD-fixed bond that is due 2037. What is the coupon rate of this debt? How do you know? (2 points) 3. Refer to 3M's description of its Medium term note, $650 million USDfixed note due on 2026. What was the amount of interest expense recorded in fiscal 2021? How much cash was paid towards interest in fiscal 2021 related to this note? (3 points) 4. Suppose that 3M were to redeem all of its long term debt as of January 1 , 2022 by paying cash. How would the effect of this transaction be displayed in (1) the income statement and (2) the statement of cash flows? (4 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started