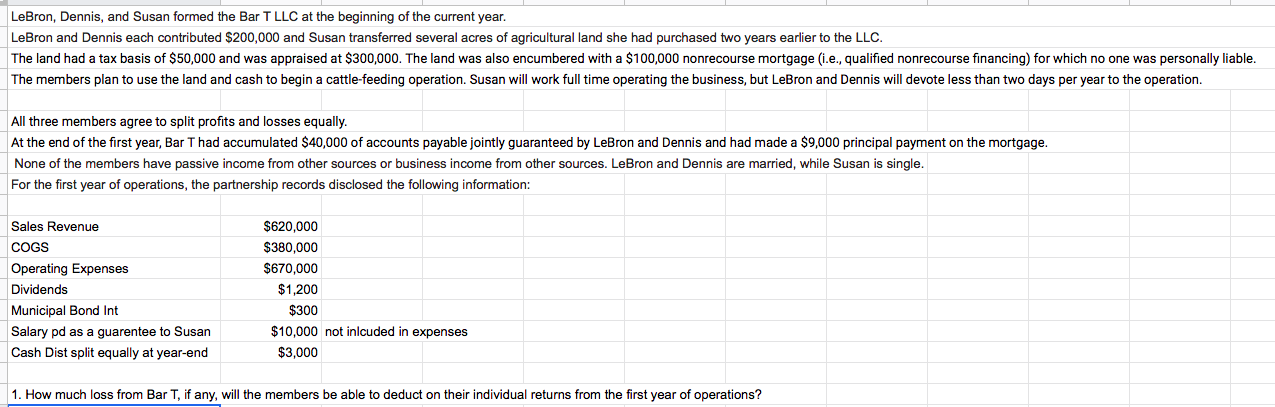

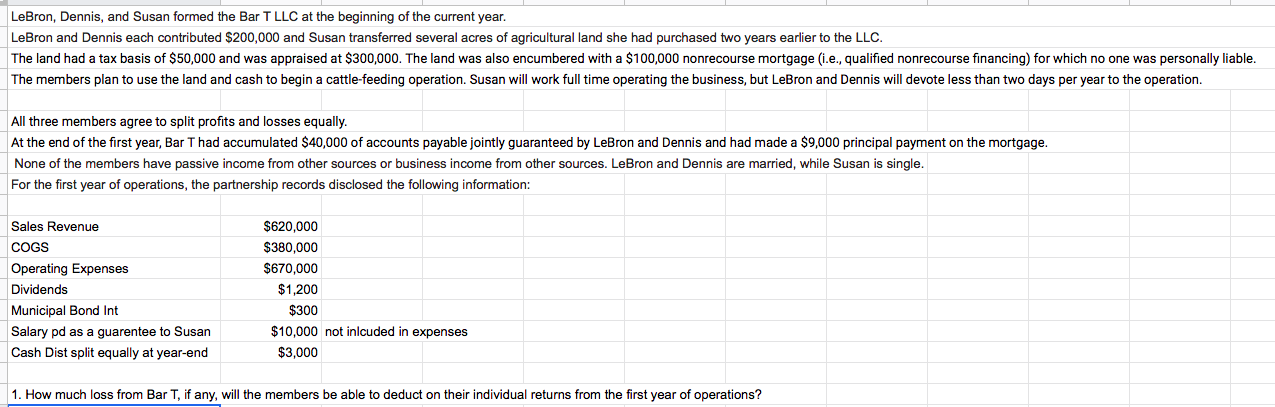

LeBron, Dennis, and Susan formed the Bar T LLC at the beginning of the current year LeBron and Dennis each contributed $200,000 and Susan transferred several acres of agricultural land she had purchased two years earlier to the LLC The land had a tax basis of $50,000 and was appraised at $300,000. The land was also encumbered with a $100,000 nonrecourse mortgage (i.e., qualified nonrecourse financing) for which no one was personally liable. The members plan to use the land and cash to begin a cattle-feeding operation. Susan will work full time operating the business, but LeBron and Dennis will devote less than two days per year to the operation All three members agree to split profits and losses equally. At the end of the first year, Bar T had accumulated $40,000 of accounts payable jointly guaranteed by LeBron and Dennis and had made a $9,000 principal payment on the mortgage. None of the members have passive income from other sources or business income from other sources. LeBron and Dennis are married, while Susan is single. For the first year of operations, the partnership records disclosed the following information: Sales Revenue $620,000 COGS $380,000 Operating Expenses $670,000 Dividends $1,200 Municipal Bond Int $300 $10,000 not inlcuded in expenses Salary pd as a guarentee to Susan Cash Dist split equally at year-end $3,000 1. How much loss from Bar T, if any, will the members be able to deduct on their individual returns from the first year of operations? LeBron, Dennis, and Susan formed the Bar T LLC at the beginning of the current year LeBron and Dennis each contributed $200,000 and Susan transferred several acres of agricultural land she had purchased two years earlier to the LLC The land had a tax basis of $50,000 and was appraised at $300,000. The land was also encumbered with a $100,000 nonrecourse mortgage (i.e., qualified nonrecourse financing) for which no one was personally liable. The members plan to use the land and cash to begin a cattle-feeding operation. Susan will work full time operating the business, but LeBron and Dennis will devote less than two days per year to the operation All three members agree to split profits and losses equally. At the end of the first year, Bar T had accumulated $40,000 of accounts payable jointly guaranteed by LeBron and Dennis and had made a $9,000 principal payment on the mortgage. None of the members have passive income from other sources or business income from other sources. LeBron and Dennis are married, while Susan is single. For the first year of operations, the partnership records disclosed the following information: Sales Revenue $620,000 COGS $380,000 Operating Expenses $670,000 Dividends $1,200 Municipal Bond Int $300 $10,000 not inlcuded in expenses Salary pd as a guarentee to Susan Cash Dist split equally at year-end $3,000 1. How much loss from Bar T, if any, will the members be able to deduct on their individual returns from the first year of operations