Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LEASING You are evaluating a capital lease that offers annual payments of $ 2 5 , 0 0 0 for five years. Lease rental payments

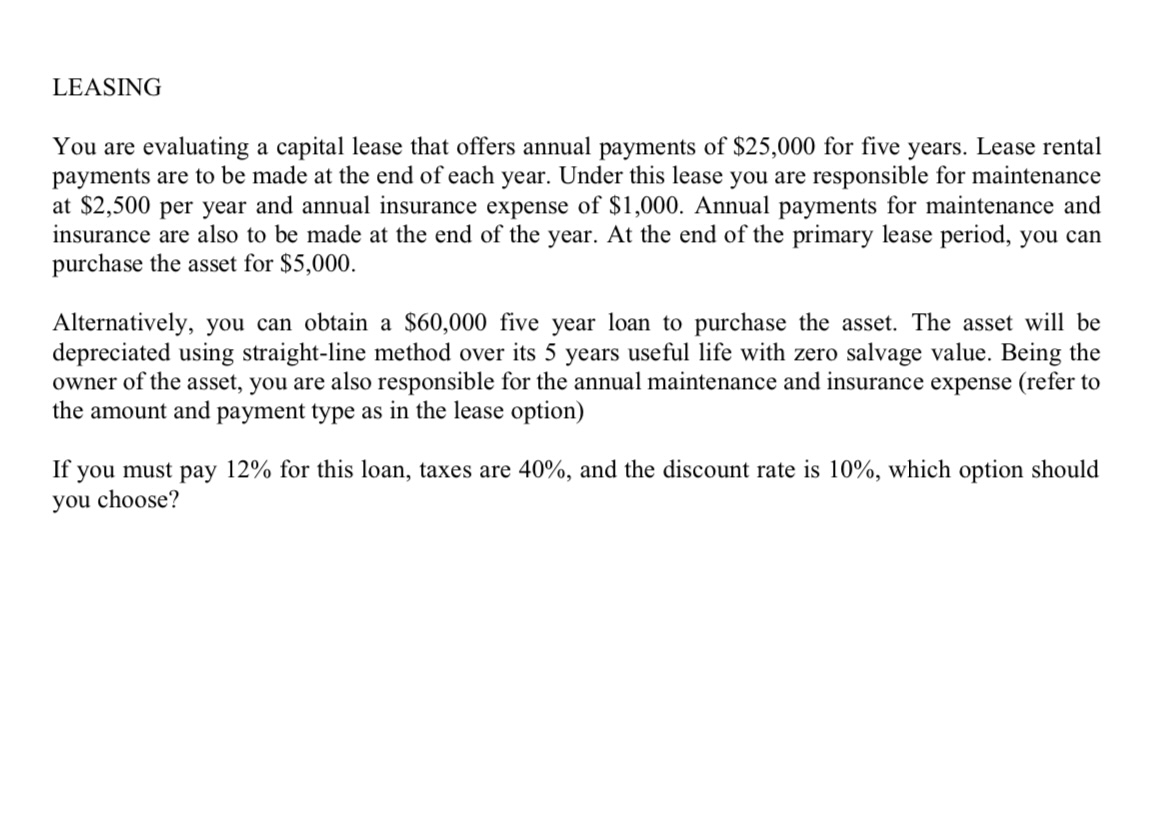

LEASING

You are evaluating a capital lease that offers annual payments of $ for five years. Lease rental

payments are to be made at the end of each year. Under this lease you are responsible for maintenance

at $ per year and annual insurance expense of $ Annual payments for maintenance and

insurance are also to be made at the end of the year. At the end of the primary lease period, you can

purchase the asset for $

Alternatively, you can obtain a $ five year loan to purchase the asset. The asset will be

depreciated using straightline method over its years useful life with zero salvage value. Being the

owner of the asset, you are also responsible for the annual maintenance and insurance expense refer to

the amount and payment type as in the lease option

If you must pay for this loan, taxes are and the discount rate is which option should

you choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started